Chicago Board of Trade Market News

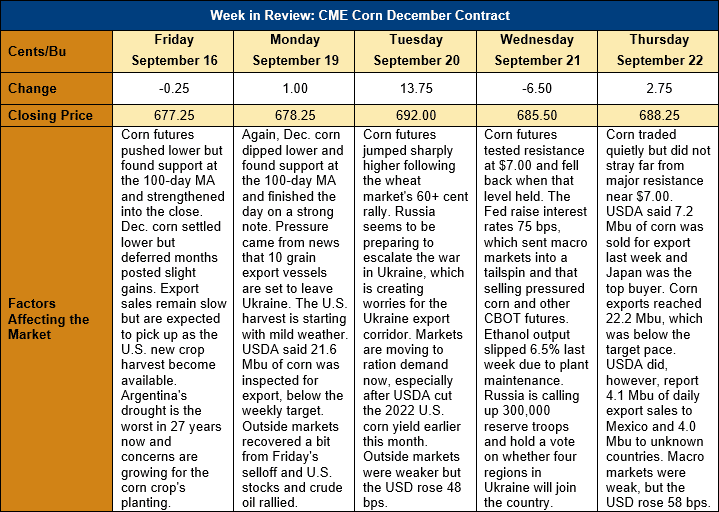

Outlook: December corn futures are 11 cents (1.6 percent) higher this week after the market found technical support during dips on Friday and Monday and received a bullish influence from wheat futures’ rally. Recent moves by Russian President Vladimir Putin seem to indicate an intent to escalate the war in Ukraine, which is causing concern for the export corridor agreement. In response, world grain markets have move to ration demand and wheat has led this rally. Beyond the situation in the Black Sea, corn markets are watching the U.S. harvest-time weather as well as the start of the new crop export season.

Forty percent of the U.S. corn crop is now rated “mature” with dry weather across the U.S. and warm conditions in the Plains and western Corn Belt aiding the crop’s finishing. As of Sunday, USDA said just 7 percent of fields were harvested, slightly below the five-year average progress of 8 percent but a figure that should increase sharply next week due to favorable conditions this week. The U.S. weather outlook remains friendly for the crop’s final push to maturity with above-average temperatures predicted for the West and Plains and cool, dry conditions for the eastern Corn Belt.

The USDA’s latest Export Sales report featured 0.403 MMT of gross export sales for corn and 0.563 MMT of corn exports, with the export figure rising 32 percent from last week. YTD corn exports total 1.026 MMT, up 21 percent from last year’s pace that was slowed by the impacts of Hurricane Ida. YTD bookings (exports plus unshipped sales) now total 12.48 MMT, down 50 percent from last year. YTD bookings currently account for 20 percent of USDA’s 2022/23 export forecast.

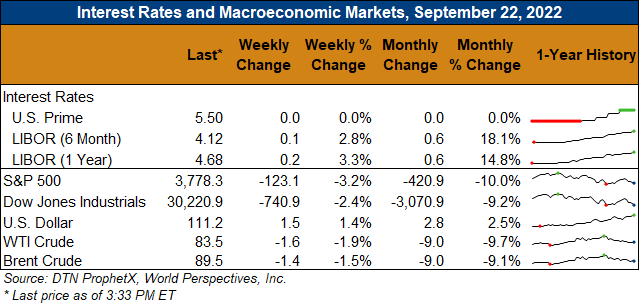

Corn and other CBOT futures saw pressure this week from the selloff in macroeconomic markets (e.g., stocks, bonds, currencies, etc.) after the U.S. Federal Reserve raised its target interest rate by 0.75 percent. The move was expected by Wall Street, but stocks and energy markets sold off after Wednesday’s announcement and a broad “risk off” mentality pressured grain futures as well.

From a technical standpoint, December corn futures are bumping up against technical and psychological resistance near $7.00. The contract approached that level on both 12 and 22 September and was rebuffed both times. Still, the contract remains in a technical uptrend with support at $6.77 and $6.60 and momentum indicators are swinging higher, which should keep funds as active buyers on breaks.