Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS prices are slightly lower this week as domestic buyers have largely filled near-term needs and are content to sit back for now. Ethanol production fell for the third straight week according to the latest EIA report, which indicates U.S. DDGS supplies may soon tighten. Broader feedstuff markets remain well-supported amid the grain market’s rally, though soymeal is starting to show signs of weaker near-term demand. Regardless, the current Kansas City soymeal/DDGS ratio is steady with last week at 0.59 and above the three-year average of 0.48. The DDGS/cash corn ratio fell to 1.04 this week, down from 1.1 last week and below the three-year average of 1.06.

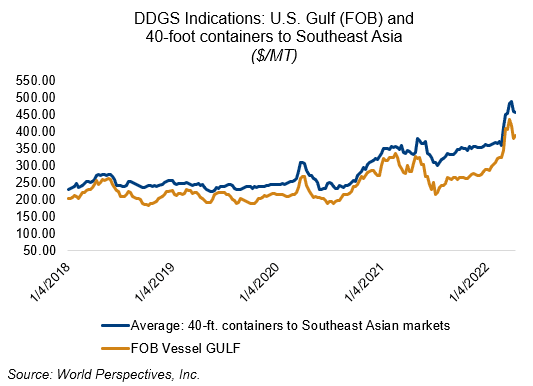

Barge CIF NOLA and FOB Gulf DDGS values regained some of last week’s losses amid an uptick in export purchase interest. Barge CIF NOLA offers are up $12-14/MT for May/June while FOB Gulf offers are up $8/MT for May and up $13/MT for June and July.

Prices for containerized DDGS into southeast Asia are steady/slightly lower this week after last week’s declines. Brokers indicate offers for 40-foot containers to Southeast Asia are down $4/MT on average this week at $458 for May, June, and July shipment.