Chicago Board of Trade Market News

Outlook

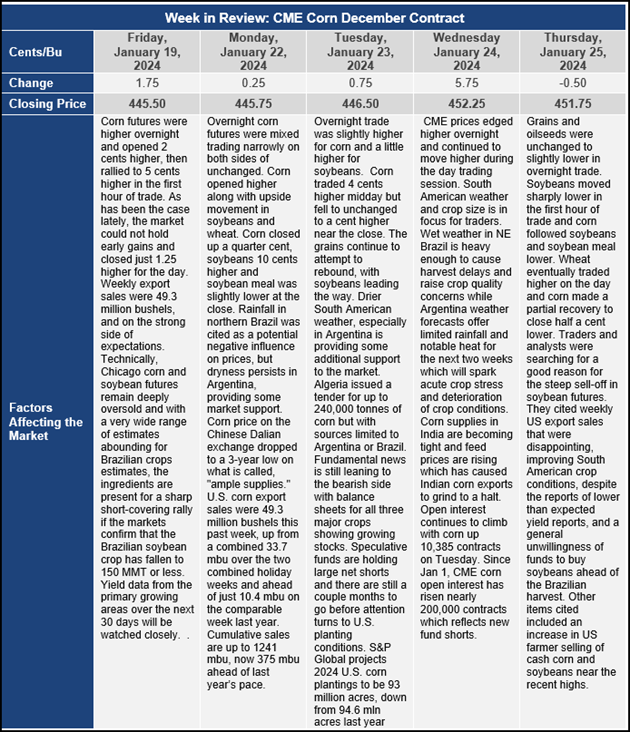

With the USDA reports now behind us, the focus of the market is now turning to prospects for southern hemisphere weather, crop conditions, and crop prospects, especially for Argentina corn and the potential for Brazil’s safrinha corn crop. Refinitiv Commodities Research reports that poor soil moisture conditions across the Central-West/Southeast and gloomy second crop weather outlooks through May lower 2023/24 Brazil total corn production by 1% to a median estimate of 119.2 [108.0–127.6] million tons. Refinitiv’s current median estimate is now 7.8 million tons below the USDA’s 127 million tons, which assumes total corn sowings at 22.4 million hectares and a national level yield of 5.67 tons per hectare versus LSEG Ag Research’s 21.7 million hectares and 5.51 tons per hectare. Brazil’s agriculture state agency (CONAB) has lately pegged corn production and area at 117.6 million tons based on 21 million hectares. As of 20 January, Brazil’s first corn is 90.4% planted nationally according to the latest CONAB crop progress report (22 January), behind last year’s pace of 95.8% and the 4-year average of 97%. “First corn” harvest kicked off in most major crop regions, largely ahead of schedule thanks to recent dry weather. Soybean harvest has also kicked off in some key regions, the progress of which usually plays a critical role determining the second corn sowing pace and hence yield. Delays in soy crop progress could leave a significant portion of the second safrinha corn crop to be sown outside the ideal window, as the safrinha crop is planted after soybeans are harvested. The second corn accounts for more than 75% of Brazil’s total corn production, warranting close attention.

In other world corn supply news, corn supplies in India are becoming tight and feed prices are rising which has caused Indian corn exports to grind to a halt. Meanwhile, corn price on the Chinese Dalian exchange dropped to a 3-year low on what is called, “ample supplies.”

U.S. weekly average ethanol production plunged 22% during the polar vortex (extreme cold) of the Jan 12-19 period in the U.S., twice as large as expected. This is a lower weekly rate than last year’s lowest weekly rates during 2022/23 and is the lowest weekly pace since the Covid year of 2020. Despite the drop in output, the U.S. ethanol stocks were reported at 25.815 million barrels, a 0.5% increase. A bounce back is expected soon for output and as demand picks up, a drop in stocks.

S&P Global released their early U.S. plantings estimates for spring 2024 (93 million acres vs 94.6 million acres last year) and Farm Futures magazine reported their survey of 92.8 million corn acres expected to be planted in 2024. While this lowered planted acreage expectation is a positive consideration for those bullish corn, it is unlikely that it produces much spark as an “acreage fight” won’t be needed this year with both corn and soybeans in decent shape stocks-wise.

Open interest continues to climb with corn up 10,385 contracts on Tuesday. Since Jan 1, CME corn open interest has risen nearly 200,000 contracts which reflects new fund shorts. When the market does turn, this very high level of fund shorts could provide the fuel for a significant rally in corn prices.

U.S. corn export sales were 49.3 million bushels this past week, up from a combined 33.7 mbu over the two combined holiday weeks and ahead of just 10.4 mbu on the comparable week last year. Cumulative sales are up to 1241 mbu, now 375 mbu ahead of last year’s pace.