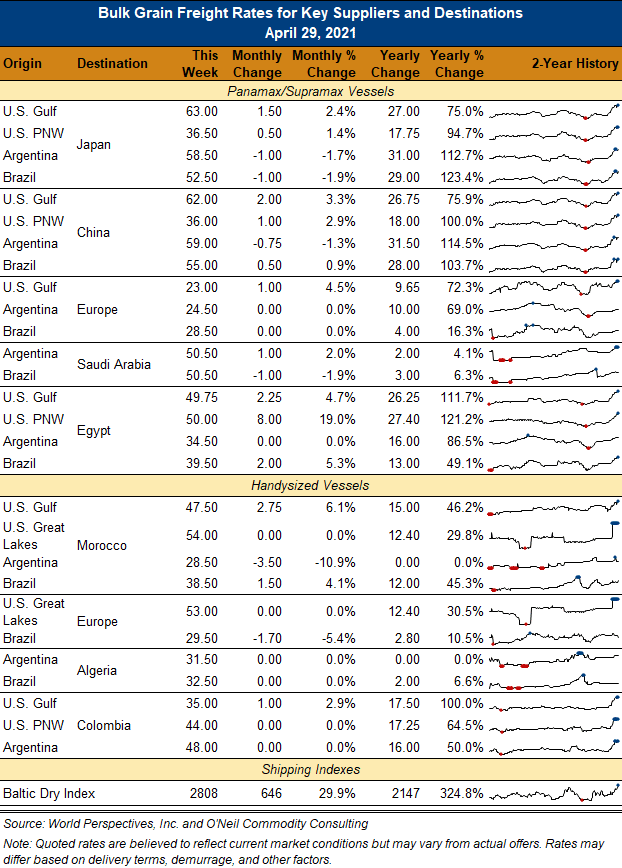

Ocean Freight Comments

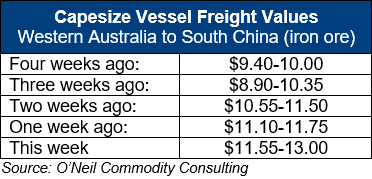

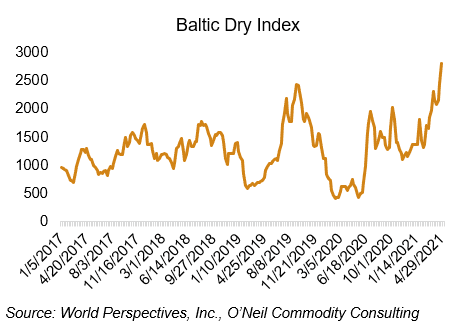

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: This was a relatively quiet week in dry-bulk markets following the wild volatility of the last few weeks. Capesize markets are again leading the parade and paper traders were able to keep support under the market but could not move the needle much.

China’s purchases of raw materials and a healthy grain trade continues to provide hope that further upside potential exists, but it will not be an easy task. Some analysts are already predicting a late summer selloff.

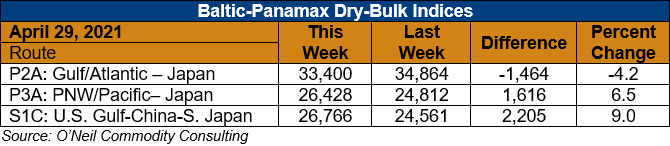

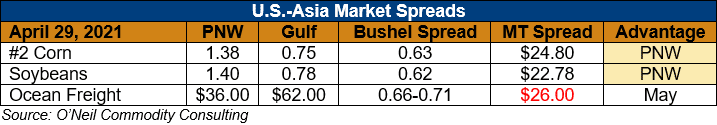

The FFA market saw Panamax daily rates for May trade at $22,500-23,200. Late buying pushed Q3 rates to $20,350 and Q4 to $18,250. For 2022, Q1traded to $18,650 and cal22 reached $14,500. Container grain rates remain strong, and logistics are challenging. U.S. weekly exports of containerized grain remain below 80,000 MT.