Chicago Board of Trade Market News

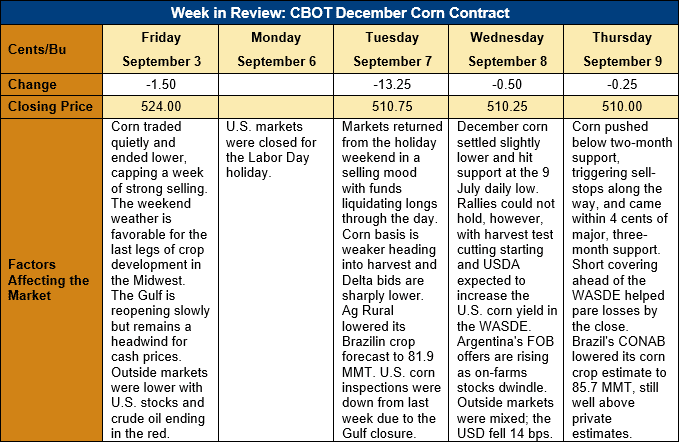

Outlook: December corn futures are 14 cents (2.7 percent) lower this week as the U.S. Gulf closure/slow re-opening and broadly favorable finishing weather for the Midwest crop pressure markets. Heading into the September WASDE on Friday, 10 September, funds and traders are looking for USDA to increase the U.S. crop projection and are positioning accordingly.

Last weekend, the U.S. Coast Guard fully reopened the Mississippi River for navigation, which was a major step towards resuming trade and exports from the Gulf. At least one grain export facility is fully reopen this week and others are expected to regain power by the weekend. At least two export facilities suffered damage that will take weeks to repair, but others should be online more quickly. The market is slowly starting to see more offers and indications for commodities out of the Gulf, but liquidity remains thin at best. Analysts are increasingly wondering if the eventual full reopening of the Gulf will release a flurry of pent-up demand, especially with December futures (for now) near three-month lows and psychological support at $5.00.

Monday’s U.S. holiday has delayed the weekly Export Sales report from the USDA, but the Export Inspections report reflected the ongoing impacts of Hurricane Ida. Corn export inspections totaled just 0.275 MMT, down 53 percent from the prior week. The export figure meant the first week of 2021/22 exports was down 85 percent from the same period last year. Inspections are expected to increase this week as more commodities are routed through the PNW and Gulf business resumes.

The U.S. crop is finishing and maturing under nearly ideal weather across the U.S. The latest data from USDA pegs the crop at 59 percent good/excellent, down 1 percent from the prior week and below the 5-year average of 64 percent. USDA noted 74 percent of the crop is dented (5 percent ahead of the average pace) and 21 percent is mature (2 percent above average). Industry sources say harvest is starting in parts of Midwest with highly variable yields. Overall, however, the market is looking for USDA to boost its assessment of the 2021 U.S. corn yield by 0.0628 MT/ha (1 BPA) to 11.028 MT/ha (175.6 BPA).

From a technical standpoint, December corn futures are following through on last week’s breach of trendline support and have subsequently edged below two additional support levels. On Tuesday, the market pushed below last week’s lows and triggered sell-stops in the process. Then, on Thursday, the market pushed below the 9 July daily low ($5.07) and triggered another round of sell-stops that pushed futures to $5.04 ¼. December futures are hovering near three-month lows at $5.00 ¼ but short covering helped pull the market away from that level by Thursday’s close. The near-term direction for the corn market is lower but the WASDE will have greater influence on market direction than short-term technicals. Aside from the U.S. yield figure, the market will be closely watching USDA’s assessment of the Brazilian crop and China’s 2021/22 imports, both of which could be supportive factors for the U.S. market.