Chicago Board of Trade Market News

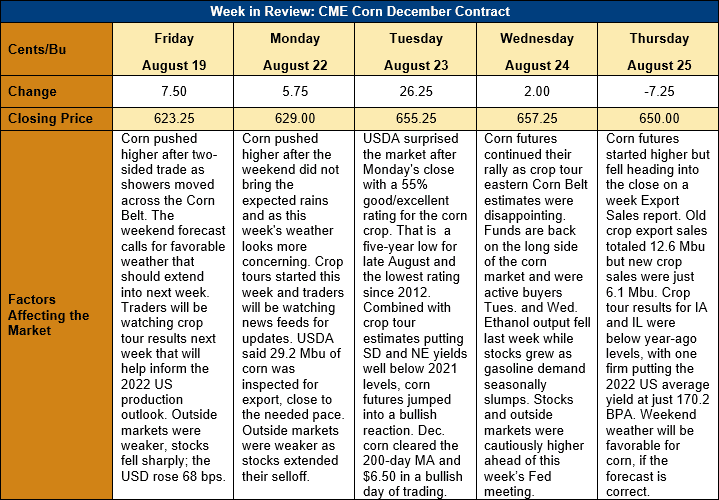

Outlook: December corn futures are up 26 ¾ cents (4.3 percent) and have erased all last week’s losses as a decline in conditions ratings and disappointing crop tour yields surprised the market. Corn futures started Monday on a high note after the weekend featured a dry weather pattern for most of the Corn Belt. After the markets close on Monday, USDA’s crop progress report found a 2 percent decline in the share of the crop rated good or excellent, with 55 percent of fields falling in those two categories. The rating was a new five-year low for this time of year and the second lowest rating since the drought year of 2012. The news elicited a 26-cent rally in December corn the following trading day and the market climbed to its highest price since late June.

Combined with the USDA’s ratings decline, various crop tours made their way across the Midwest this week and found larger-than-expected impacts from this year’s heat and dry weather. One tour estimated the U.S. average 2022 yield at 10.689 MT/ha (107.2 bushels per acre, or BPA), down from USDA’s official estimate for the 2021 crop of 11.116 MT/ha (177 BPA). The tour estimated that the nation’s two largest corn producing states, Iowa and Illinois, would produce strong yields, but that they would fall 3-10 percent. Yields in the western Corn Belt were the most surprising, particularly in South Dakota and Nebraska, where the heat negatively impacted final kernel fill. The eastern Corn Belt will likely see yields fall 3 percent this year due to smaller production in Indiana and Ohio. It’s important to note that most private crop tours often underestimate USDA’s final yield. The USDA will issue is first “objective yield” estimate in the September 2022 WADSE report.

U.S. old crop corn net export sales rose 222 percent last week to 0.32 MMT while exports fell 50 percent to 0.313 MMT. YTD exports for the 2021/22 crop total 58.054 MMT with just two weeks left in the marketing year and are down 10 percent. U.S. new crop export sales fell from last week but totaled 0.139 MMT while outstanding sales for the 2022/23 marketing year total 3.215 MMT.

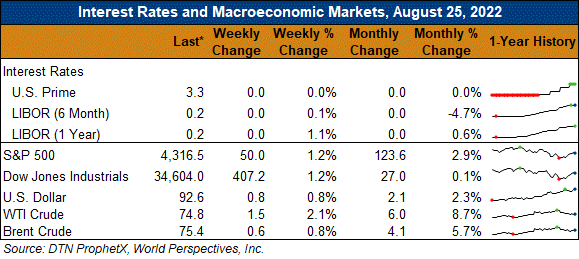

From a technical standpoint, December corn futures marked important developments this week with two consecutive closes above the 200-day moving average. Additional, Tuesday’s rally took futures above the psychologically-important $6.50 level with heavy fund and commercial buying. The market now seems to be drifting sideways with some resistance near the100-day moving average ($6.76 ¼). The weather forecast’s recent shift to favor cooler temperatures with steady precipitation for the Corn Belt may help boost final yields, which is taking some pressure off the corn market. Still, the results from this week’s crop tours indicate that the U.S. yield and production estimates may move lower in coming USDA reports.