Chicago Board of Trade Market News

Outlook

Somewhat unexpectedly, the USDA decided to jump its US 2024/25 corn demand outlooks dramatically, this month. This year’s overseas demand (sales) has been quite aggressive with the 2024/25 sales pace 335 million bushels ahead of last year. This past fall’s strong ethanol output has already advanced this year’s domestic demand by 25-30 million higher in the first 2 months of year vs 2023. Overall, the trade was looking for just a 32 million bushels lowering of US corn stocks. This month’s 200 million bushel smaller carryover (1.738 billion bushels) is a positive step in the right direction, but this year’s endings stocks probably need to decline to 1.6 billion bushels or lower for a major long-term change in corn’s price outlook. If a smaller US final 2024 corn yield comes to pass next month, that would also help the bullish case for corn.

With no US wheat crop production estimate similar to corn and soybeans this month, the US market wasn’t expecting any balance sheet changes in the December report. However, the World Board increased US exports by 25 million bushels to 850 million, but they also upped US imports by 5 bushels. With this year’s US wheat sales 90 million ahead of 2023/24, this increase seems reasonable. Overall, the latest US wheat ending stocks are down 20 million to 795 million.

USDA left the US soybeans supply/demand data unchanged from last month but did lower the season-average price from $10.80 per bushel to $10.20 per bushel. The World Board appeared to be more cautious about US soybean demand in the upcoming US 2024/25 crop year due to potential changes in trade policy. President-elect Trump’s statements about re-instating tariffs on Chinese purchasing from the US and a general increase of 10% on all imports from China to 60% levels seems to have paused the USDA leaving this month’s US soybean balance sheet unchanged. With the current 24/25 export sales 145 million bushels ahead of last year on this date and shipments 130 million higher than last year, a rebound in last month’s 25 million decline in exports seemed possible to some analysts, but there is also a general consensus that soybean sales and shipments are front-loaded this year and could drop off dramatically in the near future. The USDA also left its US 24/25 soybean crush unchanged despite indications that this fall’s overall pace is 35-38 million bushels larger than last year. If soybean oil for renewable biofuels continues to drive the crush, the question is where all the soybean meal will go and will this weigh on values for corn distillers grains. With futures prices are relatively low levels for soybeans and basis levels out in the country at relatively wide levels, it will not be surprising if USDA in future reports lowers the season-average price for soybeans even more.

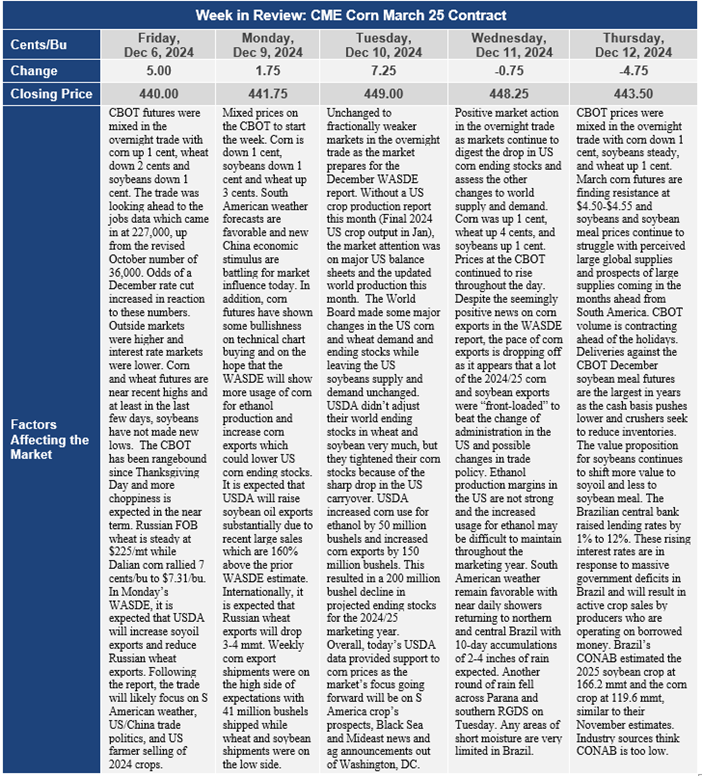

Internationally, the USDA didn’t adjust their world ending stocks in wheat and soybean very much, but they tightened their corn stocks because of the sharp drop in the US carryover. USDA lowered Mexico’s corn crop by 800,000 tons reflecting lower winter corn area and China reduced its crop size by 3.2 mmt in an update today. EU corn production is down reflecting reductions for Italy, Romania, Croatia, and Austria that are partially offset by increases for Poland, Spain, and France. Overall, USDA’s world corn ending stocks dropped 7.7 mmt this month to 296.44 mmt for the upcoming 2024/25 crop year. Corn exports for 2024/25 are raised for the United States and Canada but lowered for the EU. Corn imports are higher for Bangladesh, the EU, Iran, and Mexico but cut for China. Foreign corn ending stocks were reduced based on declines for China, the EU, and Indonesia.