Ocean Freight Comments

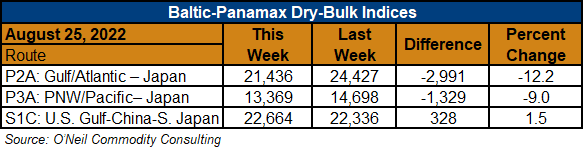

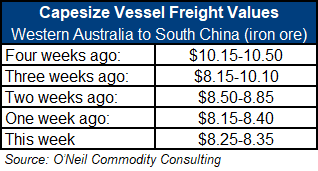

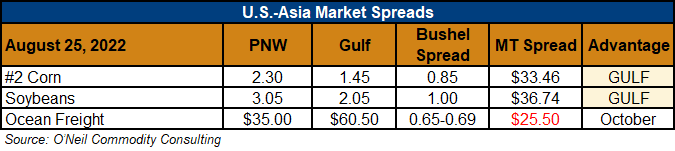

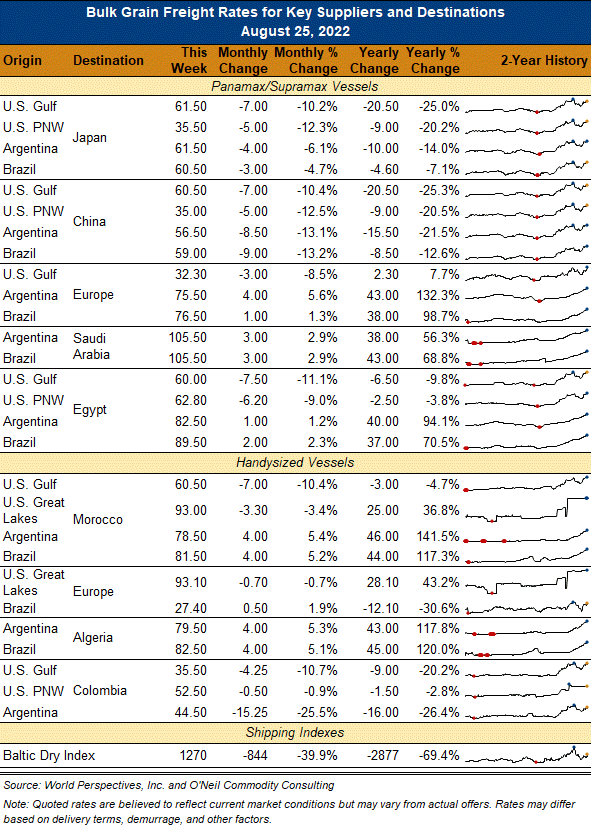

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: All the FFA ocean freight traders are still yelling; “Are we there yet?”, and “If not, can we stay afloat until we get there”? Early in the week it looked like markets hit bottom and were providing a small upward bounce. Many articles stated that the outlook for freight now appeared positive for the balance of the year. But then, once again, everything slipped back and proceeded to head even lower. Dry-bulk rates have erased almost all this year’s gains are now sitting close to their January values. This is certainly not what was expected. There really is not much new news, just growing concern over the slow growth of the Chinese economy and that nation’s overall commodity import volumes. Maybe things will bottom out next week after the market has taken all the money from those with long freight positions?

The ILWU-West Coast Port labor contract negotiations are ongoing but seem to have hit a snag on the key issue of automation. Additional troubles are brewing over a dispute between two different labor unions over authority over in port equipment movements in Seattle.

The market is still carefully watching the railroad union negotiations as the “cooling-off” period for those negotiations expires on 16 September.