Chicago Board of Trade Market News

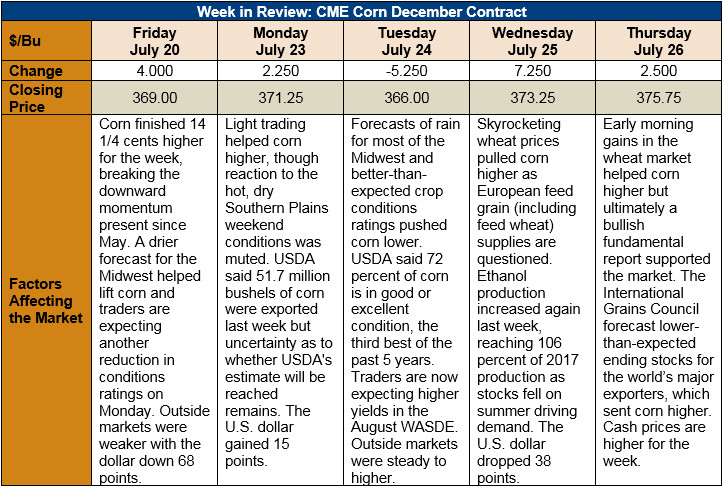

Outlook: December corn futures continue to rally, posting a 10.75-cent (3 percent) gain since last Thursday. The market has been helped by spotty conditions around the U.S. Corn Belt, higher wheat prices, and fundamentally bullish reports.

The U.S. corn crop remains in excellent condition with 72 percent rated in good or excellent condition, two percentage points above the five-year average for this time of year. Moreover, 81 percent of the crop is silking (above the five-year average of 62 percent) and doing so under the present cool temperatures will be helpful for yields. The weather forecast turns hotter/drier towards the end of the next two weeks, however, and excessive August heat could still limit the crop’s yield potential. Additionally, reports of spotty conditions around the Corn Belt, with some fields “too dry” and others suffering from mild flooding, will likely reduce the overall yield potential of the U.S. crop as well.

On Thursday, the International Grains Council released a report forecasting corn ending stocks for the world’s four largest corn exporters would hit 49 MMT in 2018/19, down from earlier estimates and from USDA’s latest figure. International demand for feed grains is expected to increase in 2018/19 as hot, dry weather in Europe takes its toll on the wheat crop there, reducing feed wheat supplies.

The weekly Export Sales report featured 1.281 MMT of exports this week and 338,000 MT of old-crop net sales, brining YTD bookings to 59.074 MMT, up 5 percent from 2016/17. YTD exports reached 49.137 MMT this week, down 2 percent from last year and below USDA’s forecast. U.S. sorghum exports were reportedly 13,000 MT while barley exports reached 1,600 MT. YTD sorghum bookings are up 8 percent from last year while barley bookings have grown 37 percent.

From a technical standpoint, December corn continues to hit and hold major bullish targets, including breaking above the 40-day moving average. The contract looks to have established contract/seasonal lows at $3.50/bushel and is working higher from there. Resistance is likely at $3.80/bushel, however, and additional bullish fundamentals are needed to sustain a close above this point. Fund are believed to have been active buyers this week and the weather issues in Europe, combined with some bullish fundamental forecasts, should prompt them to hold their positions for a while. Thus, the market still has bullish potential but with momentum indicators turning overbought, a small pullback is likely in the near-term.