Ocean Freight Markets and Spreads

Ocean Freight Comments

The number of daily vessel transits at the Panama Canal is set to rise to 32 starting June 1. The Panamax Locks will lose three slots for maintenance from May 7 to 15, for a total of 24 for both the Panamax and Neopanamax locks. Starting May 16 daily transits increase to 31 (from 17 to 24 at the Panamax locks), then on June 1 increase to 32 with the Neopanamax at 8 slots. Grain exports out of the U.S. Center Gulf that would transit the Panama Canal mostly use the Panamax locks.

In Baltimore, Maryland, where the MV Dali had an allision with the Francis Scott Key Bridge that collapsed, the U.S. Coast Guard and U.S. Army Corps of Engineers established a third access channel for commercially essential vessels. The channel has a controlling depth of 35 feet (the Maryland Pilots require a 3-foot under-keel clearance), a 300-foot horizontal clearance, and a vertical clearance of 214 feet. The controlling depth and horizontal clearance may change following ongoing survey analysis. This channel will be available through April 29 or April 30. Vessels that have been entrapped since the bridge collapse on March 26, will have the opportunity to depart. Quite possibly other vessels that require access to terminals to be discharged could access the port. The controlling width, depth, and height clearances will accommodate about 42% of the vessels that access the Port of Baltimore, including container, Ro-Ro, and loaded dry bulk vessels that meet the clearance requirements.

The Houthis continue to attack vessels plying the Red Sea and around the Arabian Peninsula. This week they shot missiles at the MV Maersk Yorktown in the Gulf of Aden identified as a US-flagged, owned, and operated vessel, and targeted the MV MCS Veracruz in the Indian Ocean, which was identified as an Israeli vessel. The attacks by the Houthis are slowing as they are running out of munitions and equipment. However, they vow to keep up the attacks until there is a cease-fire or an end to attacks in Gaza.

After gaining ground last week, the Baltic Dry Index turned negative on weakness in the Capesize sector. The Panamax and Supramax sectors are holding firm with steady demand and capacity utilization. The BDI gave up 70 index points or 3.8% for the week to 1,774. The Baltic Capesize Index dropped 15.5% or 415 points to an index of 2,345 this week while the Baltic Panamax Index was up 5.8% to 1,910 and the Baltic Supramax Index was up 8.9% to an index of 1,456.

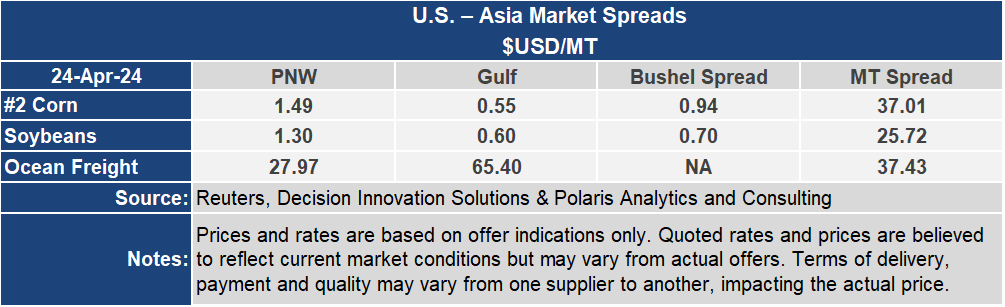

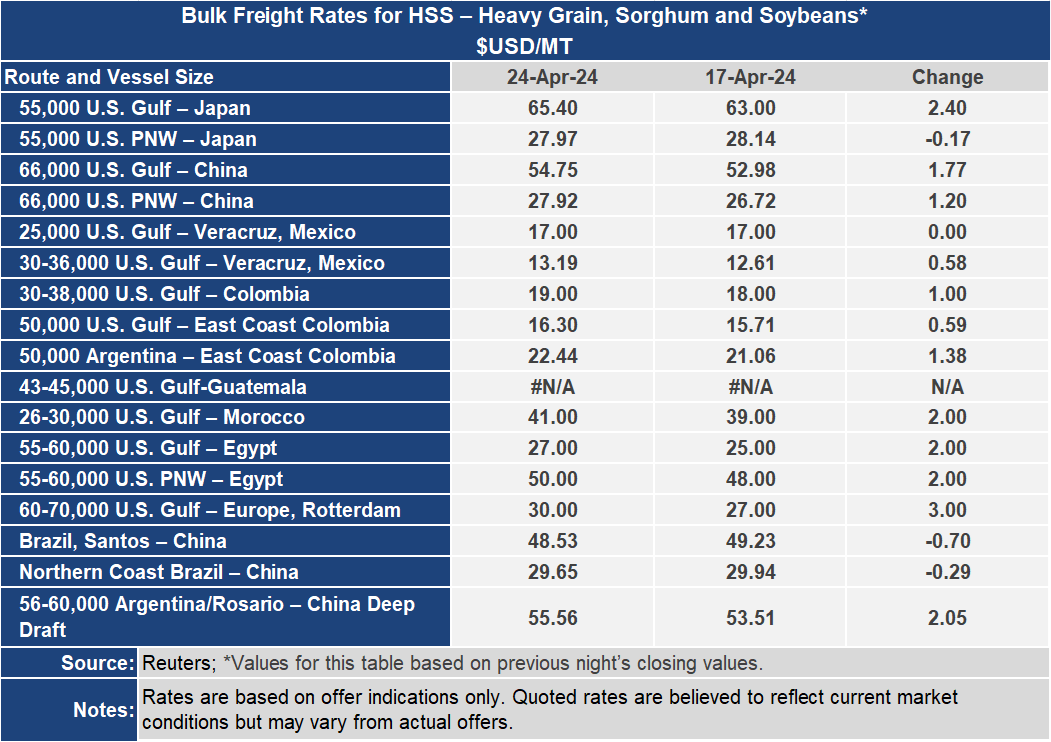

The strength of the dry Panamax and Supramax indices flowed over to most of the voyage rates. For grain shipments out of the U.S. Gulf to Japan, the freight rate ended the week up 3.8% or $2.40 per metric ton higher for the current week to $65.40 per metric ton. Out of the Pacific Northwest, the rate to Japan was nearly unchanged, down six-tenths of one percent to $27.97 per metric ton. The spread between these closely monitored routes ended the week at $37.43 per metric ton, an increase of 7.4% or $2.57 per metric ton. On the routes to China, the Gulf was up 3.3% to $54.75 per metric ton for the week while from the PNW the rate was up 4.5% to $27.92 per metric ton.