Chicago Board of Trade Market News

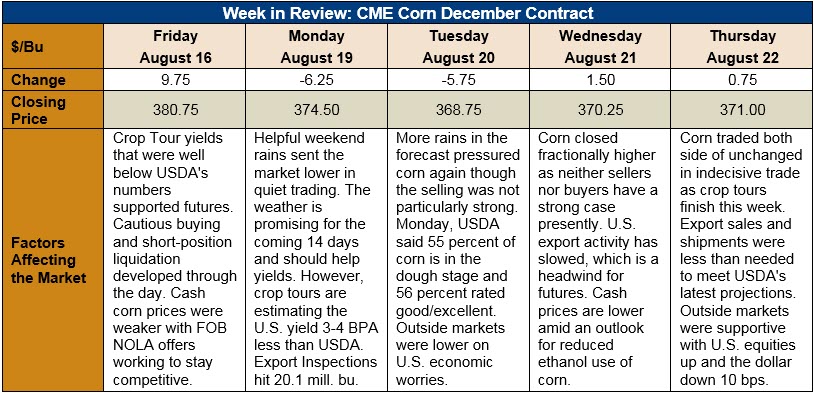

Outlook: December corn futures are down 9 ¾ cents (2.6 percent) this week as the market trades sideways after last week’s bearish WASDE. The market has apparently found its equilibrium amid bearish forecasts for good weather into the fall and bullish crop tour yield estimates that are below USDA’s latest.

Trading this week was largely dominated by good rains across the Midwest that will help boost yields for the corn and soybean crops. Parts of Kansas, Southeastern Nebraska, and Missouri would prefer consistent sunshine over more rain, however, with warmer temperatures and sunlight needed to finish the crop. Overall, however, the weather has been favorable the past week, and looks to continue that trend for the next 14 days. Parts of the Eastern Corn Belt that were too dry a week ago now have adequate moisture with additional precipitation expected. The favorable weather forecast left futures with a muted tone this week.

Various private crop tours have reported yield forecasts that are less than USDA’s August forecast. The tours note wide-ranging yields across Ohio, one of the latest-planted states and one where rains were needed early this week. Private yield forecasts averaged near 158-162 BPA for the state. In Illinois, crop tours estimated this year’s yield at roughly 20 BPA less than 2018 and Iowa yields reflected a similar reduction from last year. The crop tour results seem to suggest that USDA will lower its 2019 corn yield estimate later this fall.

USDA’s weekly Export Sales report featured net sales of 119,300 MT and exports of 539,700 MT. The export figure was down 24 percent from the prior week and less than needed to keep pace with USDA’s latest export forecast. YTD exports are down 12 percent while YTD bookings are off 17 percent. USDA also noted that 50,600 MT of sorghum and 600 MT of barley were exported last week.

U.S. cash prices are weaker across the Midwest this week with the average price moving 2 percent lower to $139.23/MT. Barge CIF NOLA and FOB NOLA corn prices are steady this week with Gulf export offers at $163.75/MT, a decrease of 11 percent from the prior week. FOB NOLA prices are 5 percent higher than this time in 2018.

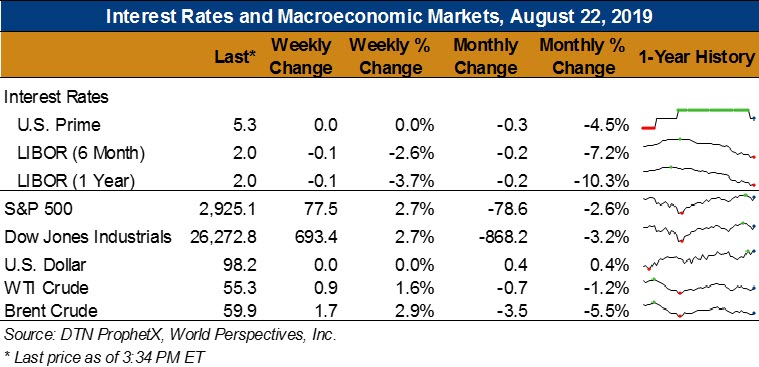

From a technical standpoint, December corn has stabilized and is trading sideways off technical support at $3.65. Funds are thought to hold a neutral position in corn, which should help keep futures range-bound unless significant fundamental news is uncovered. The contract is technical oversold, however, which could spark a modest rally towards upside resistance at the August 16th high of $3.81.