Chicago Board of Trade Market News

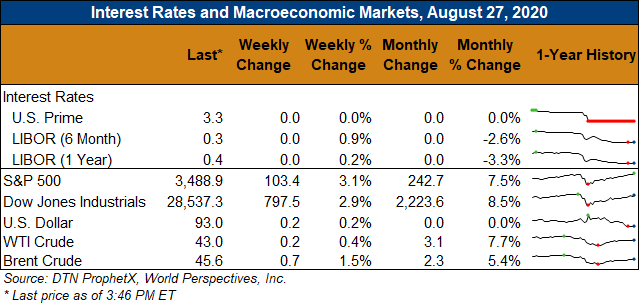

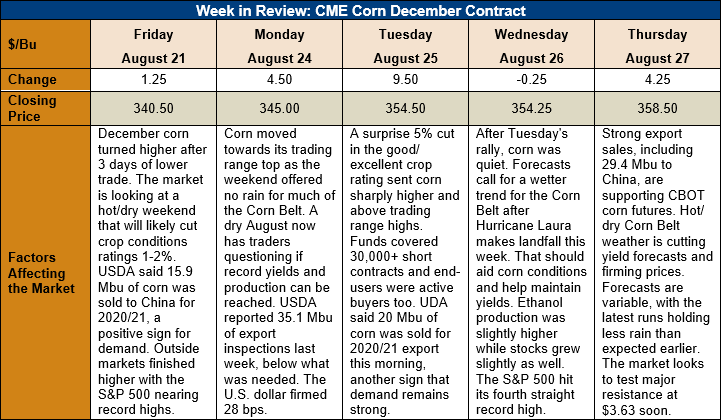

Outlook: December corn futures are 18 cents (5.3 percent) higher this week as a surprisingly large decrease in U.S. corn conditions prompted massive short covering and end-user buying. Funds are paring back their net short position while end-users increase pricing ideas as charts turn bullish. The market made quick work of technical resistance points and is looking to test the 1 July daily high.

Monday’s Crop Progress report surprised the market with a 5 percent decline in the good/excellent rating for U.S. corn. The market was expecting a 1-2 percent decline due to ongoing dryness in Iowa and parts of the Western Corn Belt. The larger-than-expected decline in ratings pushed futures higher as prospects for a record-large crop are increasingly in question. Despite the dry Midwest conditions, the International Grains Council increased its forecast of the U.S. corn crop to 384.2 MMT (15.125 billion bushels). That estimate is still below USDA’s current forecast and the 2016/17 record crop of 384.8 MMT (15.148 billion bushels).

The weekly Export Sales report featured net old-crop corn sales of 270,400 MT and net new-crop sales of 1.18 MMT. Weekly exports were down 22 percent from the prior week at 939,100 MT and were sufficient to put 2019/20 YTD bookings at 44.491 MMT – down 11 percent from the prior year and in-line with USDA’s forecast. Notably, new crop outstanding sales currently total 13.384 MMT, up 142 percent from the prior year.

International market developments continue to support expectations for strong 2020/21 U.S. corn demand. Brazilian cash and export prices have risen steadily this summer, leaving U.S. Gulf export offers priced at a significant discount to Brazil. At the same time, Chinese demand is increasing, partly due to the country’s rebuilding hog herd and shifting away from inferior feed ingredients. China has sold roughly 51.5 MMT of temporary state corn reserves over 13 weeks, out of the 52 MMT of corn offered in those auctions. China has also been actively procuring U.S. corn, buying another 747,000 MT (29.4 million bushels) on Wednesday, per the USDA’s daily export sales report. According to USDA’s weekly Export Sales report, China has booked 6.386 MMT (248 million bushels) of corn from the U.S. for the 2020/21 marketing year.

From a technical standpoint, December corn futures are showing significant strength. The chart gap left by Tuesday morning’s open remains unfilled and now stands as technical support. The market quickly traded through psychological resistance at $3.50 on Tuesday and has not thoroughly tested that point again. Momentum indicators point to higher trade and the market is not yet overbought. The next upside target is the 1 July daily high at $3.63, which is also where the 200-day moving average also lies. On the downside, there is emerging trendline support at $3.50 ½, and then at the bottom of the open chart gap ($3.45 ½).