Chicago Board of Trade Market News

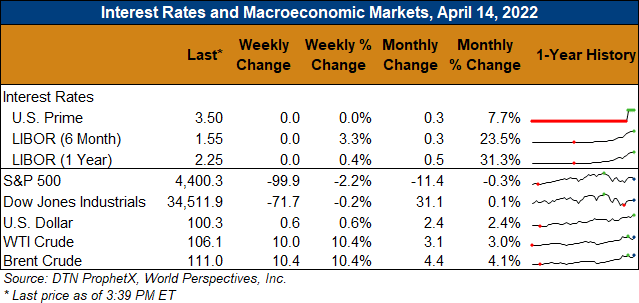

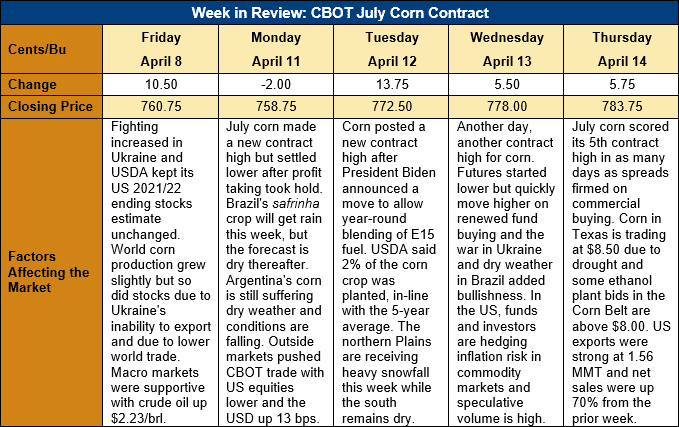

Outlook: July corn futures are 23 cents (3.0 percent) higher this week and scored five new contract highs after the April WASDE. USDA’s report was moderately bullish, but the ongoing war in Ukraine is pushing world markets to ration corn demand as the conflict threatens the country’s 2022 crop. Additional support came from this week’s index fund roll, which pushed volume into the July contract as traders rolled long May positions into July futures. The roll ended Wednesday, but Thursday’s spread trade remained strong in a sign of bullish commercial demand.

USDA’s April WASDE made few changes to the U.S. 2021/22 corn balance sheet and, notably, left its export forecast unchanged at 63.5 MMT (2.5 billion bushels). USDA increased its forecast of ethanol use of corn by 0.635 MMT (25 million bushels) and cut feed and residual demand by an equal amount. In total, these changes offset each other and the 2021/22 ending stocks forecast was left unchanged. USDA did, however, increase its average farm price forecast by $5.91/MT (15 cents/bushel) to $228.33/MT ($5.80/bushel).

Outside the U.S., WASDE increased world 2021/22 production by 4.3 MMT due to larger crops in Brazil, the EU, Pakistan, and Indonesia. Notably, USDA increased Brazil’s acreage estimate but left its corn yield forecast unchanged. The agency is awaiting weather conditions during late April, when the Brazilian crop will pass through its critical yield-defining stages. The USDA increased world ending stocks by 4.5 MMT, due to larger production and reduced trade. Notably, USDA increased its forecast of Ukraine’s 2021/22 corn ending stocks by 2.2 MMT to a record-high 6.5 MMT.

U.S. corn export sales were higher against last week with exporters reporting 1.332 MMT of net sales (up 70 percent week-over-week). Weekly exports fell just 4 percent to 1.56 MMT, putting YTD exports at 35.37 MMT, down 6 percent. YTD corn export bookings (exports plus unshipped sales) are down 17 percent at 55.77 MMT but account for 85.7 percent of UDSA’s current forecast with 4.5 months left in the 2021/22 marketing year.

From a technical standpoint, July corn futures are following a strong trend higher and have posted new contract highs each of the past 5 trading sessions. Spreads remained firm during and immediately following the index fund roll, which indicates strong commercial demand. July futures are approaching overbought levels with the Relative Strength Index at 67, but momentum indicators continue to suggest higher trade. Both managed money and index fund traders hold record or near-record long positions in corn futures (as well as other ag commodities), which is offering support to the markets. That trend is likely to continue as long as corn fundamentals lean even slightly bullish as funds are looking to commodities as a hedge against inflation. There is no lack of bullishness in corn from either a fundamental or technical standpoint presently.