Chicago Board of Trade Market News

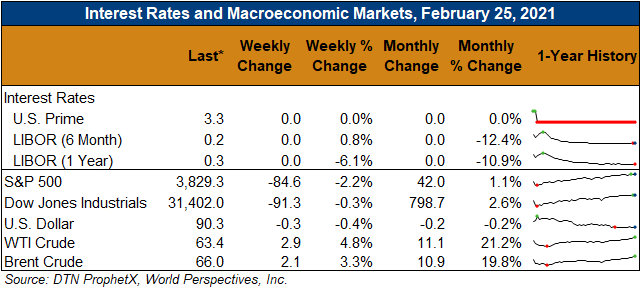

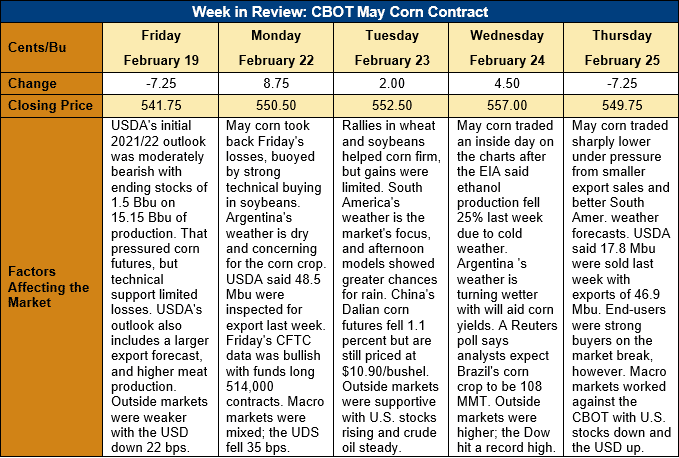

Outlook: May corn futures are 8 cents (1.5 percent) higher this week as early-week rallies in soybeans and wheat helped the market firm. Fundamental news has been somewhat light this week, but strong technical and speculative buying have helped markets higher. Thursday’s market action was mostly lower with the contract falling to key support levels before rallying and settling above trendline support. Looking forward, U.S. export demand and South American weather/crop production prospects seem to be the most influential factors.

The weekly Export Sales featured an expected reduction in sales and exports, due largely to the Lunar New Year holiday’s impacts.Net sales totaled 0.45 MMT, down 55 percent from the prior week while weekly exports fell only 14 percent at 1.19 MMT. YTD exports are up 79 percent at 24.259 MMT while YTD bookings total 59.0 MMT. Bookings are up 128 percent YTD and account for 89 percent of USDA’s 2020/21 export forecast.

The market continues to adjust its expectations of Argentine and Brazilian corn production based on fresh weather forecasts. To date, Argentina has faced drier than normal conditions and until Wednesday, the weather forecasts called for continued dryness into March. This has prompted some analysts to pare back expectations of the country’s corn crop, but most still expect production to be near USDA’s 47.5-MMT forecast.

Similarly, despite a slow start to the Brazilian soybean harvest (that could delay planting of the second, or safrinha, corn crop) analysts in a recent poll are still expecting the country’s 2020/21 production to be 108 MMT. That is just 1 MMT shy of USDA’s current projection. The poll looks for expanded planted are (19.44 million hectares in 2020/21, up from 18.5 million in 2019/20) and normal/trendline yields. The timeliness of planting the Brazilian crop and weather conditions as the La Nina fades heading into summer will be key for setting both the Brazilian and U.S. corn market outlook.

U.S. cash prices continue to firm with strong export and commercial demand. The average U.S. cash price rose to $231.55/MT ($5.42/bushel) this week with basis remaining steady at 17 cents under March futures (-17H). Barge CIF NOLA values are mostly steady this week as logistics pick up from the past two week’s cold snap while spot FOB Gulf offers are similarly unchanged at $252.45/MT.

From a technical standpoint, May futures are trading a wide range between support at $5.23 (the 11 February daily low) and the contract high at $5.72. Trendline support lies at $5.43, which the market broke and traded below briefly on Thursday. End-user buying was aggressive on the break, however, with initial volume estimates looking like a near-record for the May 2021 contract. That end-users continue to scale up pricing ideas and are aggressive on breaks is a sign of underlying fundamental support. Thursday’s close above trendline support and the converging 10- and 20-day moving averages is also a supportive development.