Ocean Freight Comments

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was not an exciting week in global dry-bulk freight markets, but the paper index traders were able to move the market a little higher even though we did not see any new bullish news. Aside from the negative feelings emanating from trade issues, the two biggest issues facing shipping companies are the cost of bunker fuel and upcoming environmental restrictions on CO2 emissions. Both are very costly for vessel owners. Therefore, vessel owners and many paper traders feel that rates need to continue to move higher to compensate for rising operating costs. But, as we all know, the markets do not always provide what people want. The laws of supply and demand still govern market direction. We will need a continuing increase in cargo demand to keep things moving up.

It should be noted that vessel scrapping activity has slowed considerably as owners are trying to hang on to ships for what they believe will be improving markets. They best not get too greedy. On the container side, this is the peak shipping season for holiday goods coming from China to the West. Christmas is coming, but for whom we do not yet know.

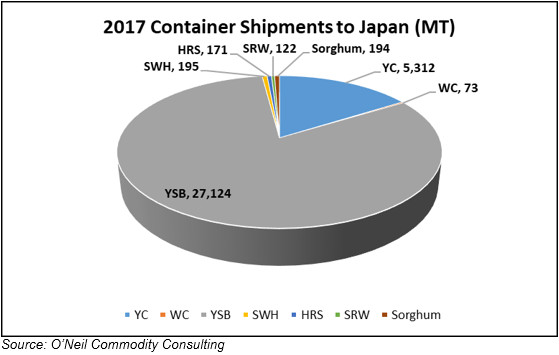

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to Japan.