Chicago Board of Trade Market News

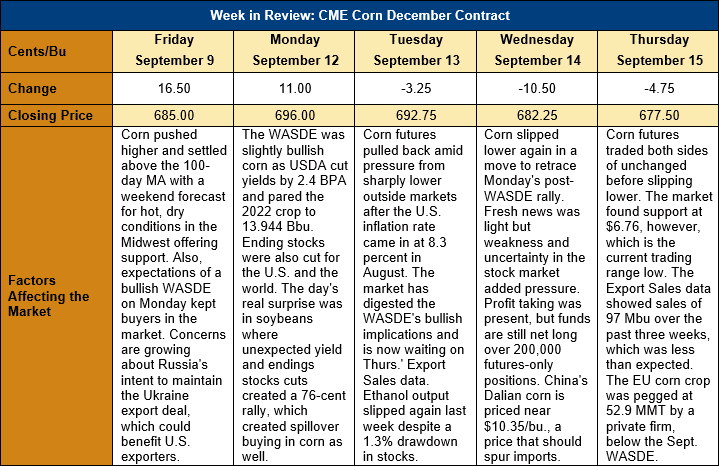

Outlook: December corn futures are 7 ½ cents (1.1) percent lower this week as the market rallied following Monday’s September WASDE but then faded lower through the week. The WASDE was slightly bullish corn, but the real surprise was the cut to U.S. soybean yields and ending stocks, which helped create spillover buying in corn. Since the WASDE, traders and analysts have been increasingly focused on the U.S. export program as well as the crop’s final push towards harvest.

The September WASDE report offered a moderately bullish influence for corn as USDA cut U.S. yields and ending stocks and lowered global corn 2022/23 carry-out as well. As the market expected, USDA shaved 0.18 MT/ha (2.9 bushels per acre) off its 2022 U.S. corn yield forecast, which now sits at 10.83 MT/ha (172.5 bushels per acre). That, combined with a reduction in harvested area, put the 2022 crop at 354.2 MMT (13.944 billion bushels), which was on the low end of analysts’ expectations. The smaller crop led USDA to cut its 2022/23 total usage forecast by 6.35 MMT (250 million bushels), which left ending stocks of 30.96 MMT (1.219 billion bushels). The ending stocks estimate was on the low end of pre-report expectations and, when combined with a 1.5 percent increase in the season average farm price, left a bullish interpretation for the market.

Outside the U.S., the WASDE raised corn production forecasts for China, Ukraine, and Canada, which offset cuts to the EU’s crop. The EU corn crop was cut another 1.2 MMT to 58.8 due to the drought’s impacts on the French, German, and Romanian crops. Between the smaller crops in the U.S. and the EU, however, world corn production fell 7.01 MMT, down 2 percent from 2021/22. Despite modest downward revisions to world corn trade and consumption, the September forecast of 2022/23 global corn ending stocks fell 2.15 MMT to 304.53 MMT, down 2.4 percent from last year.

The 2022 U.S. corn crop is entering its final stage with over three-quarters of the crop dented as of Sunday and 25 percent of fields rated “mature”. The maturity rating is down 5 percent from the five-year average but is of less concern given the late planting for this year’s crop. The harvest is just beginning in the southern U.S., with USDA reporting 5 percent harvest progress in total. Notably, the heat and dryness in the Southern Plains caused the sorghum crop’s conditions to deteriorate again last week. The good/excellent rating for sorghum fell 3 percent to 18 percent.

After technical difficulties prevented the weekly release of export sales data, on Thursday USDA released a backlog of four weeks’ data. Over the past three weeks, U.S. exporters recorded 2.465 MMT of new crop corn sales, bringing YTD sales to 12.301 MMT through September 8, a figure down 50 percent from last year. YTD exports total 463,600 MT, including 426,800 MT of exports this past week.

From a technical standpoint, December corn futures are pulling back after bullish days on the charts last Friday and Monday. Friday’s rally pushed the contract above the100-day moving average while Monday’s post-WASDE strength carried the market to within a penny of resistance at $7.00. Since then, the market has drifted lower with commercials and end users waiting to see the export sales data before chasing rallies higher. December corn has support at the 100-day moving average ($6.70) and trendline support at $6.49 ¾ below that.