Free trade agreement (FTA) partners purchased more than half of all U.S. exports of grains in all forms (GIAF) in the 2019/2020 marketing year, according to data from the U.S. Department of Agriculture (USDA) and analysis by the U.S. Grains Council (USGC).

“The continued strength of demand from trade agreement partners once again emphasizes the importance of the market access provided by these agreements,” said Ryan LeGrand, USGC president and chief executive officer. “Working to defend and expand markets allows the Council to do what it does best – capture short-term opportunities and build long-term demand for U.S. coarse grains and co-products.”

The United States has 14 official FTAs in place with 20 countries. These trading partners represent some of the largest and most loyal customers for exports of U.S. corn, barley, sorghum, ethanol, distiller’s dried grains with solubles (DDGS) and other coarse grain products. In its GIAF calculation, the Council also includes the corn equivalent of beef, pork and poultry meat exports to better capture a holistic view of actual grain demand from overseas.

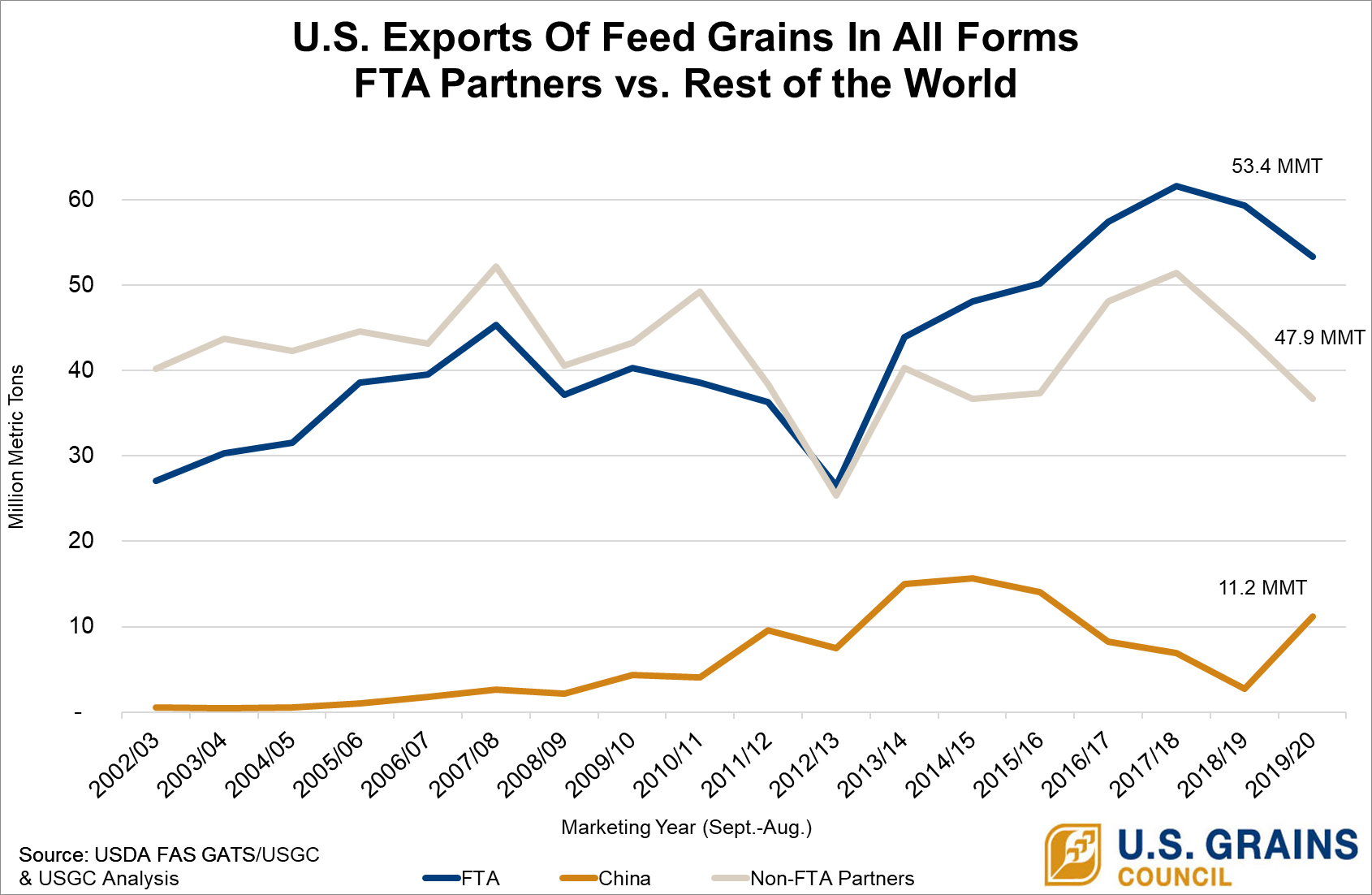

For the 2019/2020 marketing year (September 2019-August 2020), U.S. FTA partners imported 53 percent of all U.S. GIAF exports at 53.4 million metric tons, equivalent to 2.10 billion bushels.

Breaking down these agreements, the United States-Mexico-Canada Agreement (USMCA) continues to rank as the top FTA for grain-related trade. Geographic proximity, duty-free access first provided by the North American Free Trade Agreement (NAFTA) and decades of market development work have established both Mexico and Canada as large and growing markets for U.S. GIAF.

Mexico claimed the top spot for imports of U.S. GIAF in the 2019/2020 marketing year at 23.7 million metric tons (equivalent to 933 million bushels), valued at $6.65 billion. By commodity, Mexico was the top international buyer of U.S. corn, DDGS and barley/barley products; the second largest global destination for U.S. sorghum; and the seventh biggest market for exports of U.S. ethanol.

U.S. GIAF exports to Canada were the third highest on record in 2019/2020, despite declining 12.3 percent from last year’s all-time high. Overall, Canada was the fourth-largest buyer of U.S. GIAF in the marketing year with imports of 7.07 million metric tons (equivalent to 278 million bushels), valued at $3.08 billion. By commodity, Canada ranked as the largest global buyer of U.S. ethanol, second largest global buyer of U.S. barley/barley products, sixth largest global buyer of U.S. corn and eighth largest global buyer of U.S. DDGS.

The dataset used to generate the accompanying chart does not include recent trade pacts that offer market access for U.S. coarse grains, co-products and ethanol but are not full free trade agreements. The sales to these trading partners further demonstrates the importance of policy actions that maintain and grow U.S. market share.

The U.S.-Japan trade agreement, for example, went into effect on Jan. 1, 2020. The agreement both preserved duty-free market access for U.S. feed and food corn, corn gluten feed and DDGS as well as eliminated tariffs or reduced mark-up on other coarse grains and co-products.

Japan ranked as the second largest GIAF market in 2019/2020 with exports of 13.4 million metric tons (equivalent to 527.5 million bushels), valued at $5.47 billion. By commodity, Japan represented the second largest global buyer of U.S. corn, third largest global buyer of U.S. barley/barley products, fourth largest global buyer of U.S. sorghum and seventh largest global buyer of U.S. DDGS.

The U.S.-China Phase One deal, signed in January 2020, allowed importers to obtain exclusions for corn and other agricultural products from retaliatory tariffs imposed on agricultural products in July 2018. The deal also included a long-awaited import protocol for U.S. barley and barley products and opened the door to a substantial jump in U.S. sorghum purchasing.

As a result, year-over-year exports quadrupled to China, making the market the third largest destination for U.S. GIAF. Exports totaled 11.2 million metric tons (equivalent to 441 million bushels), valued at nearly $4 billion. By commodity, China ranked as the top global buyer of U.S. sorghum and fifth-largest global buyer of U.S. corn.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.