Ocean Freight Markets and Spreads

Ocean Freight Comments

There remains no let up with the Houthis attacking vessels using the Red Sea and have gone so far to announce that vessels wholly or partially owned or flagged by the United States, United Kingdom and Israel are banned. In addition to airstrikes and attacks from the sea, the Houthis are now attacking from below the sea with submarines on vessels.

That 12% of global maritime traffic has historically used the Red Sea to access the Suez Canal to connect Asia with the Middle East, Europe and North America, and vessel routes are being disrupted. Such disruptions lead to using alternative routes such as around the Cape of Good Hope that nearly doubles the journey between origin and destination markets. As a result of the longer journey, costs and freight rates increase. And such higher costs mean shippers are considering other trade flows or pass on the higher costs to the market. The situation through the Red Sea is expected to drag on indefinitely.

Meanwhile the Gatun Lake in Panama continues to see water levels fall further, standing at 80.9 feet as of February 22, 2024, down from 81.0 feet one week ago. Gatun Lake is used as a reservoir to hold water that is used to flush vessels through the series of locks of the canal zone, and for municipal water requirements. Water levels are not expected to rise anytime soon since this is the dry season that extends through May. The Panama Canal Authority is projecting water levels to fall to 79.5 feet by the second half of April. Since the current low water event started during mid-2023, the lowest water level was 79.2 feet in July 2023.

The number of daily vessel transits is limited to 24, down from the normal 36, while the draft at the Neopanamax locks is 44 feet, down from 50 feet, and the freshwater surcharge is now 2.42%, up from last week’s 2.31%. For reference purposes, a water level of 79.5 feet equates to a freshwater surcharge of 4.26% and does not change draft requirements through the Neopanamax locks or the Panamax locks.

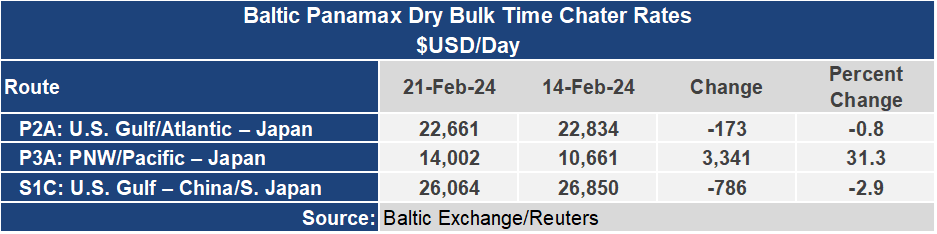

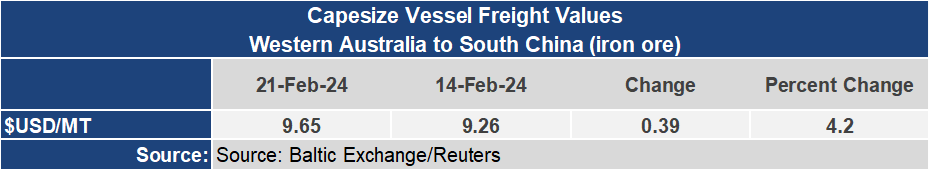

Issues through the Red Sea and at the Panama Canal, and improved iron ore shipments are impacting ocean freight rates. The Baltic Dry Index climbed 94 points or 5.9% to an index of 1,676 this week, a level last seen in early January this year. The Panamax sector gained 91 points or 5.8% for the week to 1,673. The Supramax market jumped nearly 10% on the week to 1,154.

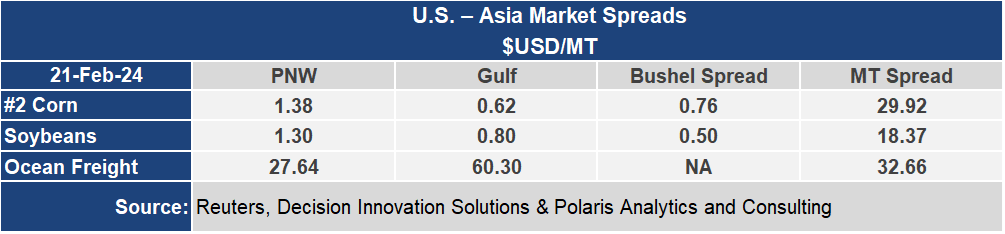

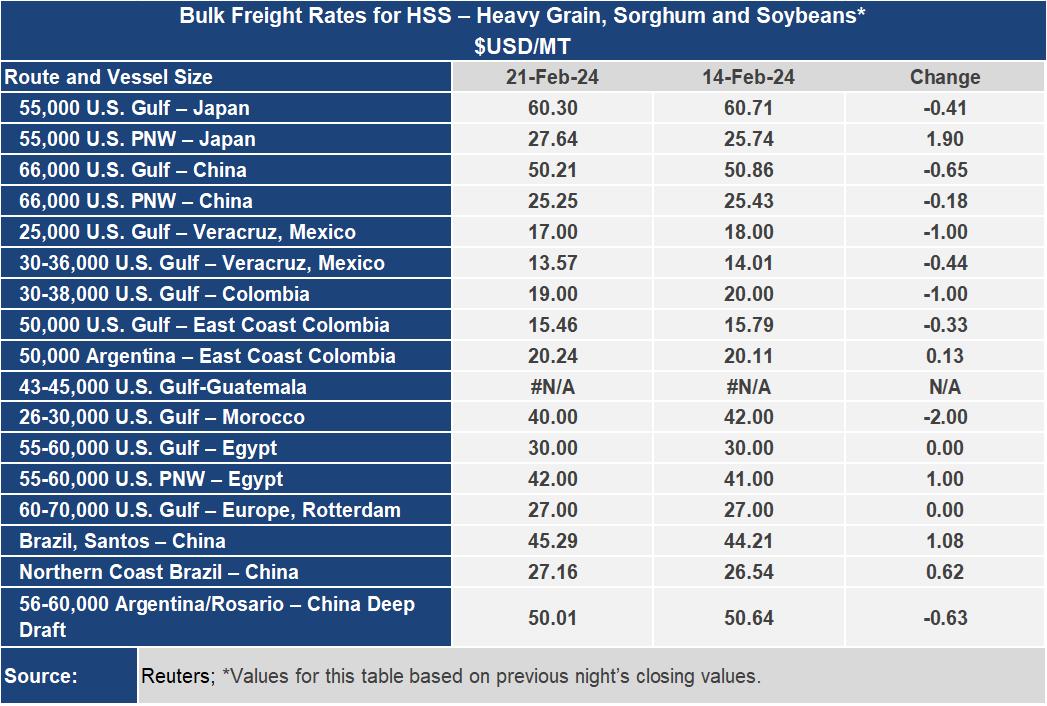

Dry bulk voyage rates on most grain routes were firmer this week. Out of the U.S. Gulf to Japan the rate was nearly 1% lower to $60.30 per metric ton for a 55,000 metric ton shipment, while out of the Pacific Northwest the rate was up more than 7% to $27.64 per metric ton. The spread between these key routes narrowed nearly 7% to $32.66 per metric ton.

Despite the strength in the nearby voyage markets, the Forward Freight Agreements (FFAs) for Panamax and Supramax vessels for March and April sailings have eased, potentially leading to lower voyage or freight rates on the horizon. Panamax timecharters for March were down $900 per day for the week to $15,200, and for April they settled at $16,000 per day, falling $700 for the week.