Ocean Freight Markets and Spreads

Ocean Freight Comments

U.S. forces actively shot down several surface and air drones of the Houthi terrorist organization this past week. However, the Houthi’s launched attacks on two tanker vessels in the Red Sea, with no reported damage. Vessel owners and operators continue to avoid the Red Sea and Arabian Peninsula because of the on-going the threat by the Houthi’s and other sympathizers attacking vessels. The owners and operators are opting to use longer routes around the Cape of Good Hope for example, adding days and weeks to the journey that in turn increases costs. The on-going saga in the Red Sea is impacting global shipping lanes by tightening up vessel capacity utilization.

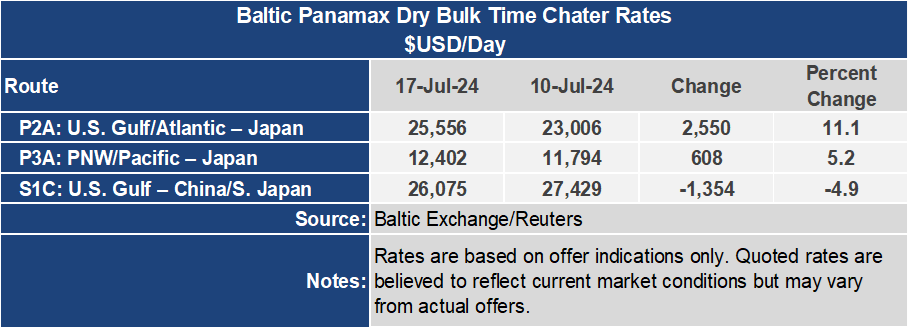

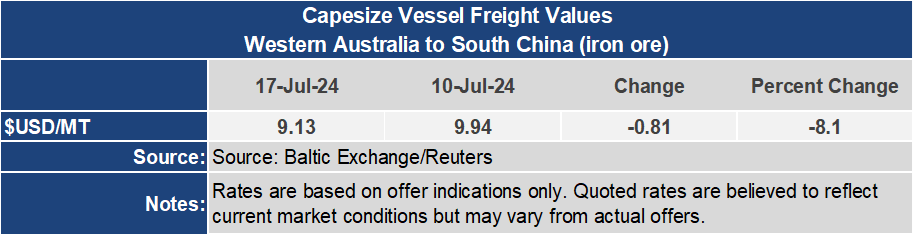

Despite the Baltic Panamax Index jumping 8.5% to 1,713 this past week, the Baltic Dry Index was down 2.5% to an index of 1,890. The Capesize sector pulled the entire sector lower by falling 8.6% to 2,940. The Baltic Capesize Index greatly influences BDI. The dry markets are being weighed down on a slower pace of vessel retirements as new vessel capacity is being launched.

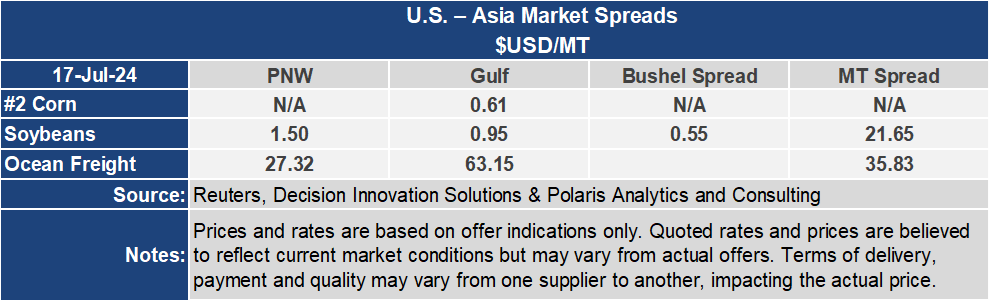

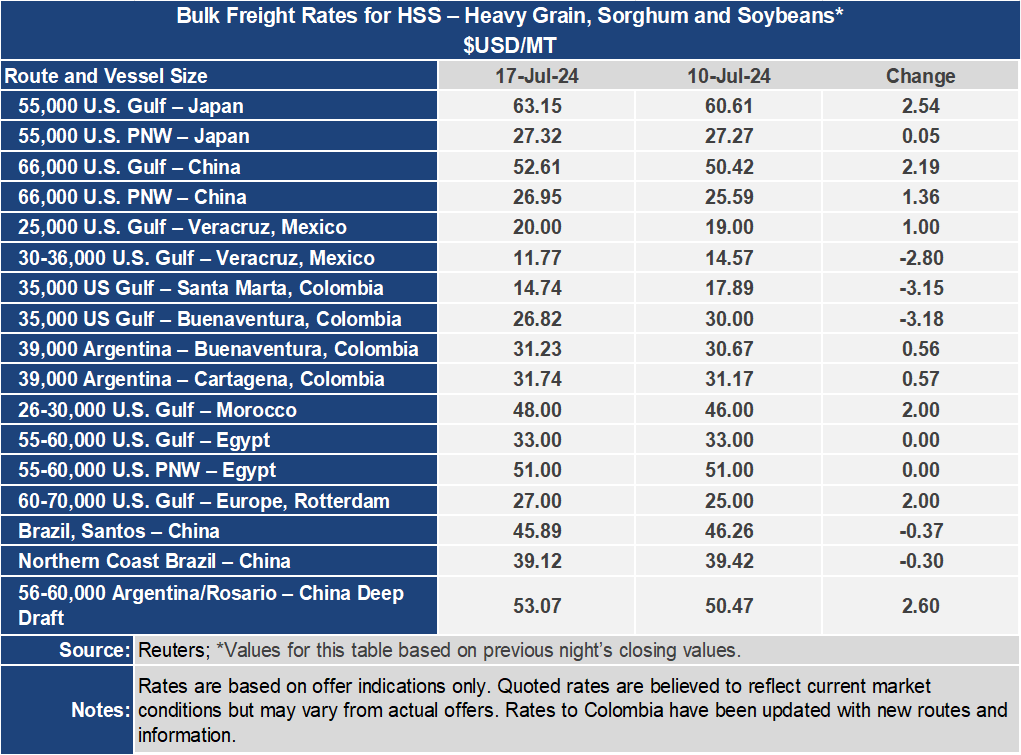

The longer haul routes from the U.S. to Asia firmed this past week while the shorter distanced routes to Latin America pulled back or increased modestly. Grain freight rates to Japan from the U.S. Center Gulf ended the week up $2.54 per metric ton to $63.15 per metric ton. The rate out of the Pacific Northwest to Japan was essentially unchanged at $27.32. The spread between these key routes widened 7.5% or $2.49 per metric ton to $35.83 for the week.