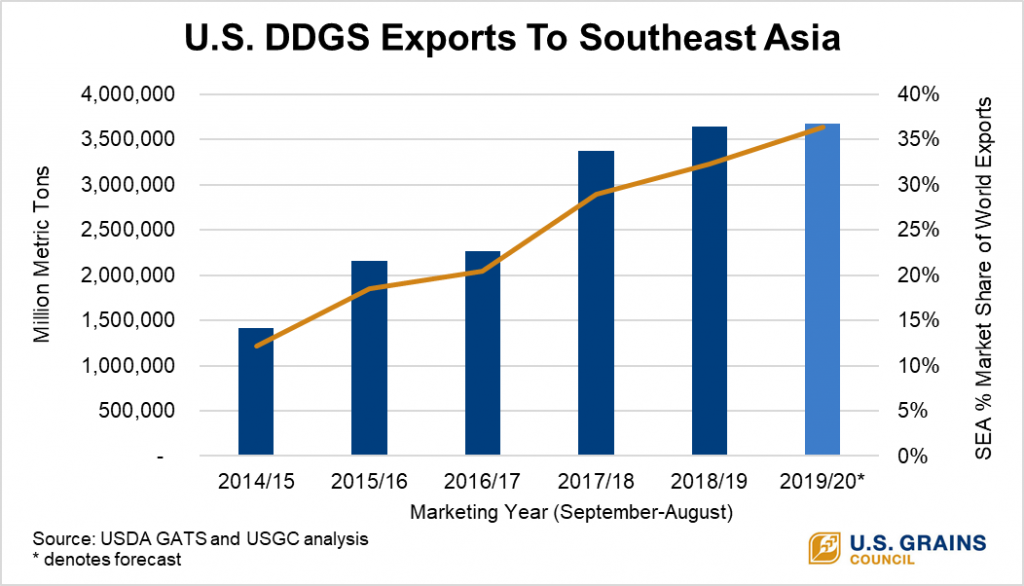

Southeast Asia represents one-third of all U.S. distiller’s dried grains with solubles (DDGS) exports, and that market share continues to grow, according to data from the U.S. Department of Agriculture (USDA) and the U.S. Grains Council (USGC).

“Southeast Asia is one of the fastest growing markets in the world,” said Manuel Sanchez, USGC director in the region. “Demand for U.S. DDGS in the region continues to build and diversify as the Council increases our engagement with rapidly-expanding feed industries in need of more efficient feed ingredients.”

Thus far in 2019/2020 (Sept. 2019-June 2020), Southeast Asia has imported 3.07 million metric tons of U.S. DDGS, slightly higher than the 2.95 million tons at this time last year. This trade volume puts Southeast Asia’s share of world DDGS imports at roughly 36 percent, compared with 32 percent last year. This uptick fits with the five-year trend of increased DDGS export share relative to the rest of the world, up from 12 percent in 2014/2015. Using a straight-line forecast for the remaining two months of the marketing year, the Council expects Southeast Asian DDGS imports to hit 3.68 million tons.

Overall, global imports of U.S. DDGS are down year-over-year at 8.43 million tons, primarily due to the spring shortfalls in production and exportable supply related to the outbreak of COVID-19.

Four of the top 10 destinations for U.S. DDGS so far in the 2019/2020 marketing year are in Southeast Asia: Vietnam, Indonesia, Thailand and New Zealand.

Vietnam currently ranks as the third largest buyer of U.S. DDGS globally at nearly 973,000 tons. With the help of the Council, grain importers in this leading market shifted in early 2020 from purchasing containers, which were in short supply, to ordering bulk vessels to secure an uninterrupted flow of feed ingredients.

Indonesia follows as the fourth largest overall buyer at 792,000 tons thus far for the marketing year. The Council has expanded engagement to reach more broiler and layer producers spread over more than 17,000 islands. Concentrated programs and feed formulation seminars demonstrated how these producers could reduce overall feed costs and see additional benefits for early laying hens. As a result, participants began first-time DDGS trials and increased DDGS inclusion levels, upping overall demand for the product.

Despite major phytosanitary constraints, Thailand imported 688,000 tons of U.S. DDGS thus far in the marketing year, a 20 percent increase from the previous year, and is now ranking as the fifth largest market. The Council is working to add to demand from the poultry industry with a focus on developing targeted technical education and trade servicing programs for aquaculture. Seminars in January 2020 focused on inclusion of DDGS in shrimp, fin fish and marine species. Raising inclusion rates even slightly for these species could result in more than 275,000 tons in additional demand for U.S. DDGS across the region.

Notably, New Zealand currently ranks as the tenth largest market for U.S. DDGS at 219,000 tons, up 52 percent year-over-year. This growth shows the dairy industry in New Zealand continues to see the positive effect of U.S. DDGS on milk production and quality.

Just outside the top 10 markets, the Philippines has also increased purchases of U.S. DDGS during the past five years, up 17 percent year-over-year to nearly 217,000 tons. The country’s swine and poultry industries are using more of the feed ingredient in their rations as a result of technical training on direct product handling and feed training.

Throughout the COVID-19 pandemic, the Council’s staff in Southeast Asia has continued to engage with customers through a variety of virtual programs. Last week, the Council and the U.S. Soybean Export Council (USSEC) jointly conducted the U.S. Grains and Soy Buyers Conference, attracting more than 450 unique viewers – representing decision-makers and influencers in the feed industry – over three days of events. The Council will keep reaching out to these key customers to spur additional areas of demand and help the region further increase its share of U.S. DDGS exports.

“The Council is expanding DDGS sales by providing technical expertise and support as well as connecting grain buyers and end-users with U.S. suppliers,” Sanchez said. “As a result, growth is being realized in both large and emerging markets for U.S. coarse grains and co-products.”

Learn more about the Council’s promotion of U.S. DDGS in Southeast Asia.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.