Ocean Freight Comments

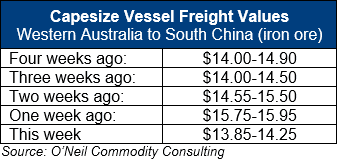

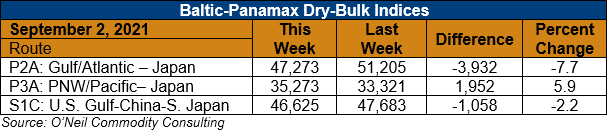

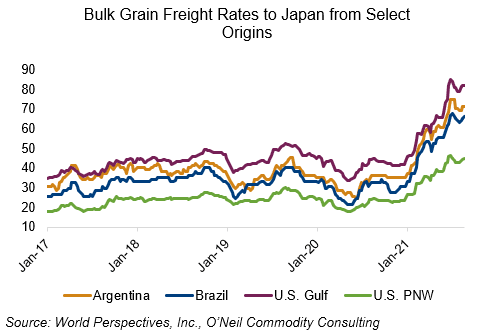

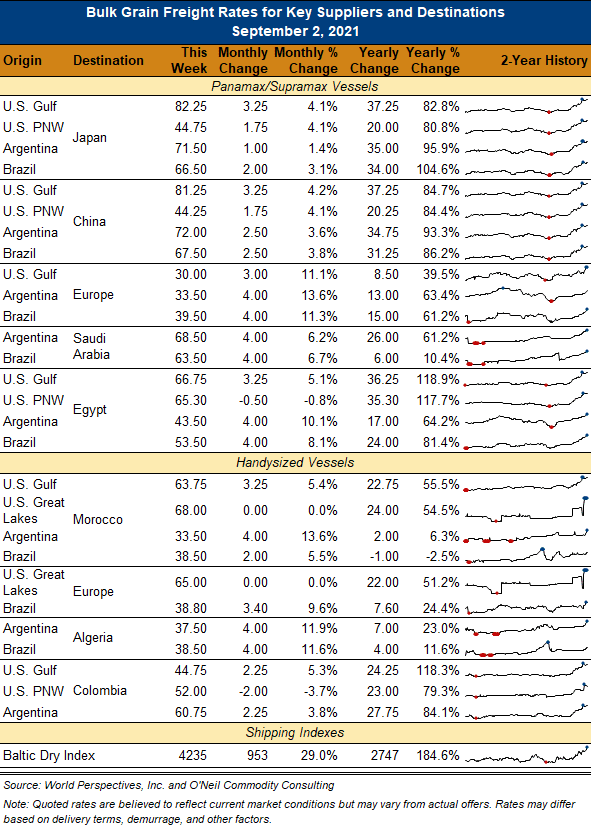

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk markets ended the week on a softer tone. Physical rates are mostly unchanged with FFA paper markets unable to find fuel for an upward push and looking for new direction. The Capesize sector showed the most weakness.

The big news this week was of the U.S. Mississippi River ports. The Cargill facility at Reserve, Louisiana is down for an unknown number of months. CHS Myrtle Grove and Cargill Westwego are also experiencing extended problems due to Hurricane Ida’s impacts. Export shipments will be switched to other elevators and to the PNW and vessel line ups will get longer and more difficult! NAEGA contract Clause 20 declarations will be sent to FOB Buyers.

Container freight markets remain unchanged with little hope for improvement prior to Q2 2022. There are additional reports of dry-bulk vessels being chartered to carry containers; but insurance issues for such are questionable.