Ocean Freight Markets and Spreads

Ocean Freight Comments

Hurricane Beryl came ashore in south Texas, impacting several ports from Brownsville to Houston. All ports are resuming operations and assessing damage and navigation channel obstructions. Some ports are without power.

Water levels in Gatun Lake in Panama continue to improve, now at 83.5 feet as of July 11. This is slightly better than the 83.4 feet average for July. The expectations are water levels will continue to improve. Gatun Lake is used as a holding basin for the locks of the Panama Canal. The Panama Canal Authority announced this week a plan to construct a new water reservoir within six years. The reservoir is estimated to cost about $1.2 billion to ensure vessel transits are unhindered as they were during 2023 and into 2024 due to drought and low water conditions. The Panama Canal Authority raised the Neopanamax draft to 48 feet today from 47 feet. Daily vessel transits will increase to 35 after August 4. Under normal operating conditions daily transits total 36 to 38.

The Houthi’s terrorist organization claims to have attacked the m/v Maersk Sentosa in the Arabian Sea. No additional details were made available. In the meanwhile, the Houthi’s and the Iraqi Islamic Resistance carried out joint efforts attacking Israel’s port city of Eilat. Vessel owners and operators continue to avoid the Red Sea and Arabian Peninsula because of the on-going the threat by the Houthi’s and other sympathizers attacking vessels. The owners and operators are opting to use longer routes around the Cape of Good Hope for example, adding days and weeks to the journey that in turn increases costs.

The Security Service of Ukraine seized a foreign cargo vessel, m/v USKO MFU, and detained the captain near the Odesa on suspicion of helping Russia export stolen Ukraine grain from Crimea. The vessel is a Cameroon-flagged and under management by a Turkey based company, who denied the claims. Ukraine seeks to protect its grain exports but runs the risk of retaliation by Russia as export season in Ukraine normally ramps up.

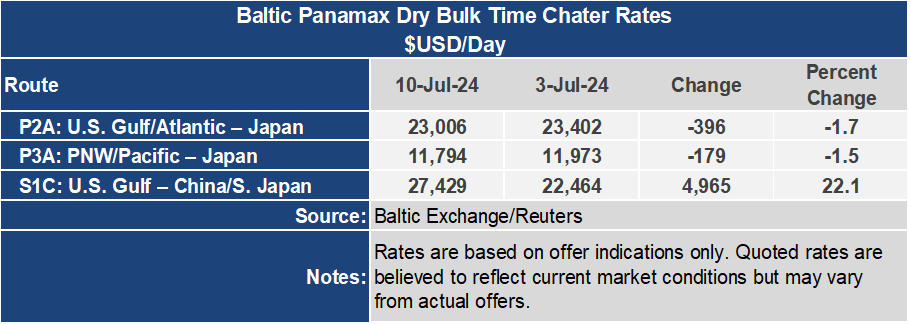

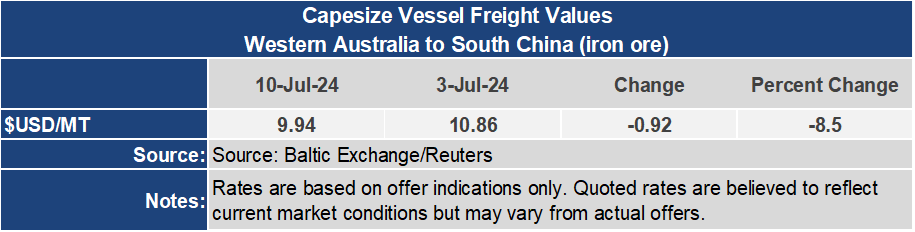

While the Baltic Dry Index ended the week down 6% to an index of 1,939, it started firming midweek on the strength of the Panamax and Supramax sectors. The Capesize sector, usually a major influence on the BDI, lost 365 points for the week to 3,215. The Panamax index was down 28 points to 1,579 while the Supramax gained 13 points to 1,353. However, compared to one year ago, the BDI is up 78%, the BCI up 93%, the BPI up 45% and the BSI is up 84%.

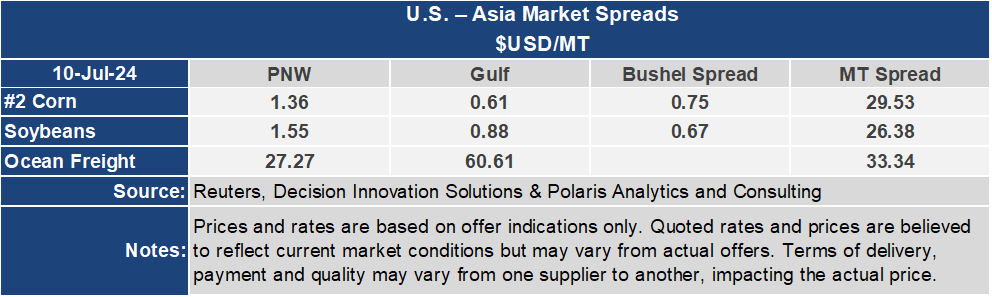

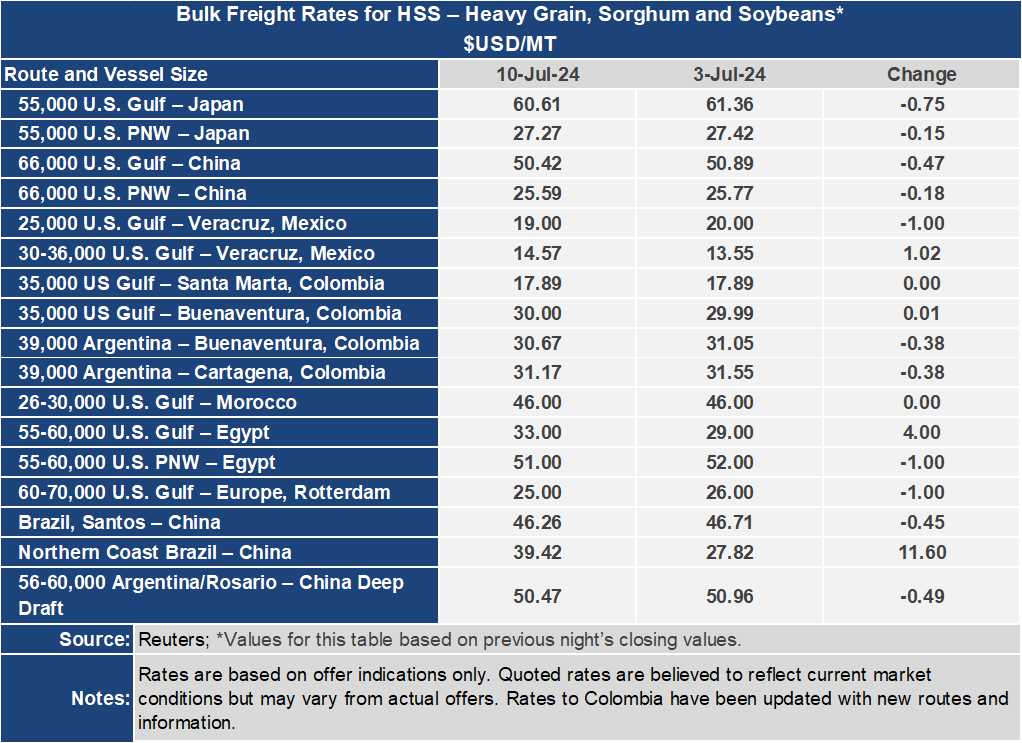

Voyage freight rates were a mixed bag this week. Rates to Asia were lower while some rates to Latin American countries and Egypt were firmer. Grain freight rates to Japan from the U.S. Center Gulf ended the week down $0.75 per metric ton to $60.61 per metric ton. The rate out of the Pacific Northwest to Japan was down $0.15 per metric ton to $27.27. The spread between these key routes narrowed by nearly 2% or $0.60 per metric ton to $33.34 for the week. The northern coast Brazil to China route surged 42% this week $39.42 per metric ton. The increase may reflect stronger vessel demand out of northern Brazil as corn harvest and export pace ramps up.