Chicago Board of Trade Market News

Outlook

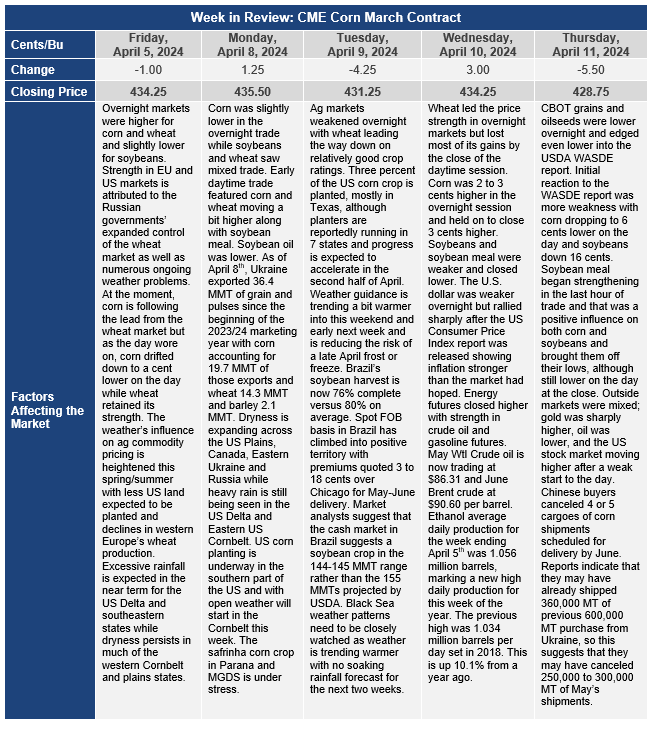

USDA released its updated WASDE report on April 11, 2024. This report brought mixed news to the corn market with a slight increase in U.S. corn usage for feed and for ethanol production which resulted in a 50-million-bushel adjustment to total usage and bringing total use to 14.605 billion bushels. However, even though ending stocks were reduced by 50 million bushels to 2.122 billion bushels, the season-average price was reduced by 5 cents per bushel to $4.70. U.S. corn ending stocks were slightly higher than the average of pre-report trade expectations but still near the middle of the range of expectations.

South American corn production was reduced slightly by USDA, dropping 1 MMT in Argentina, but holding Brazil steady with the production estimate in March. The drop in Argentinian corn production matched pre-report trade expectations, but USDA’s Brazilian corn production number was 2.25 MMT higher than the trade pre-report estimate and at the top of the range. The higher Brazilian corn production number by USDA also led to world ending stocks for corn than the trade expected.

For soybeans, USDA held production estimates for Argentina and Brazil at the same levels as reported in March. The market was expecting an increase for Argentina but a 3 to 7 MMT decrease for Brazil. The USDA estimate of 155 MMT of soybean production for Brazil was at the upper end of the range of pre-report expectations and world soybean ending stocks also were higher than trade expectations. Unrelated to today’s WASDE report, but relevant to the market’s expectations, the Brazilian crop agency, CONAB, reduced their estimates of Brazilian corn and soybean production to 110.9 MMT of corn, and 146.5 MMT of soybeans. There is now an 8.5 MMT gap between CONAB’s estimate of the size of the Brazilian crop and USDA’s estimate of the Brazilian crop. This is the largest gap ever between the estimates of the two agencies.

Ethanol average daily production for the week ending April 5 averaged 1.056 million barrels. This is a new high daily production for this week of the year. The previous high was 1.034 million barrels per day in 2018. This was down 1.6% from last week and up 10.1% from last year. The amount of corn used for the week is estimated at 104.82 million bushels. Cumulative corn use for the crop year has reached 3.209 billion bushels. Corn use needs to average 103.65 million bushels per week to meet the USDA’s marketing year forecast of 5.400 billion bushels.

The dollar index on Wednesday rallied by +1.04% and posted a 4-3/4 month high. The dollar raced higher Wednesday after the U.S. March CPI report came in stronger than expected, boosting T-note yields and dampening the outlook for Fed rate cuts. Wednesday’s slump in stocks also boosted some liquidity demand for the dollar. Fed swap markets have now priced 50 bp of rate cuts for 2024, less than the 75 bp of rate cuts that were priced last week. The minutes of the March 19-20 FOMC meeting said that almost all officials supported cutting interest rates “at some point this year,” although the committee discussed “the possibility of maintaining the current restrictive policy stance for longer should the disinflation process slow.”

Market analysts now estimate that the funds have short positions of 90,000 Chicago wheat contracts, 256,000 corn, 138,000 soybeans, 35,000 soybean meal and long positions of 4,000 soybean oil.