Ocean Freight Markets and Spreads

Ocean Freight Comments

Officials have opened a second passage to allow maritime vessels to access the Port of Baltimore. The main navigation channel remains blocked following the collision of the MV Dali with the Francis Scott Key Bridge, causing it to collapse. The two temporary passages allow vessels with drafts of 15 to 16 feet (4.6 to 4.9 meters) to access the Port of Baltimore. A third channel with a depth of 35 feet (10.7 meters) is planned to be open at the end of April. Most ocean-going vessels accessing the Port of Baltimore require 35 to 45 feet (10.7 to 13.7 meters) of draft. Until the Dali and portions of the bridge are removed from the main navigation channel, access to and from the Port of Baltimore will be limited. The removal of containers from the Dali has started but will take weeks to complete. The focus is to remove containers that are leaning over on the port side of the Dali and are creating a risk for crews working in the area. Another 140 containers will then be removed from the ship to allow the vessel to be refloated and moved by tugs.

As Ramadan ended, the Houthis mounted an attack on four vessels, including a U.S. warship, that was in the Red Sea. The United States and United Kingdom military forces remain resolute against the Houthis. Ocean vessel owners and operators have opted to use longer sailing routes including around the Cape of Good Hope to avoid the Red Sea. Shippers have adjusted their supply chains while incurring higher costs. The attacks by the Houthis will continue until the war in Israel and Gaza ends.

Water levels of Panama’s Gatun Lake are bottoming and poised to rise as the seasonal rainy season arrives. As of April 11, 2024, the water level is 80.3 feet, 2.6 feet below normal for April. The variable fresh water surcharge is 3.14%. Gatun Lake is a reservoir for water used to lock vessels across the isthmus between the Atlantic and Pacific Oceans. Dry bulk vessel transits remain at low levels, one or two per day. The Panama Canal Authority is allowing up to 27 vessels to transit the isthmus each day, down from 36 normally.

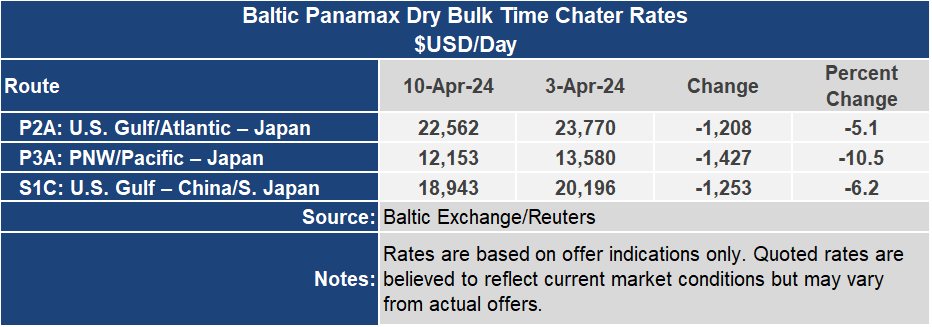

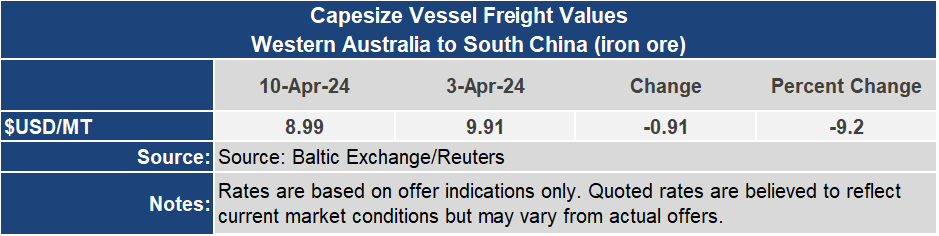

The Baltic Dry Index ended the week down 7% to an index of 1,587, which is 9% higher than the level one year ago. The Capesize market has been the drag on the BDI, down 10% for the week to an index of 2,202, while being 21% above the index level one year ago. The Panamax sector was 8% lower at 1,631 and is 10% below the level one year ago. The Baltic Supramax Index was down 2% to 1,260, which is 13% higher than one year ago.

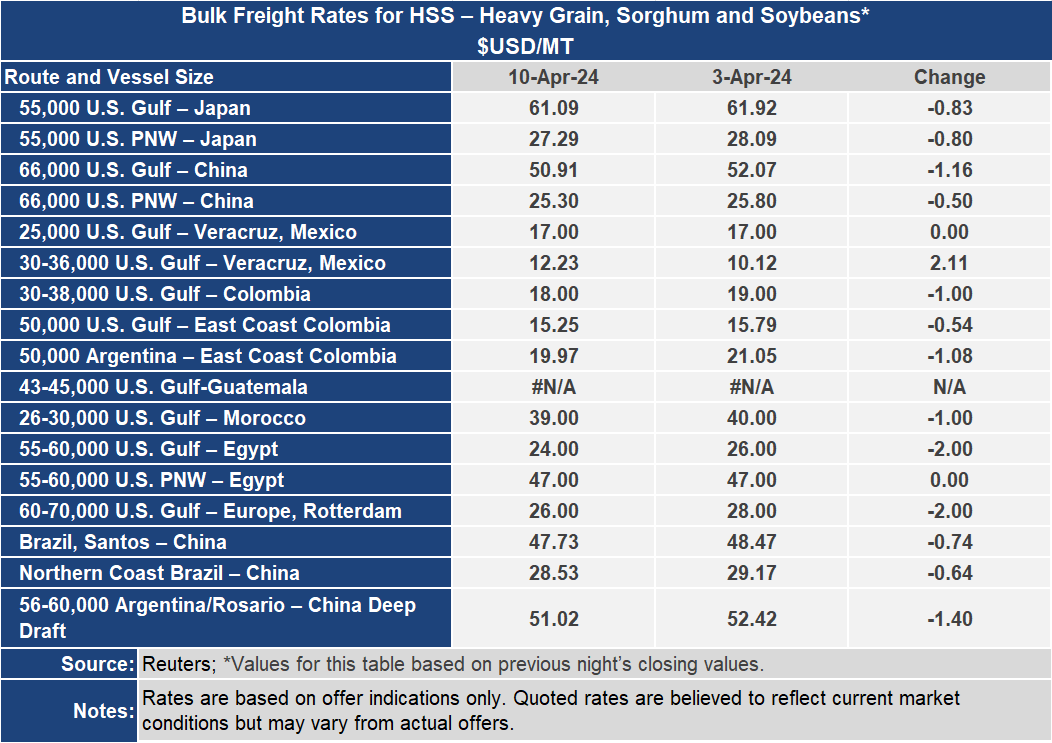

Ocean freight rates for grain out of the U.S. Gulf to Japan were down 1% or $0.83 per metric ton for the current week to $61.09 per metric ton. Out of the Pacific Northwest, the rate to Japan was down 3% or $0.80 per metric ton to $27.29 per metric ton. The spread between these venerable routes was mostly unchanged at $33.80 per metric ton. The U.S. Gulf to Veracruz, Mexico rebounded 21% or $2.11 per metric ton this week to $12.23 per metric ton on a Supramax vessel. This rate does move more widely from one week to the next, which can be impacted by the timing of bunker fuel costs being considered, congestion, and availability of Supramax vessels.