Chicago Board of Trade Market News

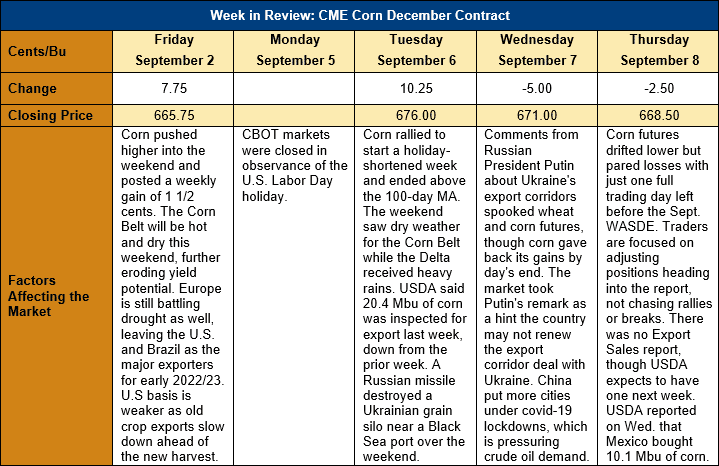

Outlook: December corn futures are up 2 ¾ cents (0.4 percent) from last Thursday as the market generally consolidated in a holiday-shortened trading week with the September WASDE coming on Monday. The market has generally drifted sideways this week with limited fresh fundamental news and traders adjusting positions ahead of the coming USDA report.

Grain markets jumped higher in early trade on Wednesday after Russian President Vladimir Putin made comments that indicated dissatisfaction with the current UN-Ukraine-Russia-Turkey export corridor agreement. The agreement, which expires in mid-November, permits Ukrainian grain to be exported via corridors in the Russian-controlled Black Sea. President Putin’s claimed on Wednesday that the agreement has not increased grain exports to developing countries, which was a goal of the deal. Grain markets interpreted the statement as a signal that Russia may not intend to renew the agreement when it expires, which would again restrict world grain supplies. Despite early gains, corn futures settled slightly lower for the day as Russia’s possible policy shift is more likely to affect wheat markets.

USDA will release the September WASDE report on Monday, 12 September and the grain trade is looking for smaller corn production and ending stocks. Pre-report surveys indicate most analysts are predicting the 2022 yield at 10.827 MT/ha (172.4 bushels per acre), with production of 357.575 MMT (14.077 billion bushels. Ending stocks are expected to decrease some 15 percent to 29.974 MMT (1.18 billion bushels), which, if correct, would be the smallest carry-out since 2012/13.

The USDA’s Export Sales report is in its second week of technical difficulties that prevented publishing. USDA expects the report to be available next week, but until then, the Export Inspections data is the market’s best gauge of U.S. grain shipments. Export inspections totaled 0.518 MMT of corn for the week ending 1 September, a figure 25 percent below the prior year. It is not unusual to see old-crop exports decrease this time of year, and the Export Inspections report, of course, gives no indication of forward sales bookings. Sorghum inspections were up 159 percent from the prior week at 58,000 MT.

The U.S. corn crop continues to march towards maturity with heat and dryness in the Corn Belt accelerating progress. Late Tuesday, USDA said 63 percent of the crop was dented, just 4 percent behind the normal progress for early September. Fifteen percent of the crop was mature, a figure that lags the 5-year average by just 3 percent. Despite expectations to the contrary, USDA did not report any harvest progress yet for corn. Recent rains in the Delta and Southeast have slowed the early harvest in those regions. Current conditions suggest an early start to harvest and a quick completion, which will minimize some of the yield risks associated with harvest delays.

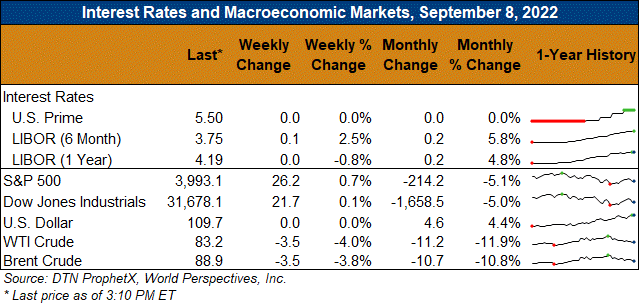

From a technical standpoint, December corn futures have turned sideways with support at $6.54 and resistance at Wednesday’s highs of $6.88. Trendline and psychological resistance converge near the $7.00 mark, and it will take some bullish fundamental news (the WASDE, perhaps?) to push December futures above that point. The market has major support at $6.50 and $6.33, however, which will likely keep the market confined on any breaks. Seasonally, corn values tend to dip near harvest time before slowly trending higher, but that may not occur this year with strong domestic and export demand vying for shares of a smaller crop.