Chicago Board of Trade Market News

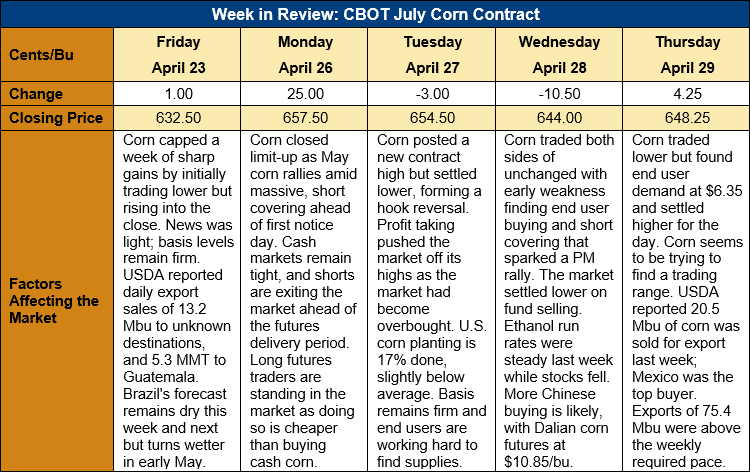

Outlook: July corn futures are 15 ¾ cents higher this week after the market hit a new contract high on Tuesday ($6.84) but settled lower, forming a technical hook reversal on the charts. Trade on Wednesday and Thursday was mostly lower but with a consolidative tone as the market evaluates its next move. Short covering ahead of first notice day in May futures, combined with rising basis levels and tight physical supplies, caused much of the corn market’s recent rally. Now, the market’s attention is turning to more long-term factors, like the U.S. planting pace and forecasts for improving weather in Brazil.

U.S. farmers continue to make strong planting progress with 17 percent of fields seeded as of Sunday. The pace is slightly behind the five-year average progress rate of 20 percent. Favorable weather this week, however, has some analysts forecasting a 40 percent completion figure for USDA’s next report. Three percent of the crop is emerged so far, essentially in-line with the 5-year average emergence rate of 4 percent.

After several weeks of dry conditions for southern and central Brazil, the country’s weather forecasts are finally shifting to favor significant rainfall for the south. The first week of May should bring 20-40 mm of rain for most of southern Brazil, which will help ease drought conditions affecting the safrinha corn crop. Most analysts recognize the current drought has cut yields on the second corn crop, but early-May rains should prevent further losses.

Despite forecasts for favorable rains in southern Brazil, current weather forecasts still hold a concerning trend. Notably, the state of Mato Grosso is slated for below-average rainfall for the next two weeks. Mato Grosso is a major producer of Brazil’s second corn crop and USDA data show the state produced 43 percent of Brazil’s safrinha corn, on average, from 2017-201. By comparison, the major southern producing states, Parana and Mato Grosso do Sul, respectively accounted for 18 and 13 percent of the safrinha crop over the same time period. Sustained dryness in Mato Grosso will have an outsized impact on the Brazilian total crop and global markets will be closely watching for rain in central Brazil.

U.S. exporters registered 521,000 MT of net corn sales last week, up 35 percent from the prior week. Exports reached 1.915 MMT, up 19 percent from the prior week, bringing YTD shipments to 41.308 MMT. YTD exports are up 83 percent while YTD bookings (unshipped sales plus exports) are up 85 percent at 67.719 MMT.

U.S. exporters also sold 107,200 MT of sorghum and shipped 241,000 MT (down 6 percent from the prior week). YTD sorghum exports total 5.348 MMT and are up 178 percent while YTD bookings are up 102 percent.

U.S. cash prices have rallied sharply with end users working hard to secure spot supplies. Despite this week’s increase in CBOT futures, basis levels have rallied equally strongly. The average U.S. basis bid was 17N (17 cents over July futures), up from 12N last week and -78N this time last year. The basis rally helped fuel strength in May CBOT futures as some end users and processors will be better off standing for delivery in the May contract rather than buying corn in the cash market.

Barge CIF NOLA prices have followed interior cash and futures markets higher this week. Spot barges are quotes at $297.25/MT, up 6 percent from the prior week. FOB Gulf offers are up 7 percent this week at $303.92/MT.

July corn futures are in an interesting technical position. The market rallied sharply to start the week but settled lower on Tuesday day as profit taking pushed values lower. Tuesday’s price action formed a technical “hook reversal” (a new high and a lower close but not trading below the prior day’s low), which is usually a moderately bearish signal. The contract was overbought and due for a correction, making Tuesday and Wednesday’s weak price action somewhat unsurprising. Momentum indicators are leaning bearish but the ADX still shows a strong uptrend, which suggests breaks will be used as buying opportunities. Initial support lies at the 10-day moving average ($6.22) in July futures, followed by the 23 April daily low at $6.19 ¼. Resistance, of course, is the contract high.