Ocean Freight Markets and Spreads

Ocean Freight Comments

Canada’s CN Rail and CPKC locked out teamster workers early this morning after talks failed to ratify a new contract. The lockout essentially stops all rail activity across Canada. The Canadian government is not intervening and will allow both sides to work toward an agreement. Even though the trains of the two Canadian railroads that operate in the U.S. will continue to operate, there will be impacts of traffic that cross the U.S.-Canada border. Some U.S. spring wheat, grains and soybeans across the Northern Plains will be impacted given the routing on the Canadian railroads. A prolonged shutdown will greatly affect the economics of North America.

Navigation conditions and operations at the Panama Canal are now operating are normal levels. The drought of 2023 and 2024 is “officially” over allowing for full draft of 50-feet through the Neopanamax locks and full slot capacity for vessels to transit across the isthmus.

Vessel attacks by the Houthis terrorist group continue in the Red Sea and around the Arabian Peninsula. This week three vessels were attacked. A tanker vessel carrying 150,000 metric tons of crude oil was hit and suffered damage that required the crew to be evacuated. The extent of the damage is being assessed while the vessel is adrift. Vessel owners and operators, shippers and beneficial cargo owners expect the situation to continue indefinitely. The attacks on vessels transiting through the Red Sea started in November 2023 in solidarity with Hamas and the Palestinians.

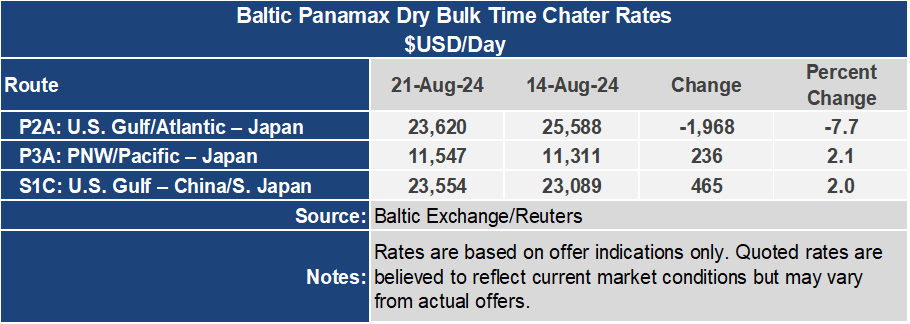

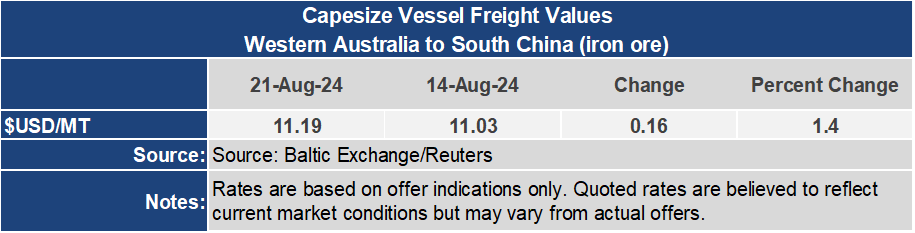

The Baltic Dry Index gained 1.8% for the week to an index of 1,759 and is 52.8% higher than one year ago. The Baltic Capesize Index led the BDI higher, ending the week 5.2% higher at 2,788 points. BDI is 104.4% higher than it was one year ago. Despite the strength in the Capesize sector, the Baltic Panamax shed 4.7% for the week to an index of 1,487. The Baltic Supramax Index found strength gaining 1% to an index of 1,310 for the week.

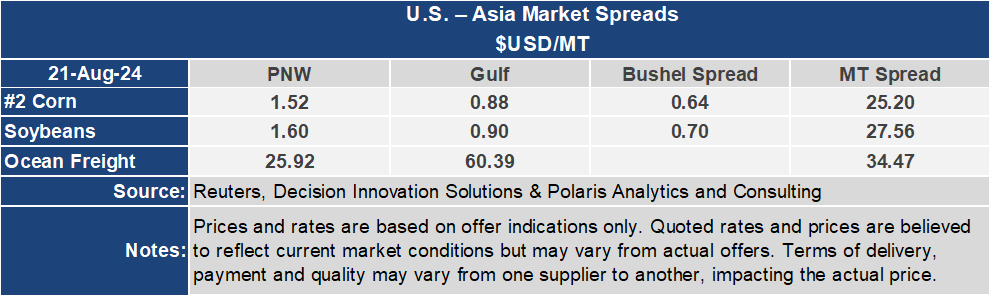

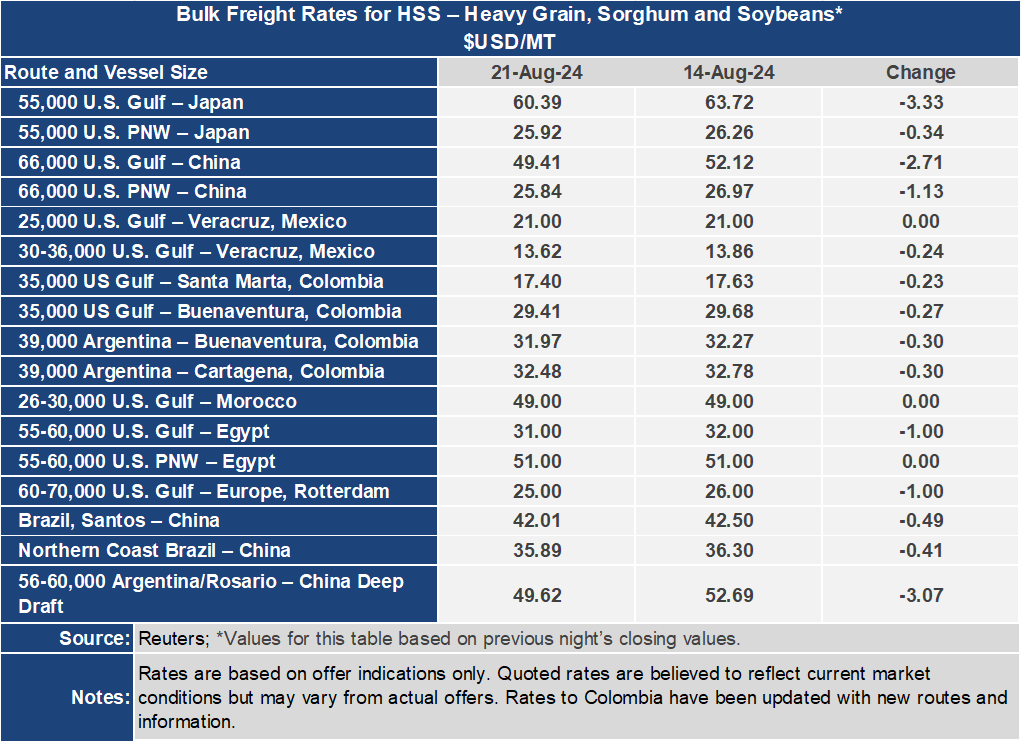

The U.S. Gulf to Japan route continues to weaken, losing $3.33 per metric ton or 5.5% for the week to $60.39 per metric ton. From the Pacific Northwest the rate lost 1.3% or $0.34 per metric ton for the week finishing at $25.92 per metric ton. The spread between these key grain routes narrowed 8% or $2.99 per metric ton to $34.47 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $49.41 per metric ton for the week, down $2.71 per metric ton or 5.2%. From the PNW the rate was $1.13 per metric ton or 4.2% lower at $25.84 per metric ton this week. The spread on this route narrowed 6.3% or $1.58 per metric ton to $23.57 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.