Ocean Freight Markets and Spreads

Ocean Freight Comments

Hurricane Francine formed in the Gulf of Mexico this week, arrived ashore between New Orleans and Baton Rouge, LA. This is a developing situation and damage reports will be forthcoming. Ports, terminals and navigation activity were halted along the U.S. Gulf Coast and Mississippi River until the hurricane passes and it is safe to resume operations. More than one half of all U.S. grain and soybeans, and products are exported through the U.S. Center Gulf, with about 98% of that volume arriving to an export elevator by barge. Depending on the route of Francine once ashore, she could bring timely rains to the Mississippi River System to recharge water levels that have been falling.

Tensions on the Black Sea are heating up. Earlier today Ukraine accused Russia of attacking a vessel carrying Ukrainian wheat to Egypt. This is an escalation of attacks. The vessel suffered damage, but no casualties were reported. With such an attack the uncertainty of shipments out of Ukraine on the Black Sea raises concern of grain commodity flows.

There have been no reports of contract negotiations between the United States Maritime Alliance and International Longshore Union. The contract covers ports along the U.S. East Coast and Gulf Coast and expires at midnight on September 30. The ILA is prepared to strike on October 1 if their demands are not met. Grain export elevators will not be directly impacted since they have their own labor, but container activity will be greatly impacted if there is a strike.

There have been no new reported attacks by the Houthi terrorist organization in the Red Sea this past week. The U.S. armed forces and military alliance in the region continues to destroy Houthi drones and missile systems. Ship owners and operators continue to divert vessels from transiting the Red Sea and Suez Canal to avoid the conflict, opting for longer and more costly routes.

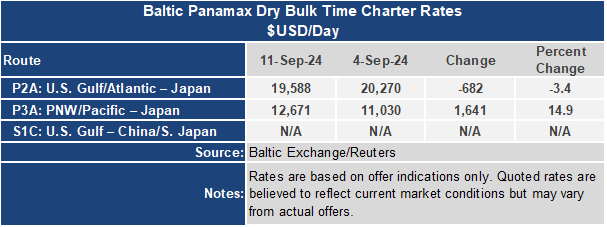

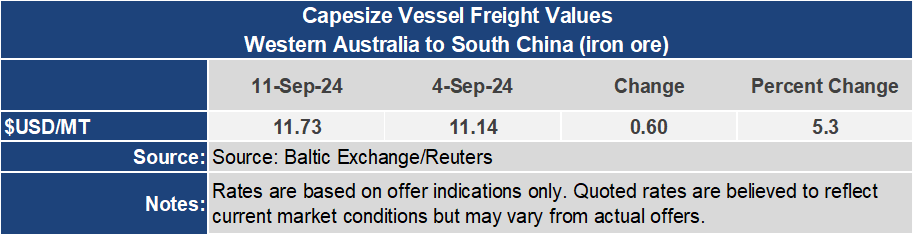

The Baltic Dry Index continued its hot streak, gaining 61 points or 3.2% this week to an index of 1,963. The Baltic Capesize Index ended the week 151 points or 4.7% higher for the week to an index of 3,375. The smaller vessel classes were mixed in the week. The Baltic Panamax Index reversed course this week, up 4.3% to an index of 1,356. The Baltic Supramax Index was down 0.9% to 1,259 for the week.

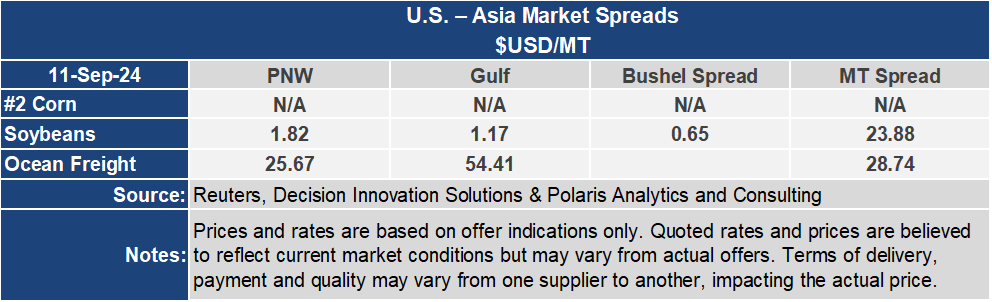

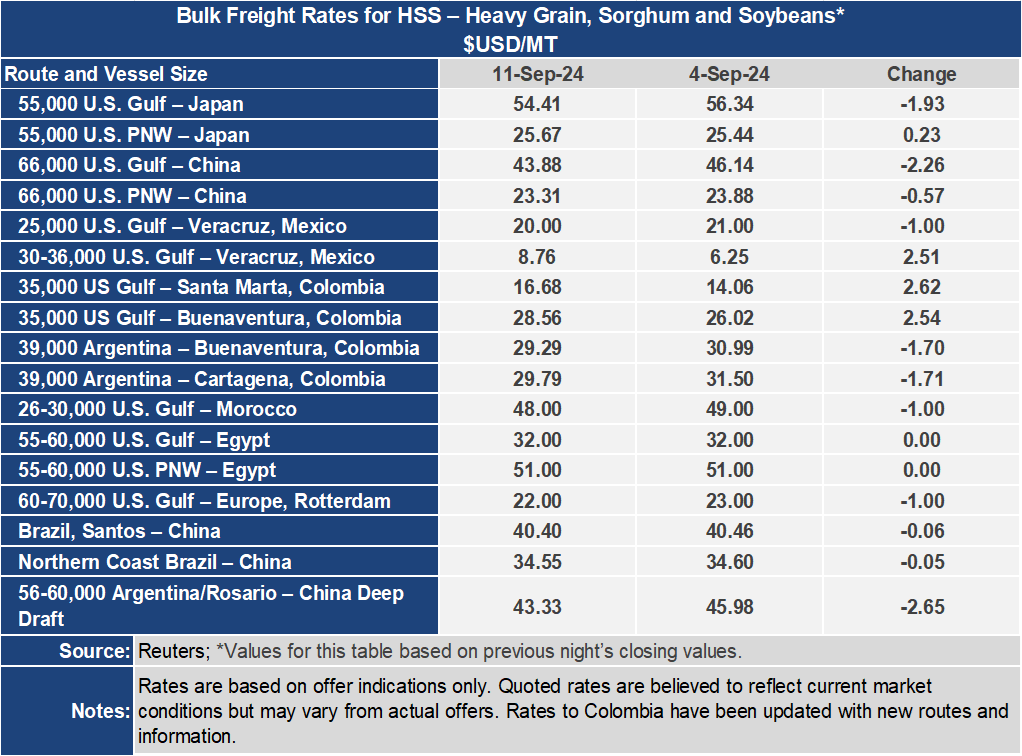

The U.S. Gulf to Japan ocean freight rate was down $1.93 per metric ton or 3.4% for the week to $54.41 per metric ton. From the Pacific Northwest the rate was up 0.9% or $0.23 per metric ton at $25.67per metric ton. The spread between these key grain routes narrowed 7.0% or $2.16 per metric ton to $28.74 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $43.88 per metric ton for the week, down $2.26 per metric ton or 4.9%. From the PNW, the rate was down $0.57 per metric ton or 2.4% to $23.31per metric ton this week. The spread on this route narrowed by 7.6% or $1.69 per metric ton to $20.57 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.