Chicago Board of Trade Market News

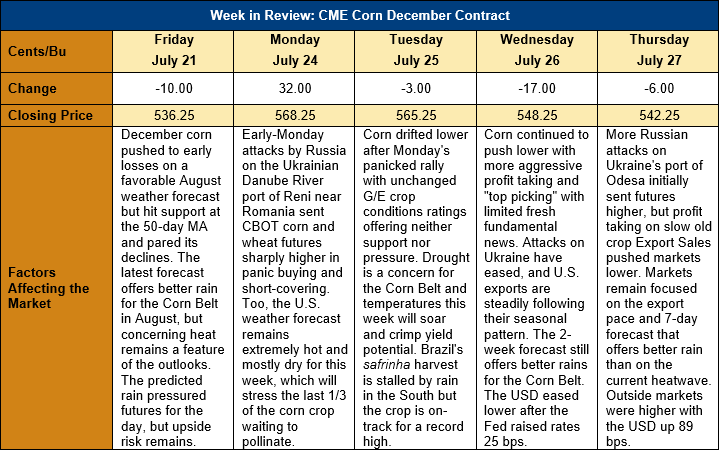

Outlook: Corn futures are 6 cents (1.1 percent) higher this week after a sharp early-week rally found subsequent profit taking and hedge selling. The rally on Monday was driven by Russia’s attacks on Ukrainian port of Reni on the Danube River near Romania. The Danube is now one of Ukraine’s remaining two options for exporting grain, along with rail shipments to northern/western Europe. With ports on the Danube potentially under attack, the outlook for Ukraine’s grain shipments going forward is much less certain. The uncertainty in Black Sea grain supplies will likely push demand to other origins, including the U.S.

While the early-week attacks, combined with forecasts of hot temperatures in the Midwest, sent corn higher, a mid-week change in the weather outlook caused the opposite reaction. Weather models began to predict more rains for the Midwest in early August, which prompted profit taking in the futures market. Additionally, producers who missed out on hedging this year’s crop in the June rally used the recent run-up to market more grain, which added pressure to futures mid-week.

As is typical of grain futures’ price action during the summer, markets remain highly sensitive to the weather outlook. While this week’s forecasts have shifted to favor more rain in August, there is little agreement beyond the 7-day outlook with some models showing persistent below-normal rains. Even more concerning, however, is the fact that nearly all still predict above-average temperatures for the Corn Belt. Excessive heat, especially overnight, can have detrimental effects on corn yields even with good precipitation. Consequently, and despite forecasts of increased precipitation, one cannot consider the U.S. crop out of danger yet.

U.S. corn conditions were steady last week with the good/excellent rating at 57 percent. USDA reported that 68 percent of the crop is silking, meaning that roughly one-third will be pollinating during the current and coming heatwave. The crop is slightly ahead of its normal development pace with 16 percent of the crop in the dough stage, up from the five-year average of 14 percent.

U.S. old crop corn export rebounded last week with gross sales rising to 413 KMT and net sales popping 33 percent higher. Old crop exports totaled 411.4 KMT last week, up 7 percent from the prior week. YTD bookings total 40.059 MMT, or 95.6 percent of USDA’s July WASDE forecast.