Chicago Board of Trade Market News

Outlook

In the most recent WASDE report, global coarse grain production for 2023/24 was lowered 2.7 million tons lower to 1,507.4 million. The most recent changes in world coarse grain outlook are for reduced production, larger trade, and smaller ending stocks relative to last month. Corn production outside the U.S. is forecast lower with declines for South Africa, Ukraine, Mexico, Venezuela, and Russia that are partly offset by increases for Argentina and Syria. South African corn production is down reflecting lower yield prospects. Corn production in Mexico is cut based on expectations of lower winter corn area. Coarse grains production in Ukraine and Russia are reduced based on reported harvest results to date. Argentina is raised based on higher expected area. Foreign barley production is down, with reductions for Iraq and Syria that are partly offset by an increase for Australia.

Major global trade changes include higher corn exports for Ukraine and Argentina but reductions for South Africa and India. Corn imports are lowered for the EU, Saudi Arabia, Israel, and South Korea but raised for Mexico, Venezuela, and Indonesia. Barley exports are raised for Australia. Corn ending stocks outside the U.S. are lower, mostly reflecting a decline for Ukraine that is partly offset by an increase for Brazil. Global corn ending stocks, at 319.6 million tons, are down 2.4 million.

With global coarse grain stocks declining, more attention is being paid to the crop prospects for the crops already planted in the southern hemisphere and the crop that is currently being planted in the northern hemisphere. Eastern Europe and the Black Sea area weather are in the spotlight as wheat supplies are getting tighter in many areas and dryness persists in the major growing areas of Eastern Europe and southwestern Russia. The EU and GFA weather models both agree that rainfall will stay north and west of the major wheat producing areas of Ukraine and southern Russia at least through May 7th. Late winter/early spring of 2020 saw similar weather patterns and winter wheat yields that were stressed in April were salvaged by timely rains in May and June. Soil moisture conditions in the area are depleted but there is still time for improvement but there is little room for warmth/dryness to be extended beyond early May and still see good yields.

In the Midwestern U.S., rainfall patterns fall in line with a forecast of a drier, warm summer. By the end of the first week in May, the spring season is likely to have a signature of precipitation very similar to those of past years in which there was a quick transition from El Nino to La Nina. Summer seasons that followed the wetter bias in the spring were often drier biased in the quick transitioning years from El Nino to La Nina. If the parallel continues, there is likely to be increased probabilities for below average precipitation during the summer months in the Plains and the Midwest as well as the Delta. This does not mean a severe drought is imminent, but the probabilities of a below-trendline national corn yield increase when the transition from El Nino to La Nina is rapid.

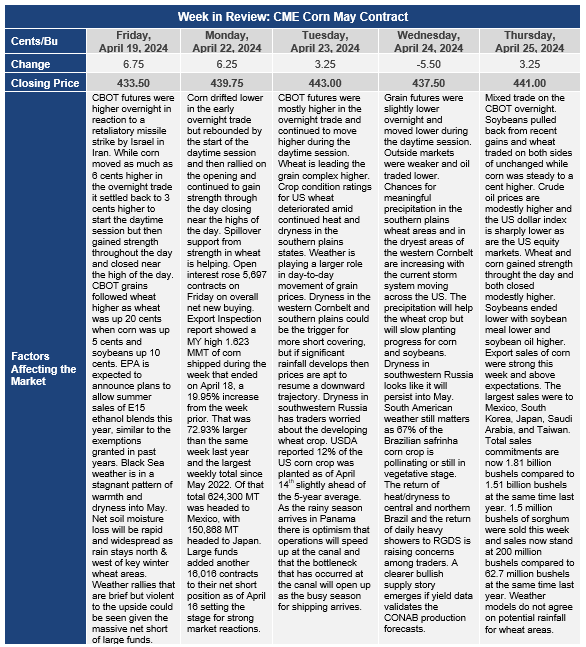

Corn export sales were strong this week at 51.2 million bushels. This was above trade expectations. Cumulative U.S. corn export commitments for the current marketing year now total 1.81 billion bushels and 19.8% above export sales commitments at this time last year.