Chicago Board of Trade Market News

Outlook

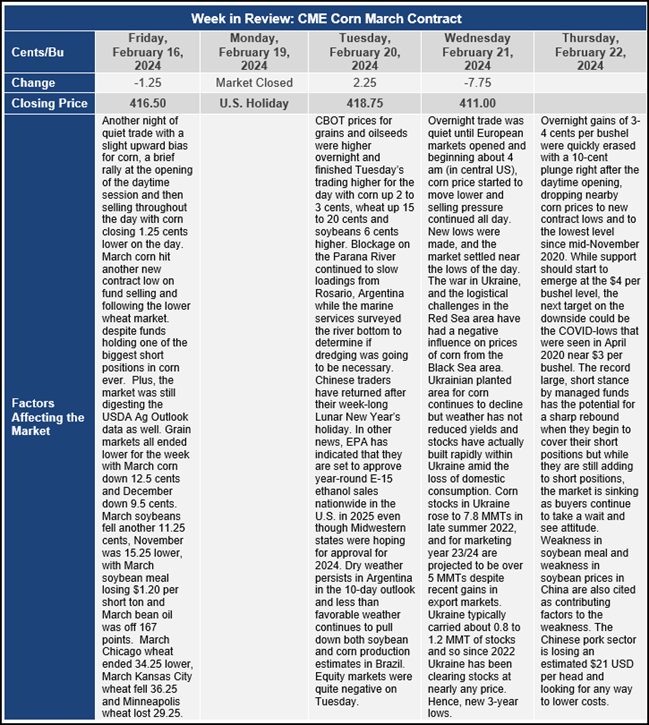

As grain markets opened after the President’s Day holiday in the U.S., markets moved higher led by shortcovering in the wheat market. The funds have built really massive, short or sold positions in the grain and oilseed sector, across corn and soybeans and wheat. And not just short positions in the U.S. but in Europe as well for the wheat market.

With the funds overexposed, it makes them nervous about any headlines out of the Red Sea or the Black Sea. The same thing applies to end users who may be going hand to mouth as prices have been in a downtrend, and they know that the funds have these big, short positions. Well, some negative news hit the market over the weekend that affected the freight price of grain and oilseeds. Two grain ships were hit in the Red Sea area, one of them ironically was headed towards Yemen. This is the first time the terrorists or rebels have actually hit grain ships and that raises the risk of higher freight costs, lengthens travel times, increases costs with the delays, and increases insurance levels according to market analysts.

Whether the rally could be sustained was answered with a resounding “No!” on Wednesday as weakness entered the market early Wednesday as European markets opened and then sank to new lows as soybean meal prices dropped more than 2%. Farmer selling has been less than normal, especially for Brazilian soybeans, but also in the United States as well. If, and when, prices rally, farmers are likely to catch up on sales muting any rally that might occur from managed funds shortcovering. The grain markets have already built in a lot of bearish news especially with last week’s projections from USDA at the Ag Outlook Forum. A near-term market bottom could develop if the bulk of the bearish news is already in the market. However, Ukrainian corn stocks are still well above the level they normally carry and selling pressure from the Black Sea area seems to be going on unabated. Ukrainian corn stocks are nearly 5 times higher than the historical levels they typically carried and turning those stocks into cash at seemingly any price appears to be one of the primary drivers of this market for now. Add to this some moderating weather in South America which is allowing the safrinha corn crop to be planted at reasonable levels of progress and the prospects of an early planting season for corn in the U.S. and it just adds fuel to the fire for the managed funds with a bearish stance.

Some spring fieldwork is already starting in Iowa, Minnesota and other Cornbelt states as the ground is not frozen and with persistent dry weather, soil conditions are good for pre-planting nitrogen applications and seedbed preparation fieldwork. Whether this early field work will affect farmer selling of corn is yet to be seen. Normally there is seasonal market strength that often starts in mid-February and lasts until planting time in the U.S. But if field work is already beginning, maybe this window of opportunity will not open this year.

Major bear markets end when the market runs out of sellers and so far, the supply of sellers has remained large.