Chicago Board of Trade Market News

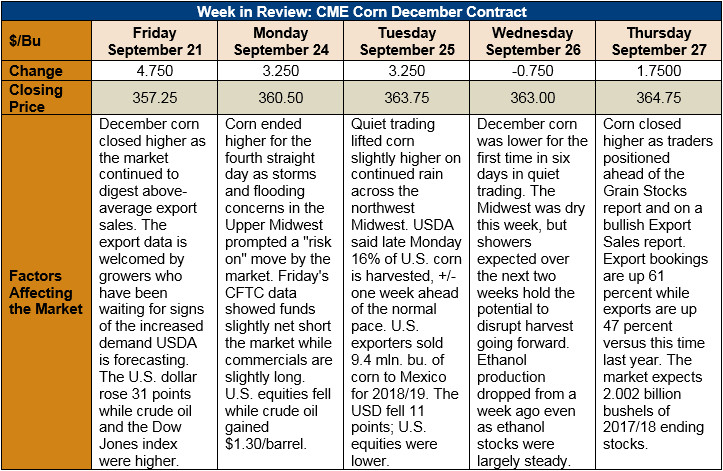

Outlook: December corn futures are up 12.25 cents (3.5 percent) this week as end users continue aggressive procurement at multi-year low prices. Additional support has come from above-average exports and persistent Midwest rains that have potential to slow or disrupt the U.S. harvest.

USDA’s weekly Export Sales report was bullish with 1.713 MMT of net sales and 1.359 MMT of exports that put YTD shipments up 47 percent. YTD bookings (exports plus unshipped sales) are up 61 percent, a strong testament to international buyers’ expanded consumption at low prices. U.S. FOB Gulf corn prices are lower cost than product from Argentina or Brazil, making American-origin corn very attractive on global markets.

The U.S. corn crop remains in above-average condition, with 69 percent rated good/excellent, above the five-year average of 67 percent. USDA said 72 percent of the corn is “mature” (versus 53 percent on average) and 16 percent of U.S. corn is harvested, five percent above the five-year average pace. Rains are forecast for much of the Midwest which may slow the harvest and, if continued, could modestly reduce harvested acreage figures.

December futures seem to be rallying from what is likely to be their seasonal low, starting the annual demand-driven grind higher. Technically, December futures are above the short-run downtrend in place since May, which points to opportunities for further price appreciation. The 40-day moving average stands as nearby resistance with the 100-day moving average (379) as the next major resistance point above that. The upcoming Grain Stocks report, which will finalize 2017/18 ending stocks, has the potential for a bearish surprise but most in the trade are expecting a reduction from the prior year. Given the aggressive export pace observed during the latter part of 2018, it seems more likely the report will be bullish than otherwise.