Ocean Freight Comments

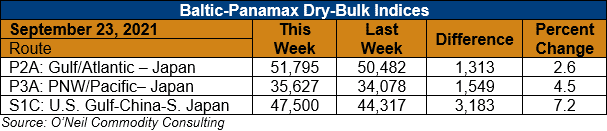

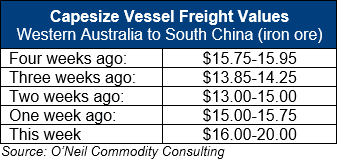

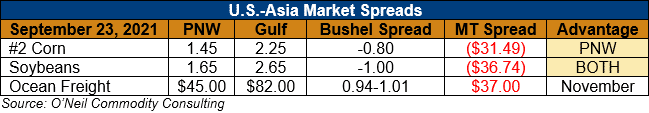

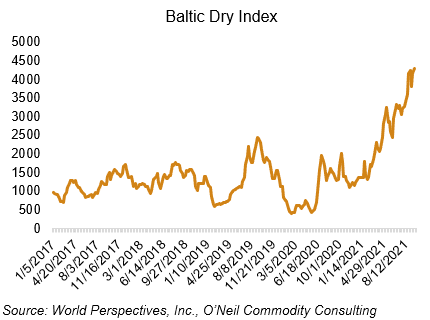

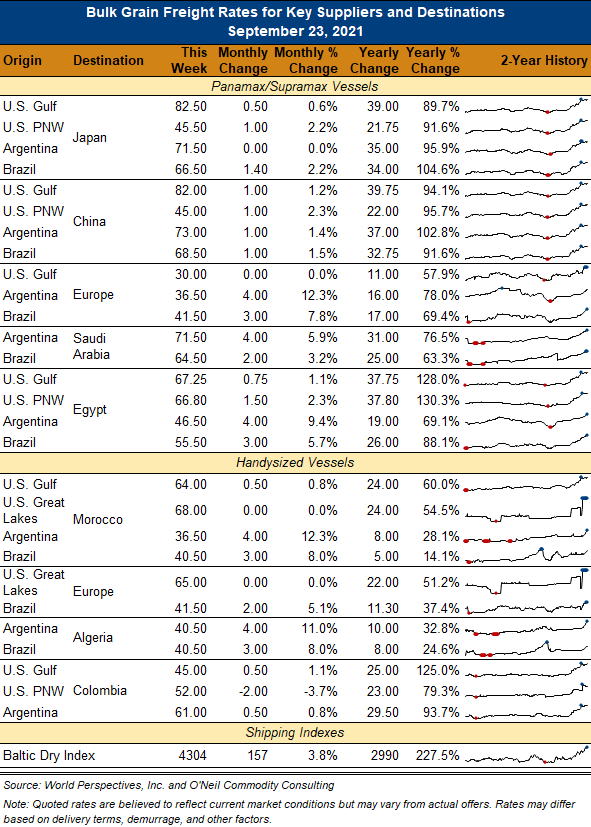

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Follow the Capes is just what Dry-Bulk markets did this week. Capesize congestion in China, a general uptick in cargo demand, and a lot of exuberance caused Capesize daily hire rates to jump to the magical figure of $50,000/day for October and $42,000 for Q4. First-quarter 2022 traded at $22,500/day; so there is a substantial inverse in the market. Panamax FFA paper gained support from the Capesize sector and traded at $36,350/day for October and $35,000 for Q4.

New Orleans export grain facilities are coming back online. Five facilities are now open and loading (LDC Baton Rouge, Bunge Destrehan, Zen-Noh, Cargill Westwego, and ADM Destrehan via floating rig). CHS Myrtle Grove expects to be operating by 29 September and ADM Destrehan should be back to full operations by Monday. There are 68 grain vessels currently in NOLA and FOB vessel export grain values for October remain uncertain.