Ocean Freight Comments

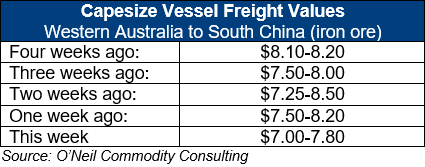

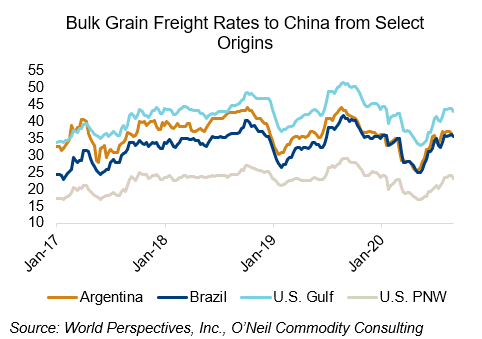

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: As mentioned last week, dull markets are not bullish. Dry-bulk freight markets continue to suffer from soft demand and vessel owners are in reverse mode, always wanting to get the last value traded but having to accept something lower.

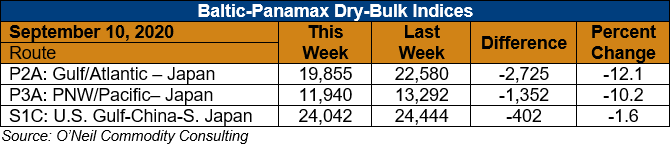

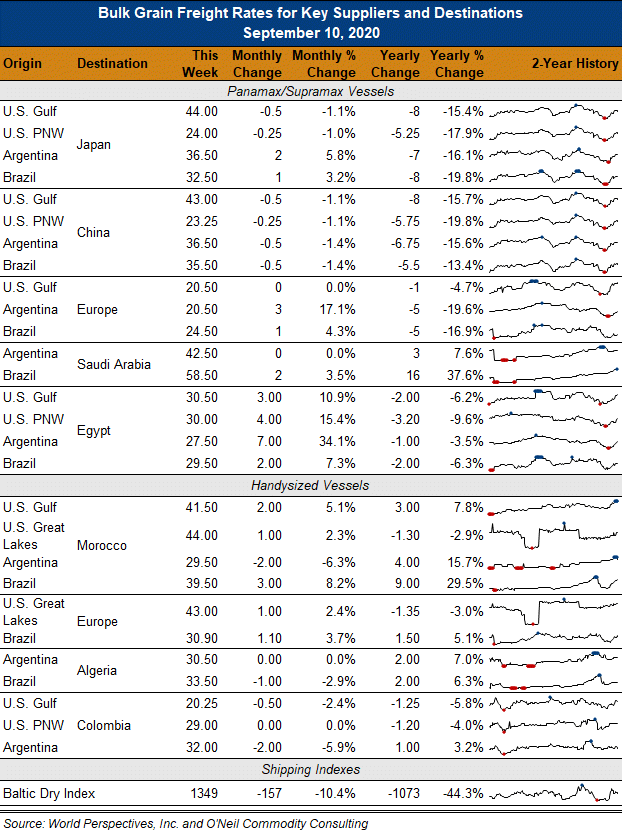

Daily hire rates for Q4 2020 Panamax vessels traded at $12,800/day early in the week but slipped to $11,500/day at the week’s end. Q1 2021 traded at $9,100/day while Q4 Supramax vessel daily hire rates hit $10,100/day and Q1 2021 traded at $8,000/day.

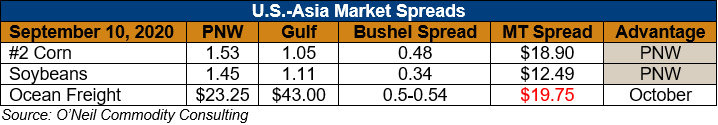

Chinese demand for grains has been the only bright spot for vessel owners, but it has not been enough to keep rates up. Chinese grain demand has increased vessel lineups at U.S. Gulf and PNW ports and the coming fall harvest will only increase the vessel congestion at U.S. ports. FOB buyers may wish to nominate their vessels early in the shipping period. CIF buyers should understand that their shipments will likely be executed late in the contract shipping period.