Ocean Freight Comments

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting:

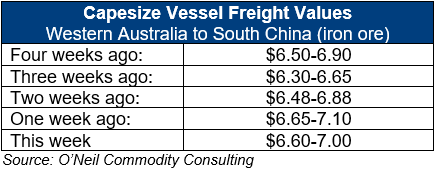

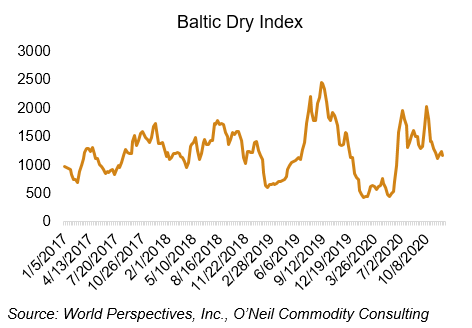

There are now only 16 days until Christmas and no more than 10 true working days until the holiday season starts. As per the old industry adage that “only those who must trade, trade close to the holidays”, trading volumes are decreasing. In times of low liquidity, it is easy to move markets up or down depending on how desperate firms are to execute trades. Both Capesize and Panamax markets saw some improvement this week but again ran into selling presser once values started to move higher. Paper trading was more active and excitable than the physical markets.

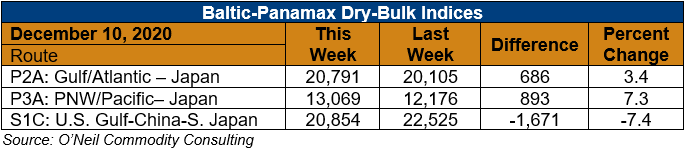

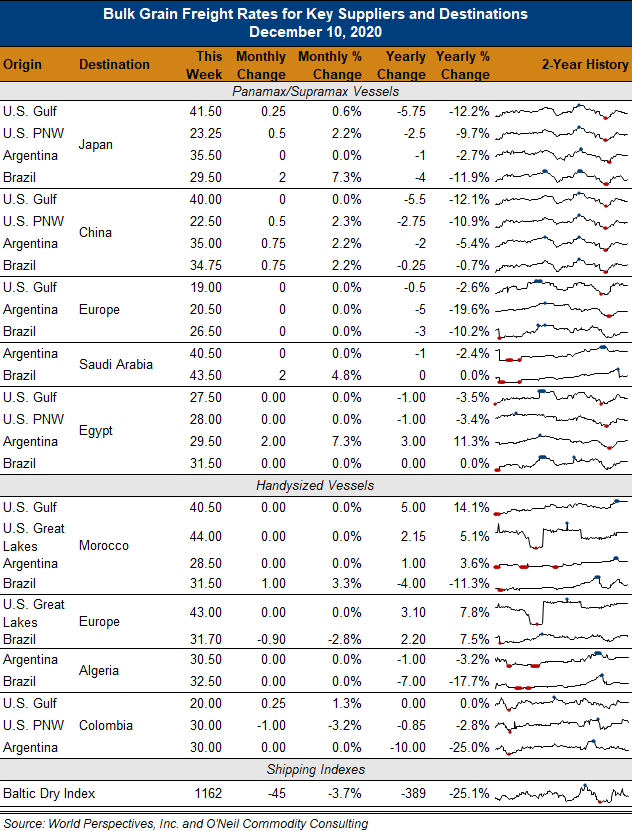

At weeks end, all markets were marginally higher and not strong enough to make a meaningful change in physical rates. Panamax FFA paper markets for January traded between $950-10,600/day with Q2 2021 trading at $10,600-11,5000/day.

With the higher rates and tight logistics, it was interesting, and encouraging, to see U.S. containerized grain export volumes increase sharply this past week with China and Indonesia as the biggest buyers.