Ocean Freight Comments

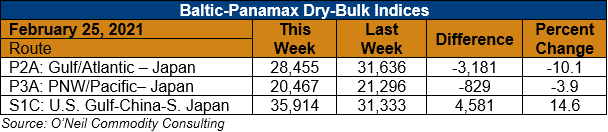

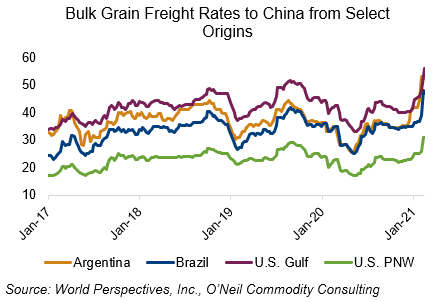

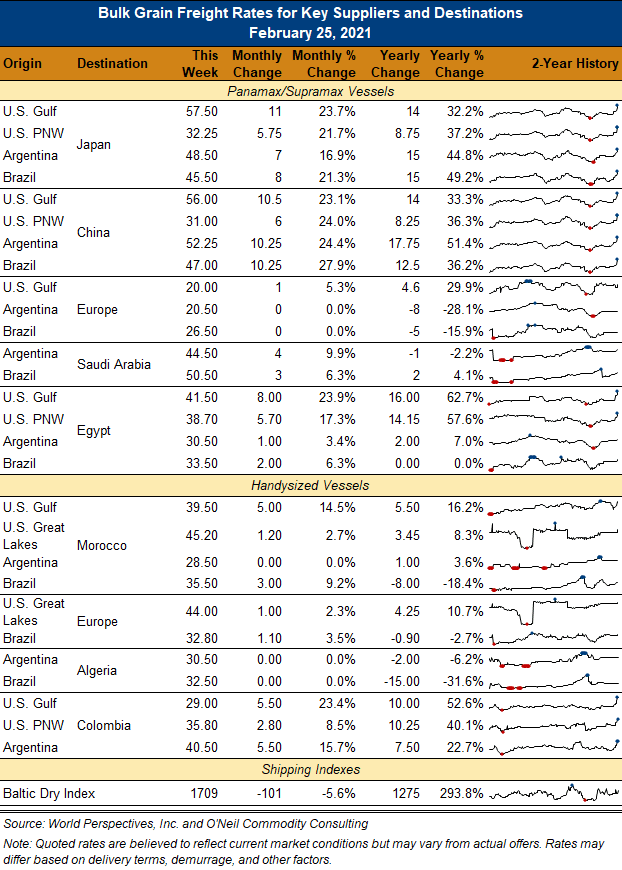

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: To quote John Maynard Keynes, “Markets can remain irrational longer than you can remain solvent”. Last week was a record week for the FFA paper markets with 88,198 lots traded, 54% of which were Panamax. This was an all-time record volume for FFA markets. Both volume and weekly volatility exceed even the wild days of 2007-08. In addition to general market enthusiasm, it was evident that a “market squeeze” has been taking place as paper trading was more volatile than physical markets. At the week’s end, Panamax paper rates were up 165% for the current year.

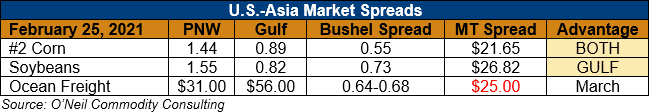

One may ask: is this rate structure sustainable? Market fundamentals have not changed, but market optimism certainly has. Volatility remains king and it has become a very bumpy ride. There is still an imbalance in vessel supply in the Atlantic versus Pacific, with short supplies in the Atlantic. This will eventually correct itself as the spread between oceans is way out of alignment.

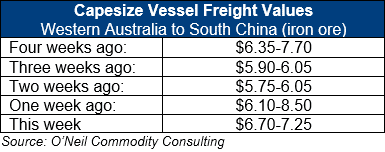

March Capesize vessels are down to $10,850 with Q2 at $15,000 and Q3 at $19,000. The March Panamax market is sitting at $19,500 with Q2 at $17,000. Aside from this week’s changes in market spreads, the interesting feature is that Panamax rates continue to outshine Capesize. Historically, Capesize vessels would command a 2.0-2.5 premium over Panamax vessels.