Chicago Board of Trade Market News

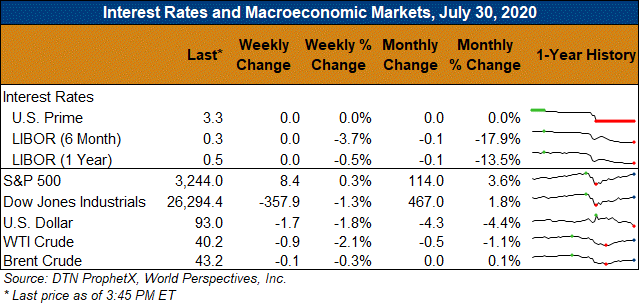

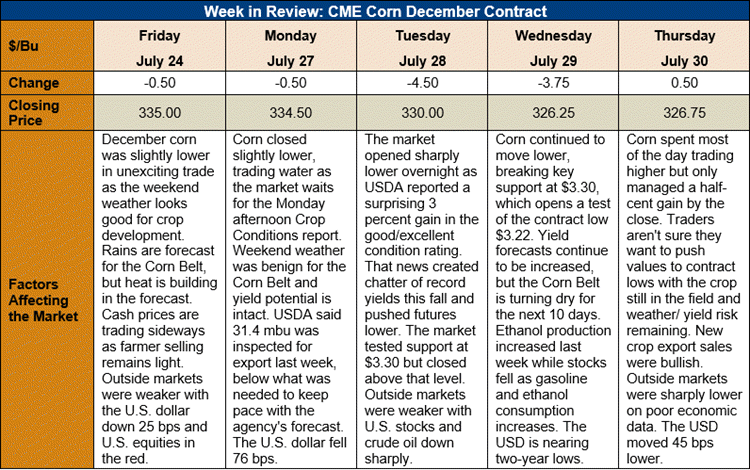

Outlook: December corn futures are 8 ¼ cents (2.5 percent) lower this week after surprisingly good crop conditions ratings in Monday’s report pressured the market. Traders are now increasing yield expectations and record large corn and soybean yields are being discussed. Expectations for larger supplies prompted funds to again become net sellers, pushing the market below technical support.

Late Monday, USDA reported a 3 percent increase in the share of U.S. corn and soybeans rated in good or excellent condition. For corn, it was the largest late-July increase in good/excellent ratings in at least 10 years. Eighty-two percent of the crop is silking (ahead of the five-year average pace of 75 percent) while 22 percent of the corn is entering the dough stage (up from 17 percent on average).

The U.S. corn crop is well ahead of schedule from a development standpoint and is doing so with excellent conditions ratings. Consequently, yield expectations are being increased and many firms and traders have 180 bushels/acre or more penciled into balance sheets. Discussions of record-high yields are increasing, especially with the two-week weather forecast again offering nearly ideal conditions. Corn harvest will start in the southern U.S. soon, and early yield reports will likely be interesting and important to price action.

The weekly Export Sales report featured gross old-crop corn sales of 132,300 MT and net new-crop sales of 0.638 MMT. The new-crop sales figure was above market expectations and was bullish the futures market. Notably, outstanding new-crop sales are up 115 percent versus this time last year.

USDA noted that corn export shipments last week hit 0.971 MMT, down from the prior week but enough to put YTD exports at 38.003 MMT. YTD exports are down 17 percent while YTD bookings (exports plus unshipped sales, totaling 43.681 MMT) are down 12 percent.

From a technical standpoint, December futures broke key support at $3.30 on Tuesday and decisively closed below that point on Wednesday. With that support level broken, a test of the contract low ($3.22) is increasingly likely. However, Thursday’s price action was mostly higher, despite the modest ½-cent higher settlement. With new crop export demand remaining strong and domestic demand picking up, it is doubtful funds will want to want to force a move below the contract low, especially with the crop still in the field. Cash prices continue to trend sideways, which should help stabilize futures.