Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are steady/$2 higher this week as markets start to quiet down ahead of the holidays. Soymeal futures pulled back sharply on Monday and have since stabilized but that market’s weakness has capped any rally attempts in DDGS. Ethanol output fell 1.5 percent last week but remained above 1 million barrels per day for the ninth straight week. DDGS supplies remain ample but strong domestic demand has prevented any weakness.

The DDGS/Kansas City soymeal ratio is at 0.49 this week, steady with last week and just below the three-year average of 0.50. The DDGS/cash corn ratio edged lower this week to 1.01 percent, still below the three-year average of 1.06.

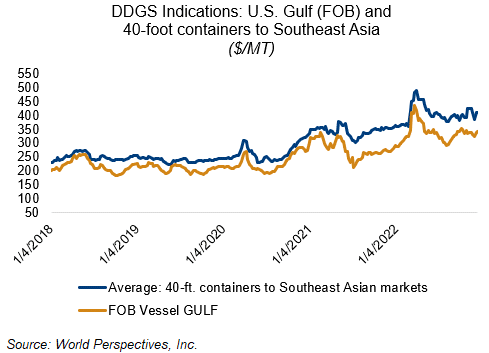

On the export market, Barge CIF NOLA prices extended last week’s gains and are another $4-7/MT higher. Offers for January barges are up $5 at $338/MT this week while FOB NOLA offers are $3-6/MT higher. January FOB NOLA DDGS are offered at $343, on aveage, this week. Prices for 40-foot containers to Southeast Asia are steady to slightly higher with Q1 2023 offers averaging $414/MT.