Ocean Freight Markets and Spreads

Ocean Freight Comments

The International Longshore Association contract with the U.S. Maritime Alliance is set to expire at midnight, September 30. The ILA is committed to strike on October 1 unless its demands of higher wages, restricted automation and improved benefits are met. The USMA has been unable to engage the ILA to negotiate. All signs and communication point to a strike taking place. The question is how long it will last. It could be a strike of one day to a “few” days. Not many are expecting a protracted strike. The Biden administration could intervene using the Taft-Hartley Act to prevent a strike. The administration is being cautious to upset a key labor constituency. A strike of one day could require one week to reset the supply chains. In the meantime, ports and railroads are communicating that all import cargo needs to be cleared off the docks by September 30. The strike will impact container operations. Most grain, dry bulk, tank and some limited terminals use non-union labor and will not be impacted as much. But all container exports through the U.S. East Coast and Gulf Coast will be impacted.

Container freight rates to the U.S. peaked in July at an index of 7,911 for forty-foot containers. Through September 23 the index is down 24% to 6,049. Despite the drop in the rate index, it is still three times higher than it was one year ago. The container rate index from the U.S. East Coast to Asia is up 21% since June to an index of 558 for a forty-foot container when it turned higher due to the threat of the ILA strike. From the U.S. West Coast to Asia, the rate is down 6% to an index of 649 for a forty-foot container.

Low water continues to be a theme on the Mississippi River System. Though Hurricane Helene could bring needed water supply relief over the Tennessee and Ohio Rivers that will improve water levels on the Lower Mississippi River. In the meanwhile, Brazil continues to be hampered by a drought impacting the Maderia River which is essentially shutdown for grain barge loadings. The drought is then impacting the Amazon River and Parana River, restricting draft levels in Argentina. Grain flows off Brazil’s Northern Arc have dramatically slowed sending business to the U.S.

The U.S. military alliance in the Red Sea and around the Arabian Peninsula have destroyed drones and unattended vehicles of the Houthi terrorist organization. Attacks by the Houthis have slowed. Vessel owners and operators continue to avoid the region and are opting for longer routes between Asia and Europe and the Mediterranean Sea by sailing long routes at higher costs around the Cape of Good Hope.

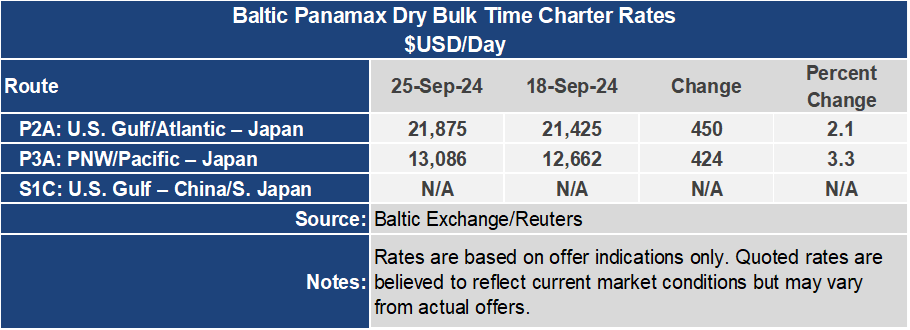

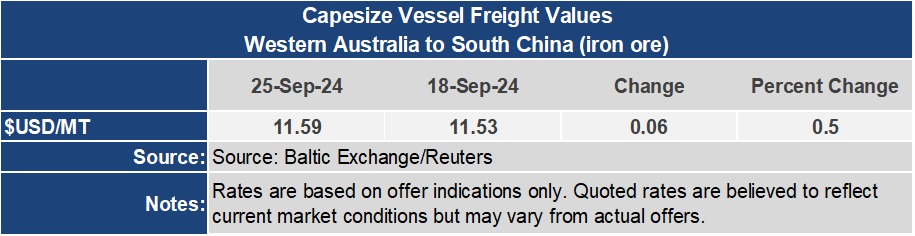

The Baltic Dry Index turned higher this week, gaining 6.7% or 126 points to an index of 2,016. The Baltic Capesize Index ended the week 291 points or 9.6% higher, mostly erasing the previous weeks’ losses to an index of 3,315. The smaller vessel classes continued to be a firmer tone for the week. The Baltic Panamax Index was up 2.7% to an index of 1,543. The Baltic Supramax Index was up 3.7% to 1,317.

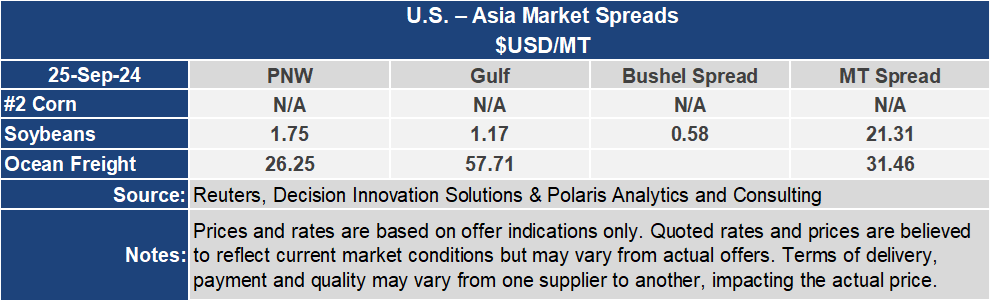

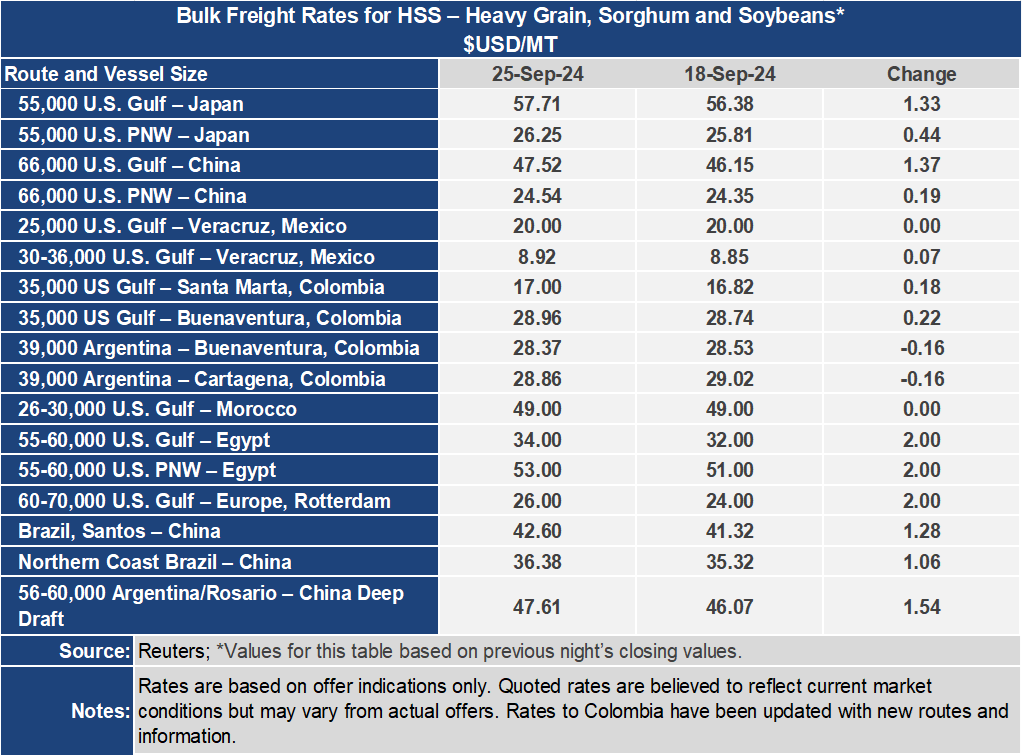

With continued firmness in the Panamax and Supramax sectors, voyage grain rates were stronger yet again. The U.S. Gulf to Japan freight rate was up $1.33 per metric ton or 2.4% for the week to $57.72 per metric ton. From the Pacific Northwest the rate was up 1.7% or $0.44 per metric ton at $26.25 per metric ton. The spread between these closely watched grain routes widened 2.9% or $0.89 per metric ton to $31.46 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $47.52 per metric ton for the week, up $1.37 per metric ton or 3.0%. From the PNW, the rate was up $0.19 per metric ton or 0.8% to $24.54 per metric ton this week. The spread on this route widened by 5.4% or $1.18 per metric ton to $22.98 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.