Ocean Freight Markets and Spreads

Ocean Freight Comments

No significant developments were announced from either side of the International Longshore Association and the U.S. Maritime Alliance on their contract. The contract is set to expire January 15, 2025. The key sticking point is automation of docks and terminal operations.

No new attacks on vessels sailing through the Red Sea by the Houthi terrorist organization were announced this week. The U.S. led military alliance continues to destroy Houthi drones and missiles. Vessel owners and operators continue to bypass the Red Sea and Suez Canal sailing between Europe and the Mediterranean and Asia, opting for the longer route around the Cape of Good Hope.

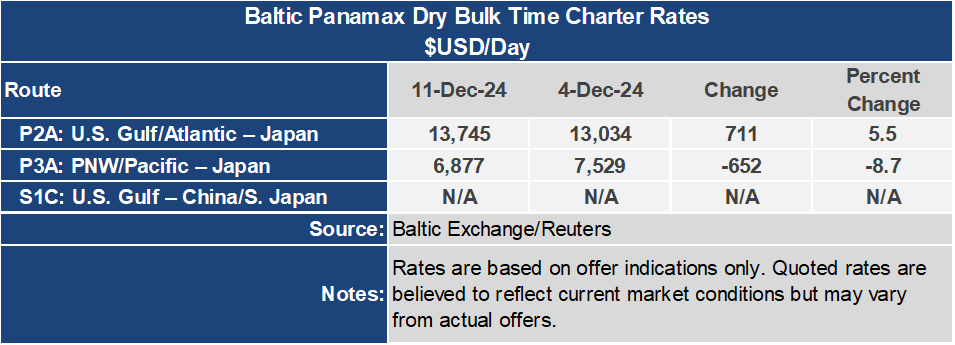

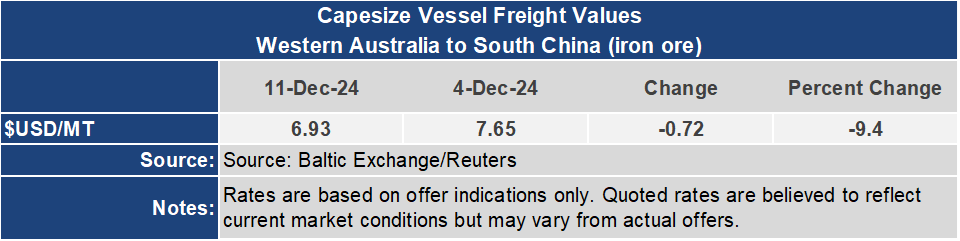

The Baltic Dry Index continues to weaken on the back of the Baltic Capesize Index, losing 6% or 74 points this week to an index of 1,106. This is the lowest level the BDI has been at since September 2023. The BCI dropped 232 points or 14% for the week to an index of 1,377. The BDI is greatly influenced by the BCI. The Baltic Panamax Index was the only route to reverse course during the week, gaining 4% or 39 points to an index of 1,053.

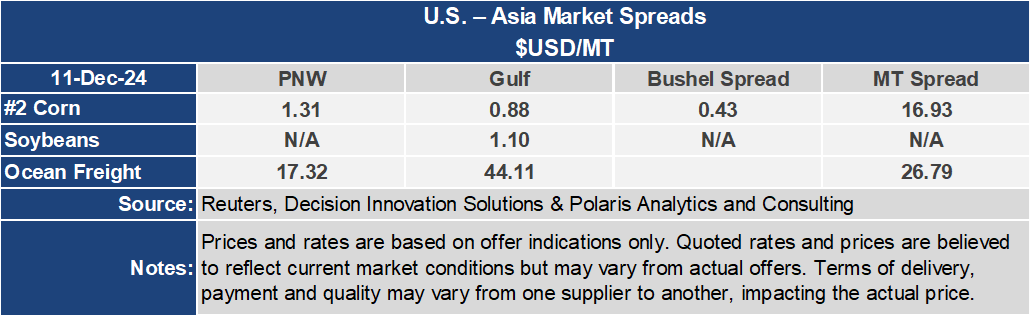

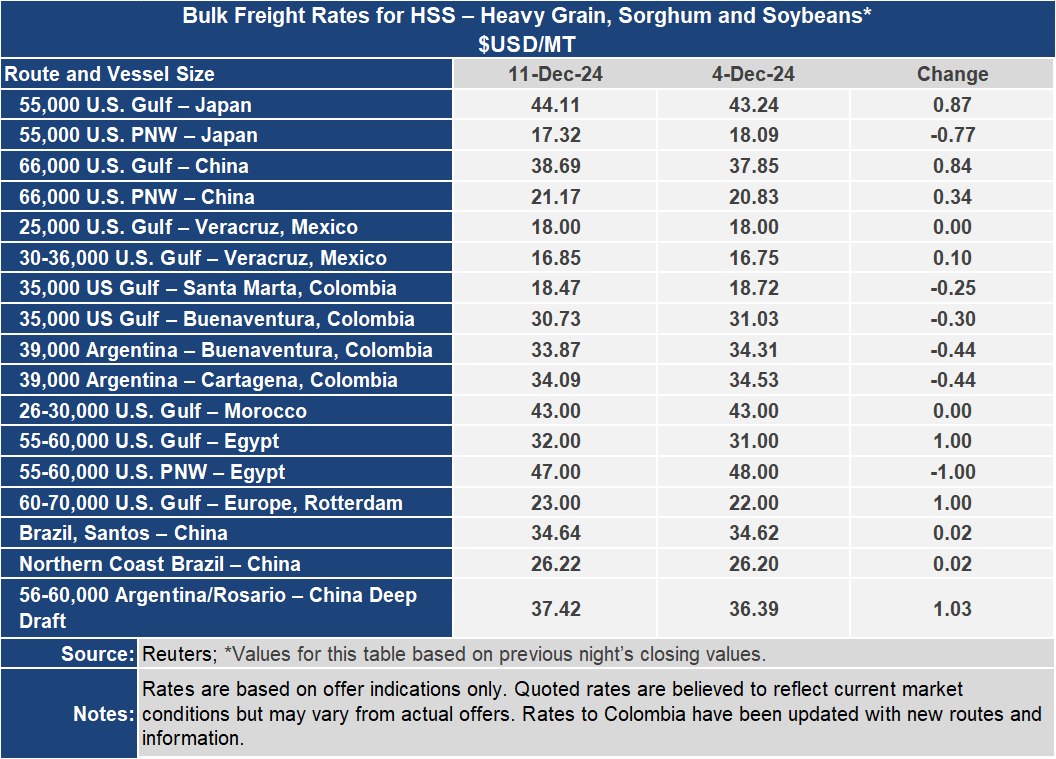

Voyage rates were mixed during the past week. To Japan from the U.S. Gulf, the rate ended the week up $0.87 per metric ton or 2% higher to $44.11 per metric ton. From the Pacific Northwest to Japan the rate was down 4% or $0.77 per metric ton to $17.32 per metric ton. The spread on these routes widened $1.64 per metric ton or 7% to $26.79 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf ended the week 2% or $0.84 per metric ton higher to $38.69. From the PNW the rate to China was up 2% or $0.34 per metric ton to $21.87. The spread on this route widened by 3% or $0.50 per metric ton to $17.52 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.