Ocean Freight Comments

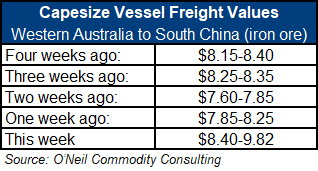

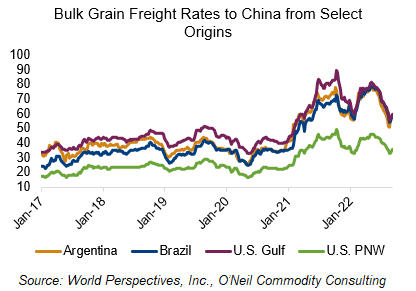

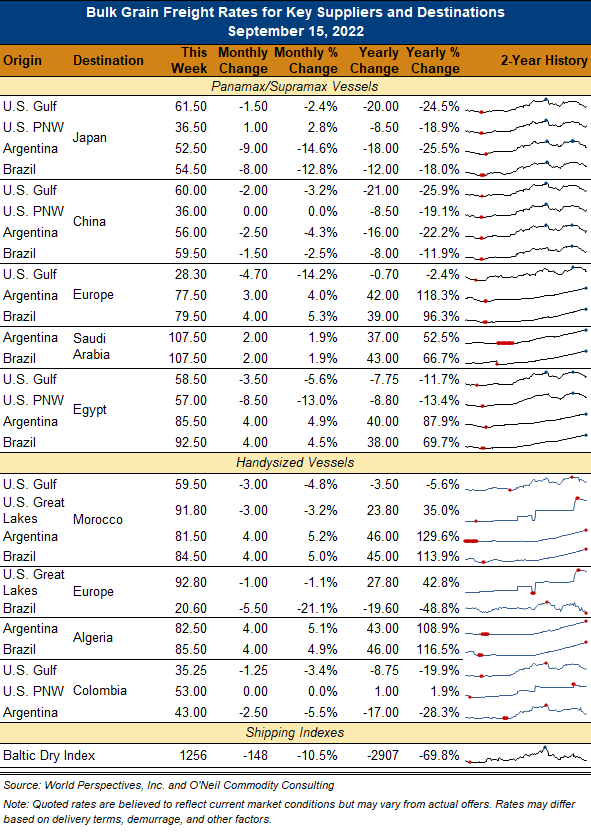

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: The bounce off bottom continued this week as dry-bulk markets jumped higher. This was mostly a technical move in FFA paper markets, but the rally lost momentum at the top and settled slightly off the highs for the week. Q4 2022 Panamax markets settled at $16,500 after reaching an earlier high of $17,950/day. Q1 2023 Panamax markets were less enthusiastic and settled at $11,300/day. Without an increase in physical cargo demand, dry-bulk markets will struggle to move much higher.

The ILWU-West Coast Port labor contract negotiations are ongoing with no schedule for a conclusion soon. Port automation remains the biggest sticking point.

The feared U.S. railroad strike has apparently been averted. A tentative contract has been negotiated and now must go to the rank-and-file union membership for final approval. Unions agreed to a new 5-year contract (beginning from 2020, ending in 2025) that provides a 24 percent pay increase over the period and a single individual payment of $11,000 to each union member.