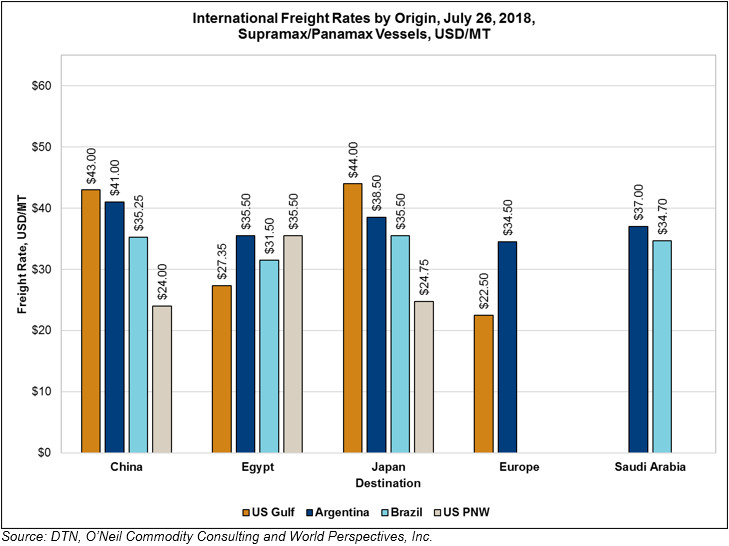

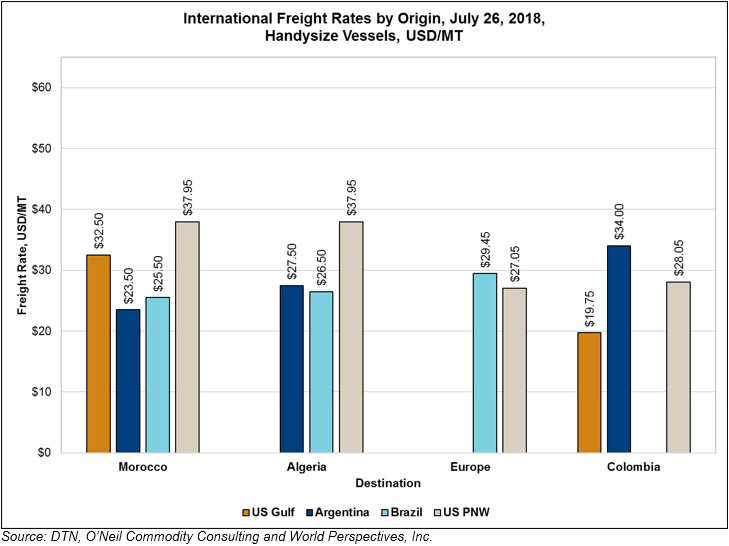

Ocean Freight Comments

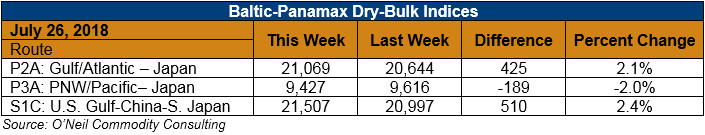

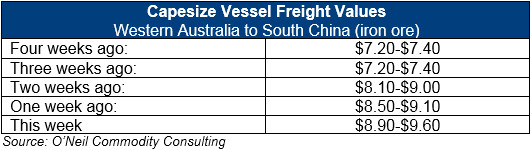

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: I think you have heard this story before: it was another week of mixed results in global dry-bulk freight markets. The main catchphrase being touted is that the market is largely “range-bound.” Paper traders did their best to provide limited support, but the physical side of freight is just not going anywhere. Brazil freight is up slightly due to the Chinese demand there.

Generally, however, China and other international cargo demand growth is not sufficient to move the market higher at this time. On the agricultural side, I heard an interesting presentation today from Bell Chang of R.J. O’Brian. He suggested three possibilities for Chinese soybean imports this year:

- China imports 95 million tons of soybeans.

- China imports 91 million tons of soybeans.

- China cuts back its soybean crush, depletes their 8 million-ton soy reserve and only imports 85 million tons of soybeans.

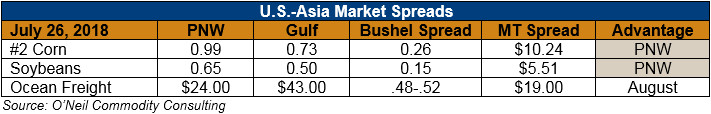

None of these projections paint a bullish picture for either soybean prices or freight; a Canadian trader suggested that shuttle trains of U.S. soybeans could potentially be shipped to Canada and exported as Canada origin to capture a higher price to China. Maybe? Stay tuned.

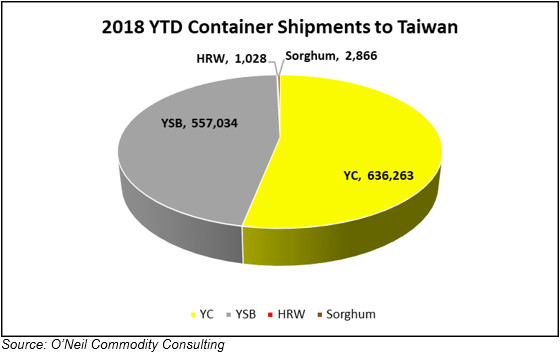

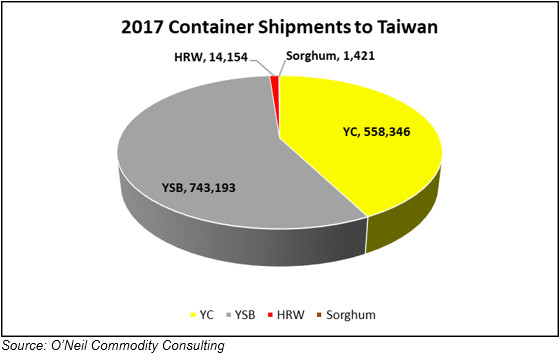

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to Taiwan.