Ocean Freight Comments

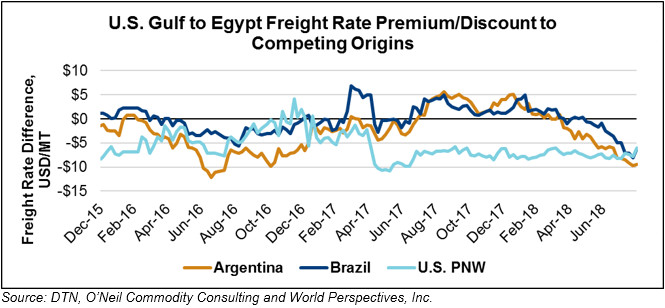

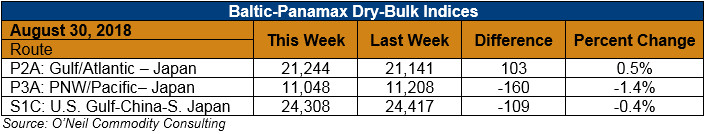

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: The dry-bulk Baltic indices showed small gains week-over-week but exhibited some weakness at week’s end by closing on the low side of the week’s trading range. Physical freight markets have not shown any willingness to pay up and therefore were mostly unchanged for the week.

The bigger story is probably in the grain container market where we have now gone two full months without a single container load of any grain commodity going to China. This is the start of the Christmas consumer goods movement season from Asia/China to the U.S. Thus, the question has been, is there an increased volume of empty containers to move U.S. grains and co-products back to Asia? The answer is yes and no. Since most containers need to move back to China for reloading, you can find good availability of empties to go there at very negotiable/attractive rates. If you are looking for empty containers to load and go to other Asian destinations you will find limited availability, increased transit times and freight rate increases of $100-200/TEU. This is creating a challenge for U.S. exporters who are seeking alternative demand in Asia to compensate for market volumes that have been temporarily lost in China.

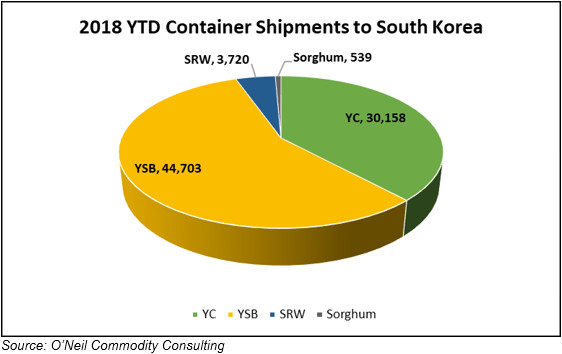

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to South Korea.