Chicago Board of Trade Market News

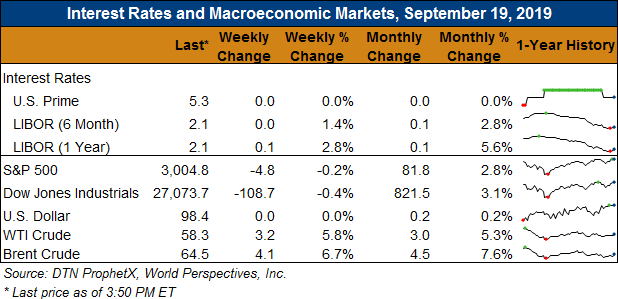

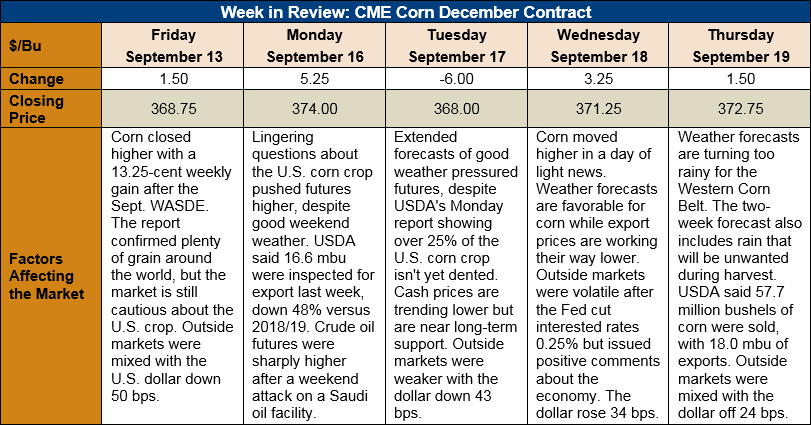

Outlook: December corn futures are 4 cents (1.1 percent) higher this week as improving demand signals and supportive technical developments helped the market higher. The weather across the U.S. remains broadly favorable for finishing the lingering corn crop, except that expected rains in the 14-day forecast could delay harvest. Demand is picking up and with traders keeping a small weather premium embedded in prices, the outlook largely calls for steady/higher prices.

USDA’s latest Export Sales report recorded 1.464 MMT of net sales and 457,300 MT of exports. While still very early in the marketing year, YTD bookings are down 48 percent. However, prices around the world are turning higher, a signal that demand may be strengthening. Notably, white corn shipments have been strong in recent weeks, sparking a $20/MT increase in offer prices in since the first of September. Other Export Sales highlights include 3,000 MT of sorghum exports and 200 MT of barley shipments. YTD bookings for sorghum and barley are up 6 and 7 percent, respectively.

Cash prices are higher this week with the average price across the U.S. reaching $140.25/MT. Barge CIF NOLA values are 4 percent higher as well while FOB NOLA prices are slightly higher at $164.50/MT for October delivery.

From a technical standpoint, December corn seems to have formed its seasonal lows and is forging a new sideways trading range. The contract has found support from commercial buying as well as technical trading at the 20-day moving average ($3.65/bushel). Despite the fact U.S. ending stocks are projected to be ample for the 2019/20 marketing year, traders are still cautious about the U.S. supply situation, as the crop is not made yet. Consequently, the futures market is retaining a small weather premium until the crop is in the bin. Between that and solid commercial demand at relatively low prices, futures are likely to continue a slow, demand-driven grind higher.