Chicago Board of Trade Market News

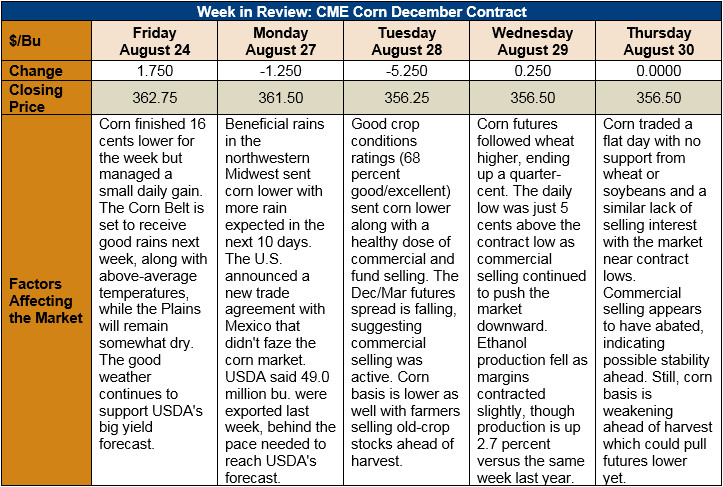

Outlook: December corn futures fell 4.5 cents (1.2 percent) from last Thursday in lackluster trade. The contract is now pennies above its life-of-contract low, typically a major support point. At this time, the market has absorbed the implications of USDA’s 11.204 MT/Ha (178.4 BPA) yield estimate and corresponding 42.776 MMT (1.648 billion bushel) ending stocks figure for the U.S. Now, it’s all about just how accurate USDA’s August projection was and just how much demand will come to the U.S.

The U.S. crop remains in amazingly good condition, with 68 percent of corn rated good/excellent, above last year and the five-year average. USDA said Monday that 61 percent of corn is dented (versus 42 percent on average) and fully 10 percent of the corn is mature (versus the five-year average of 5 percent).

The advanced maturity of the crop likely implies two things: 1) USDA’s yield estimate is likely to be more accurate than otherwise, and 2) harvest/harvest price pressure will come earlier than usual. The latter is important in that the market could set its yearly low in the next few weeks, then turn to demand/exports for guidance on price appreciation.

So far, 2017/18 exports stand at 56.001 MMT, up 2 percent from last year and slightly below USDA’s forecast of 59.69 MMT. Given the recent export pace, it seems likely the market will miss USDA’s forecast by 2 MMT, or about 3 percent. Year-to-date (YTD) corn bookings (exports plus unshipped sales), however, are up 7 percent, suggesting there will be a good bit of business “already done” to carry over into 2018/19 and give a boost to that year’s exports.

Other Export Sales report highlights include sorghum exports up 5 percent YTD and barley exports up 57 percent YTD.

From a technical standpoint, December corn is hovering above life-of-contract lows which should prove key support. The December/March futures contract spread has been widening in recent days, suggesting active commercial selling. It would be unsurprising if the market tested $3.50 again and briefly traded below this point in the next few weeks. However, it seems equally unlikely, given present information, that the market would make a sustained push below this point, especially with bullishness growing in wheat. Consequently, corn futures are likely to trade largely sideways in the near-term.