Ocean Freight Comments

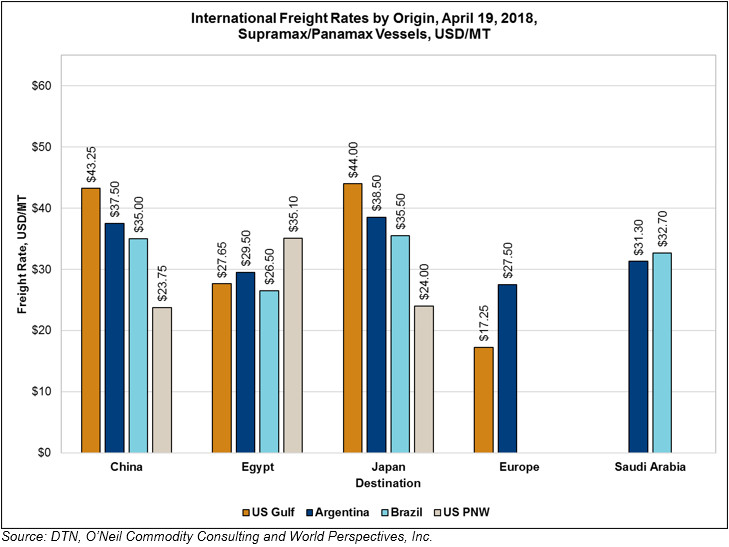

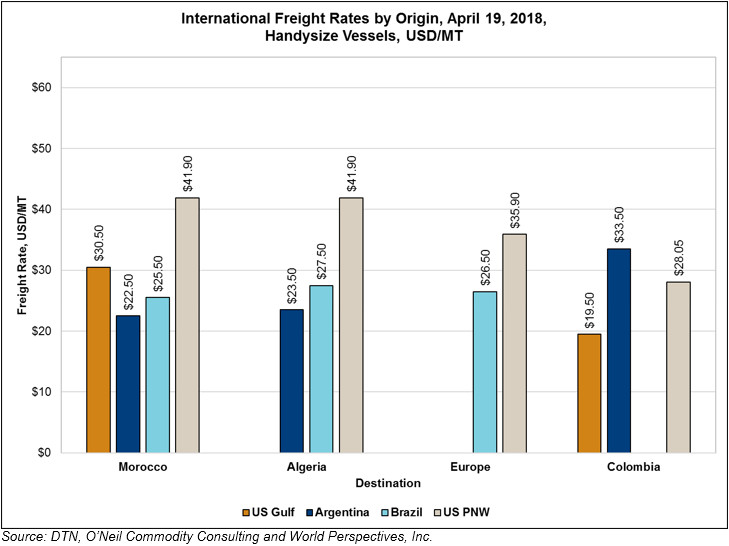

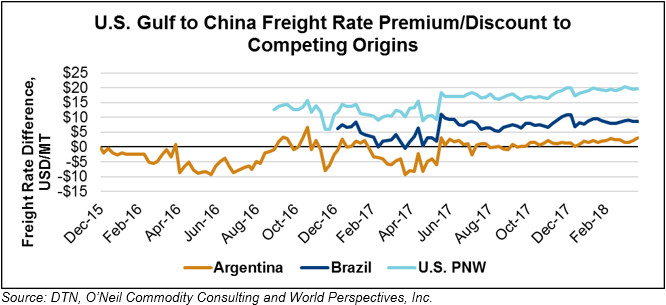

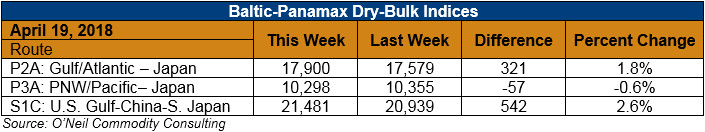

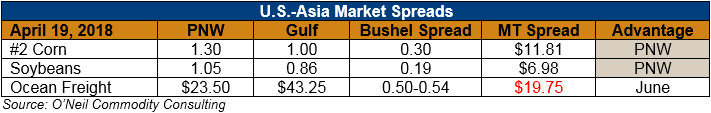

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was another week of mixed market signals. The Baltic indices increased slightly but, again, the physical markets did not follow. The Capesize vessel market was able to command slightly better/higher rates and they are often a leading indicator in dry-bulk markets. However, it was an uneventful week with only small rate changes for international freight buyers. China continues to play a big role in global grain logistics as they impose import tariffs on U.S commodities in retaliation to the new U.S. tariffs.

This week it was sorghum’s turn in the tariff battle after China imposed a 179 percent import tariff on U.S. sorghum. U.S. markets went to a no-bid stance with U.S. farmers and U.S. sorghum vessels must now look for new homes. Meanwhile, Australian sorghum markets witnessed a big jump in market value as those farmers and traders look to benefit from the hole left by the expected decrease in U.S. sorghum exports to China. It is an ever-changing supply chain shift as the tariff war continues. For the moment, no one really knows where the true U.S. sorghum market stands.

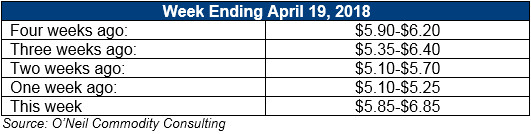

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

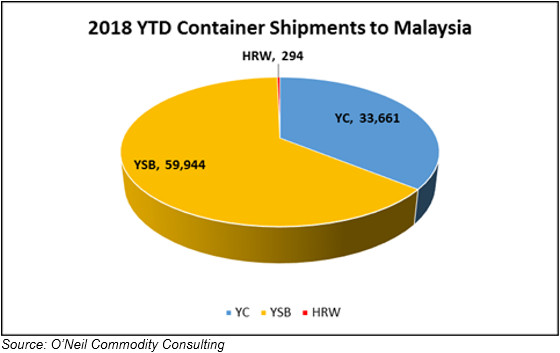

The charts below represent 2017 annual totals versus 2016 annual totals for container shipments to Malaysia.