Ocean Freight Markets and Spreads

Ocean Freight Comments

Ocean freight rates firmed this past week on capacity tightening with some vessels being rerouted away from the Red Sea, adding more than ten days and 3,300 nautical miles to the journey, while delayed iron ore inspections in China are holding up vessels, and improving grain activity is bolstering vessel demand.

Vessels carrying U.S. military and aid cargoes through the Red Sea are experiencing attacks. Companies such as Maersk Line, Limited (the U.S. subsidiary of Maersk) that operate such vessels through the region are instead suspending or diverting sailings around the Cape of Good Hope.

The water level of Gatun Lake in Panama has not changed much the past week, holding steady at 81.3 feet, about six feet below normal for this time of year. Without meaningful rains recharging Gatun Lake, water levels are expected to fall to 80.2 feet in late March. Gatun Lake serves as an important reservoir to flush ships through the Panama Canal system of locks. The freshwater surcharge is 2.01% this week, up from 1.82% last week. Daily vessel transits are limited to 24, down from 36 during normal navigation conditions. This is Panama’s dry season that runs through May.

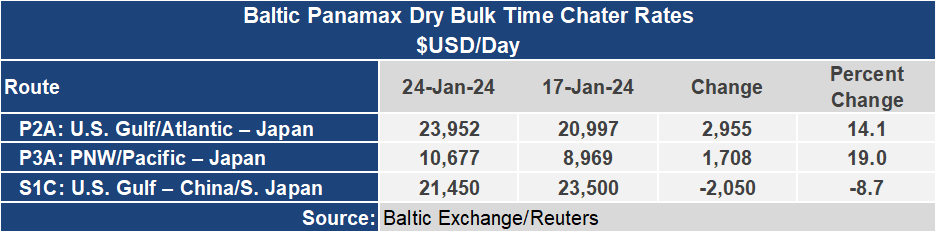

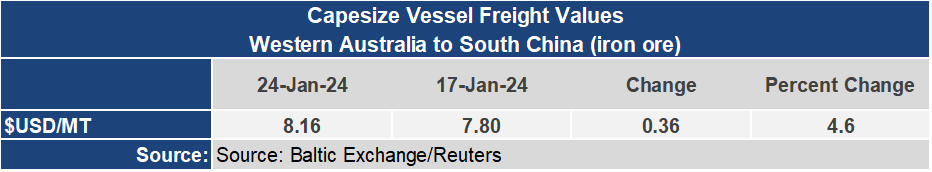

The Baltic Dry Index, the core index of the dry bulk sector, gained 199 points or 15% this week to an index of 1,507. The dry bulk markets are being supported by tightened vessel capacity utilization. The sector is supported by the Capesize market, jumping 24% for the week to an index of 2,145. The Panamax sector ended the week 15% higher to an index of 1,663 while the Supramax gained 1% ground to an index of 1,050.

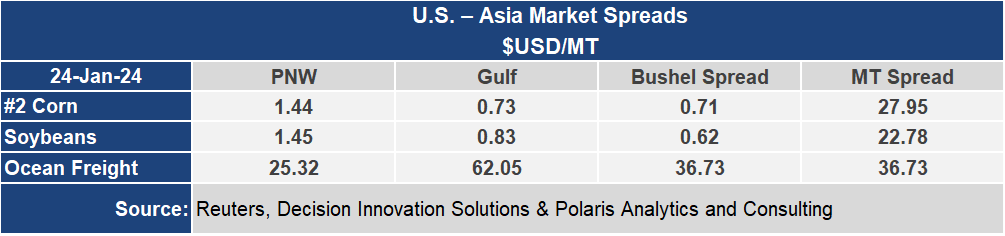

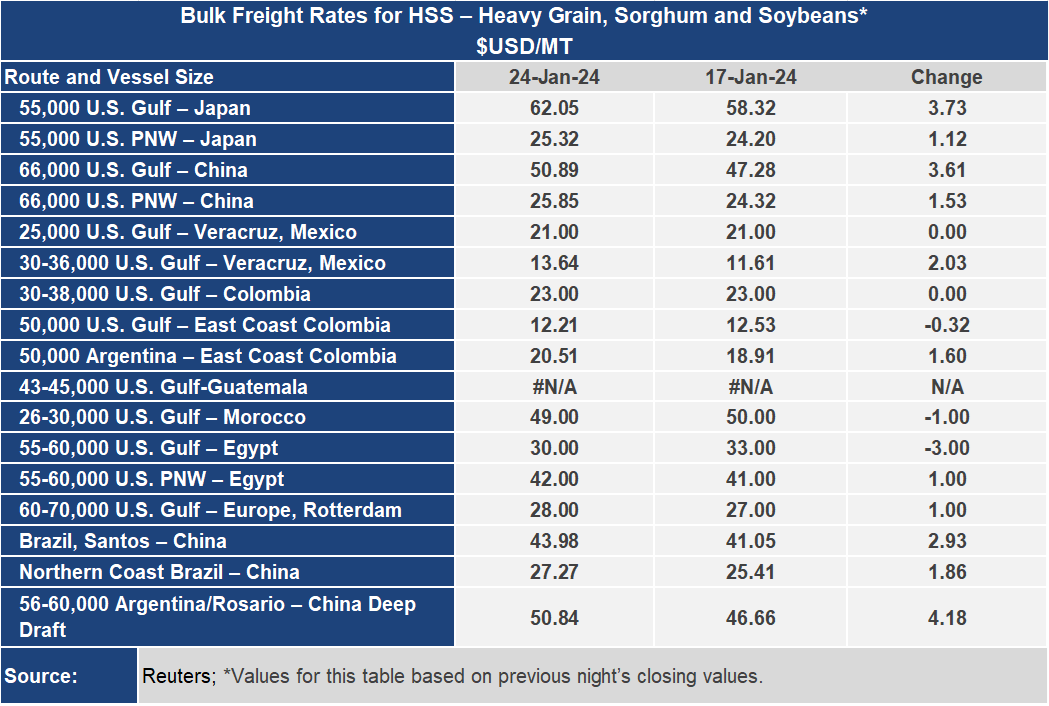

With firmness in the dry bulk sector, voyage rates gained steam this week. The U.S. Gulf to China route jumped $3.61 per metric ton or 7.6% to $50.89 per metric ton. This is the highest level since the start of the New Year, yet 12.5% higher than the rate one year ago. Out of the Pacific Northwest the rate to China ended the week at $25.85 per metric ton, up 6.3% or $1.53 per metric ton. The PNW rate is about 3% higher than it was for the same week last year.

The strength in ocean freight is taking place during a period when demand is seasonally weak and ahead of when China will be slowing heading into its New Year celebrations that start February 10, 2024, running through February 20, 2024.

The forward freight agreement for Panamax time charters points to firmness with bids and offers at $12,800 per day and $13,200 for the rest of January, $13,300 and $13,700 for February, 15,200 and 15,600 for March and $15,400 and $15,800 for April.