Chicago Board of Trade Market News

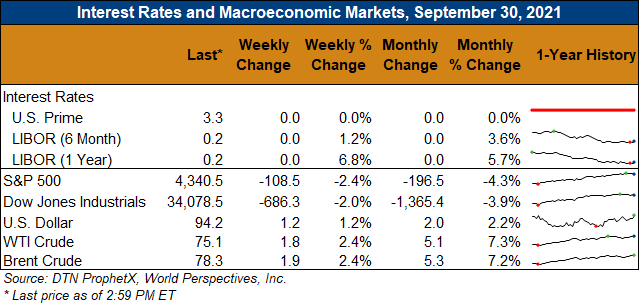

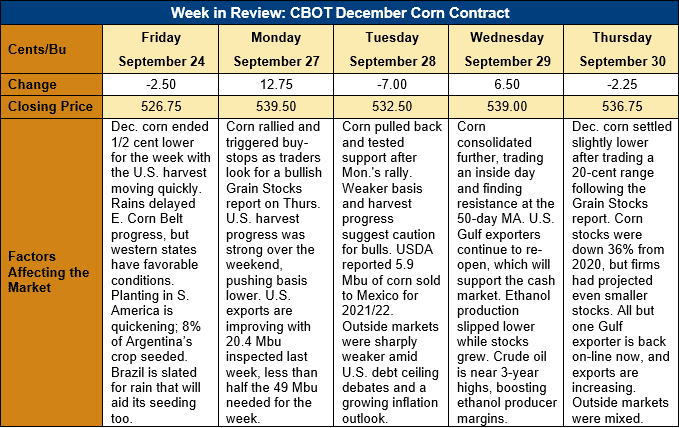

Outlook: December corn futures are 10 cents (1.9 percent) higher this week after stronger U.S. exports and pre-Grain Stocks report positioning pushed the market higher. Trade has been volatile this week with outside markets (equities, crude oil, etc.) being buffeted by political and macroeconomic factors and, in turn, heightening volatility at the CBOT. Additionally, the September Grain Stocks report was more bearish corn and soybeans and more bullish wheat than expected, and December corn traded a 20-cent range shortly after the report’s release.

The September Grain Stocks report from USDA was more bearish corn than expected, despite a 36 percent year-over-year reduction in total corn stocks. Prior to the report, traders and analysts were expecting 29.339 MMT (1.15 billion bushels) of corn stocks on 1 September (e.g., 2020/21 ending stocks), but USDA’s figure totaled 31.396 MMT (1.236 billion bushels). The larger-than-expected stocks figure pressured corn futures, though losses were pared by strong gains in the wheat market (where 1 September stocks were lower than expected). Notably, on-farm corn stocks fell 47 percent from last year and was the smallest on-farm stocks figure since at least 2015.

Based on the 1 September stocks and estimated disappearance for exports, food, feed, and residual use, USDA revised its estimate for the 2020 crop’s area, yield, and production. Planted area for the 2020 crop is now estimated at 36.686 million hectares (90.652 million acres) and harvested area was revised down to 33.312 million hectares (82.3 million acres. The 2020 U.S. corn yield is now forecast at 10.764 MT/ha (171.4 bushels/acre), leaving a 358.438-MMT (14.11 million bushel) crop. The production estimate is down 1.803 MMT (71 million bushels) from USDA’s prior forecast.

Despite some delays in the Eastern Corn Belt last weekend and early this week due to rain, the U.S. corn harvest is making strong progress and accelerating. On Monday, USDA said 74 percent of the crop was mature, which is 18 percent ahead of the normal progress rate. The crop is maturing at its fastest rate in at least five years, which will help translate to a potentially record-fast harvest. USDA said 18 percent of the crop was harvested through Sunday, up 8 percent from the prior week and 7 percent ahead of the five-year average pace. Except for the PNW, every state west of the Mississippi and Ohio Rivers is harvesting faster than the prior year and the five-year average. The early start to the harvest means any seasonal basis weakness will likely come earlier than normal and ensure new-crop supplies are also available earlier.

U.S. cash markets and basis levels are starting to show evidence of harvest pressure, though are well above year-ago or normal harvest-time levels. The average Midwest basis this week was -17Z (17 cents under December futures), down from -11Z last week but above the -26Z that occurred this time last year. Barge CIF NOLA prices are up 4 percent this week at $248.00/MT while FOB NOLA offers, while highly variable, are up 2-3 percent at $268.60/MT.

From a technical standpoint, December corn futures are following a short-term trendline higher that is offering support at $5.28. The market briefly dipped below that point after the Grain Stocks report but settled well above that level and additional support at $5.30. Thursday’s trade confirmed that support lies near or just below $5.30 while $5.50 stands as upside resistance. These two points form the market’s immediate trading range and the fact December corn did not selloff more sharply following the stocks report suggests the sideways/higher trend will continue.