Ocean Freight Markets and Spreads

Ocean Freight Comments

Panama’s early, abundant rainy season is recharging Gatun Lake at a faster pace than anticipated. As of this morning the water level stood at 85.2 feet compared to the normal level of 83.9 feet for August. Water levels are expected to rise further to nearly 87 feet during October. This week the Panama Canal Authority immediately increased the Neopanamax draft to 49 feet from 48 feet given the trajectory of water availability in Gatun Lake. The number of daily transits was increased by one to 35 as well. Under normal conditions daily transits can total 36. The Panama Canal drought crisis of 2023 is over and operating conditions are essentially back to normal.

Shipping activity through the Red Sea is anything but normal. The Houthis have been quiet the previous two weeks. This week the terrorist group claims to have fired upon on a merchant container vessel and two U.S. destroyers. According to the merchant vessel owner and the U.S. Navy, the vessels were not hit, there were no incidents affecting operations. While the Houthis are trying to keep relevant, the U.S. led alliance is destroying Houthis assets and weakening their capabilities. Despite that, and until persistent calm prevails, vessel owners and operators continue to bypass the Red Sea and Arabian Peninsula, opting for longer and more expensive routings around the Cape of Good Hope for example.

Shippers using ports and terminals along the U.S. East Coast and Gulf Coast are gearing up for potential labor retaliation or strike by the International Longshore Association. The ILA’s contract with ports, terminals, stevedores, vessel owners and operators, and shippers who are represented by the United States Maritime Alliance, expires September 30, 2024. Due to union disputes, they have canceled or delayed negotiations with USMX. The ILA is prepared to strike on October 1, 2024. The ILA notified USMX they will not extend the current contract, setting the stage for a strike. If the ILA strikes container terminals and operations will be greatly impacted. Bulk grain loadings use private or non-union labor, and a strike will have little to no impact. However, the International Longshore and Warehouse Union on the U.S. West Coast could carry out a sympathy strike or perform work downs or have sick outs. If the ILWU carries out any action that could impact grain loading on to vessels out of the Pacific Northwest.

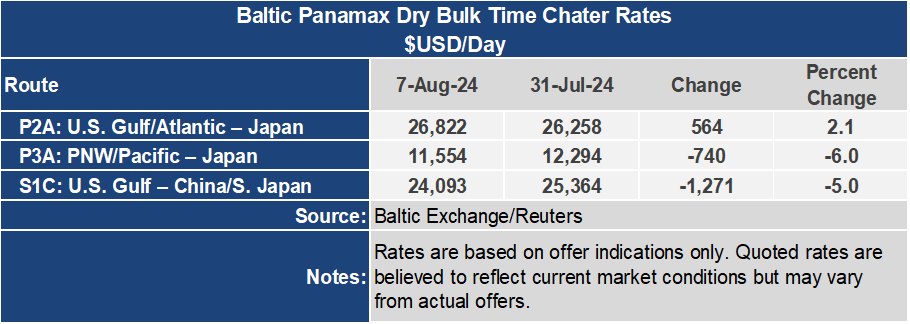

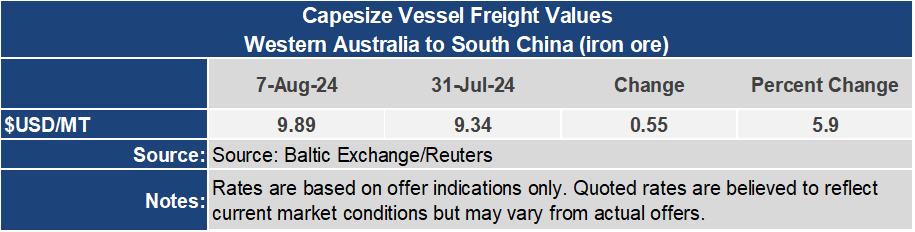

Despite the Capesize market having momentum this week, gaining 4% or 96 points to 2,473 on the Baltic Capesize Index, the Baltic Dry Index slumped 10 points to 1,698. The smaller vessel classes had an upper hand on the week with the Baltic Panamax Index down 5.1% or 88 points to 1,651 and the Baltic Supramax down 4% or 54 points to 1,309. With relatively few cargoes for the number of vessels available freight rates are muted. As China has been slowing its grain and agricultural product purchases and imports, freight demand has softened. Moreover, China reportedly has an abundance of supplies that continue to back up as consumers have slowed down protein purchases. The Baltic indices for the smaller vessel types have been in more of a sideways pattern with no breakouts in one direction or the other. The Capesize sector does have more volatility and since early 2024 had been trending higher until it peaked in early July and has pulled back. It is this time of year that coal deliveries pick up for the Capesize market to build inventories ahead of the winter heating season in Northern Hemisphere markets.

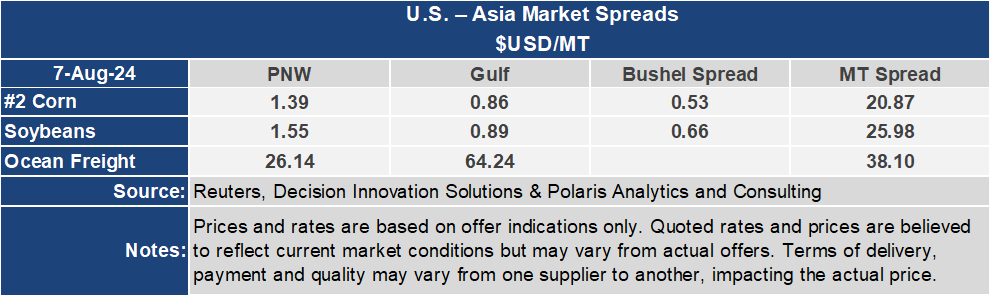

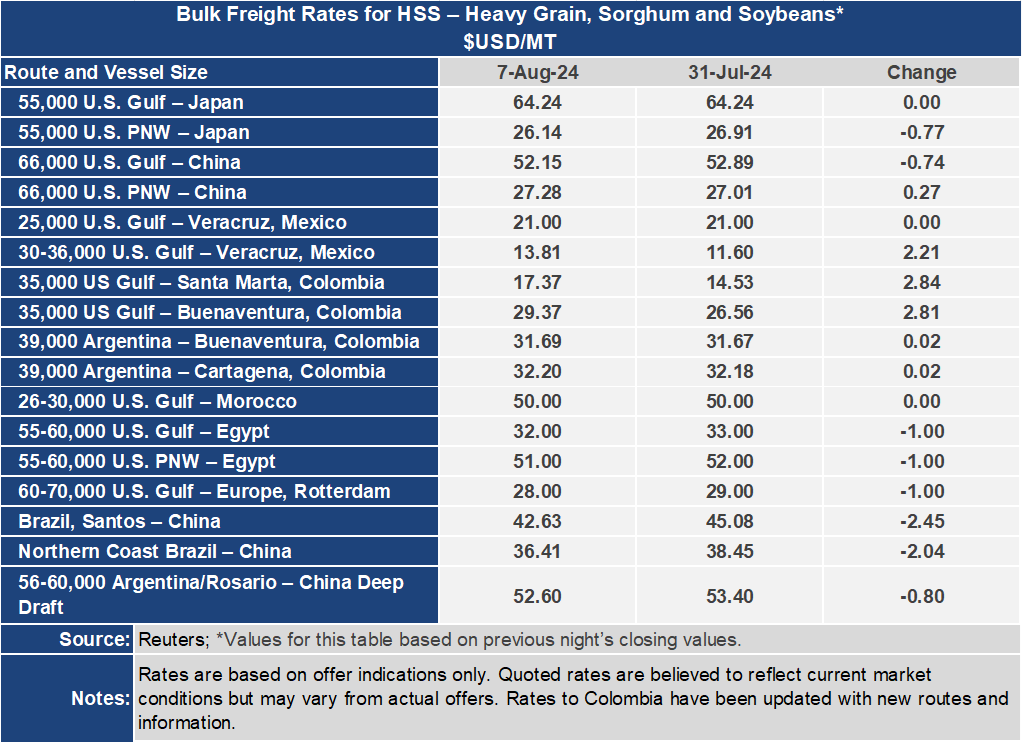

The U.S. Gulf to Japan route was unchanged this week at $64.24 per metric ton while the route from the Pacific Northwest ended the week down 2.9% or $0.77 per metric ton to $26.14 per metric ton. The spread between these two routes widened 2.1% to $38.10 per metric ton. This spread continues to expand and is the widest since March 21of this year. The reporting on ocean freight rates from the U.S. Gulf to Central America appear erratic due to the timing they are reported. These rates need to keep past few weeks in view and dismiss the erratic moves. For example, as the rates were much weaker last week, they are much stronger this week. The rates tend to break lower but keep a steady upper level. From the U.S. Gulf to Buenaventura, Colombia, the rate is hovering around $17.50 per metric ton and the rate to Veracruz, Mexico is around $14.00 per metric ton on a Supramax and $6.40 per metric ton on a Panamax.