Ocean Freight Markets and Spreads

Ocean Freight Comments

Attacks on vessels transiting the Red Sea have impacted trade routes between Asia and the Middle East and Europe more than other global routes. Ship owners and operators of container and tanker vessels, and some dry bulk vessels have halted sending equipment through the region and are routing around the Cape of Good Hope instead. Routing around the Cape of Good Hope nearly doubles the sailing time for some routes. As a result, ocean freight rates for those routes have increased, and supply chains must be reestablished to receive necessary supplies. War risk premiums have increased upwards of 50% on vessels transiting the region, especially those carrying or have a connection to the United States, United Kingdom, or Israel. Reportedly the war risk premium is 1% of the value of the vessel. However, Maersk, the largest container vessel operator, has warned that overcapacity of the container fleet will limit how much rates can rise as new vessel deliveries kick in over the next two years.

The Panama Canal Authority announced it will not make additional changes to the number of vessels transiting the isthmus until April. At present the number of daily vessel transits is limited to 24 to conserve the amount of water used to flush vessels through the network of locks. If water levels in Gatun Lake hold steady during the dry season that started in January and typically runs into the month of May then vessel transits will hold firm. Normally the number of daily vessel transits is about 36. Meanwhile, the freshwater surcharge is 2.21% this week, up from 2.11% last week.

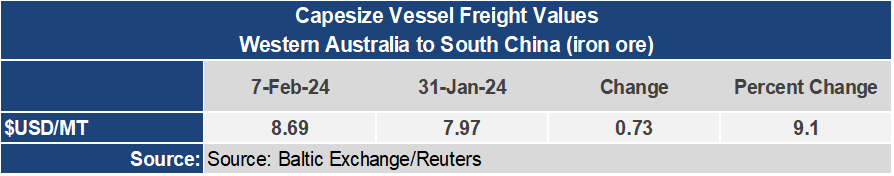

The Baltic Dry Index showed some life being 6% higher for the week to an index reading of 1,487. Although, the index peaked at 1,516 during the week and is retreating again. The Capesize market has been supportive but looks to be fizzling out. The smaller vessel classes were weaker throughout the week with the Panamax index losing nearly 8% to an index reading of 1,445 while the Supramax sector was down about 1% to 1,047.

The Forward Freight Agreements (FFAs) for Panamax and Supramax vessels were slightly firmer this week. Panamax time charters for March were up $200 per day for the week to $15,000. For April the Panamax time charters settled at $16,100 per day for the week after peaking at $16,900 during the week.

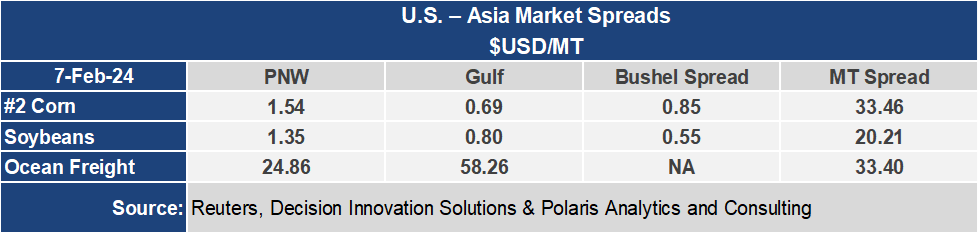

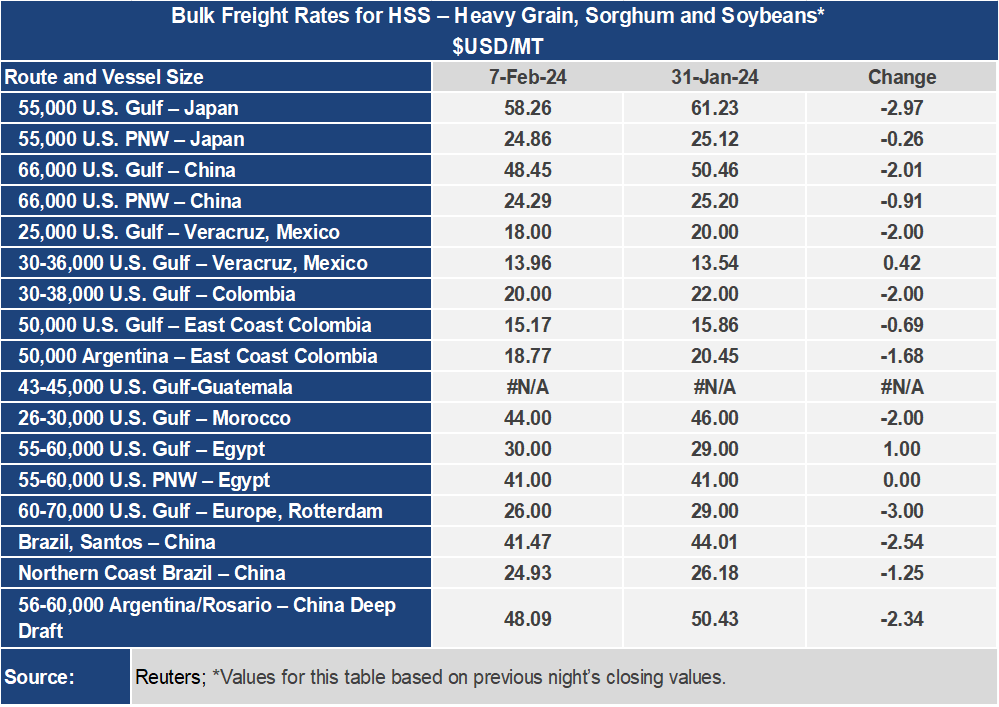

Dry bulk voyage rates were weaker on most grain routes this week. Rates on routes out of the U.S. Gulf to Asia route were down $2 to $3 per metric ton during the week. The rates out of the Pacific Northwest were down less than $1 per metric ton for the week.